Polygon CEO says L3s are taking value away from Ethereum, sparking debate

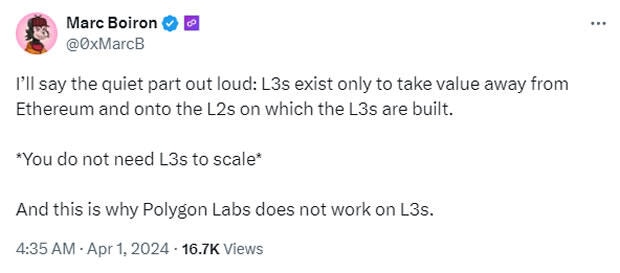

Polygon CEO Marc Boiron riled up the debate on X over the weekend after arguing that layer-3 networks aren’t necessary to scale Ethereum and exist only to rob the mainnet of value.

On April 1, the Polygon CEO said that Polygon Labs, a layer-2 scaling network for Ethereum, does not work on layer 3s because they are not needed to scale existing networks.

“L3s exist only to take value away from Ethereum and onto the L2s on which the L3s are built,” he said.

However, Boiron’s comments didn’t go unchallenged. One respondent commented that layer-2s on Ethereum “ARE value on Ethereum,” to which Boiron replied in partial agreement, adding:

I disagree that L2 value is Ethereum value. Just take this to the extreme. If all L3s settled to one L2, then Ethereum would capture basically no value and, thus, Ethereum security would be at risk.

“Also, we don’t care what people do. They can build L3s on anything, including Polygon networks,” he continued, adding: “We just aren’t trying to suck all value onto Polygon networks instead of sharing with Ethereum its fair share.”

Source: Marc Boiron

Boiron added that Polygon’s mission was to scale Ethereum when nobody else did it, when the right tech was ready, using parallelization of the Ethereum Virtual Machine and with privacy. He argued that “L3s are not consistent with that mission.”

Layer-3 protocols are built on top of L2s to host application-specific decentralized applications, providing a range of solutions for scaling, performance, interoperability, customization and costs.

Current leading players in the L3 ecosystem and solutions from L2 networks include Orbs, Xai, zkSync Hyperchains and the recently launched Degen Chain on Arbitrum Orbit. However, the sector is still small by comparison, with only four L3 tokens listed by CoinGecko.

Meanwhile, the senior partnership manager at Offchain Labs, Peter Haymond, argued that there were many benefits to L3s that don’t take value from Ethereum.

The low cost of native bridging from L2 rather than L1, the low cost of proving on-chain, custom gas tokens, and specialized state transition functions were among some of them.

Arbitrum Foundation researcher Patrick McCorry said he was surprised by Boiron’s take, adding:

L3s seem like a no-brainer, especially when it allows the L2 to eventually become a settlement layer (ie executing the bridge is cheaper) and ultimately relying on Ethereum as global ordering service + final judge of settlement.

On March 31, Helus Labs CEO Mert Mumtaz appeared to agree with Marc Boiron in a separate post on X, stating that “L3s are basically centralized servers settling on other centralized servers (L2s) — controlled by multisigs.”

Source: Mert Mumtaz

Ethereum co-founder Vitalik Buterin ignited the L3 debate in late 2022 when he said that layer-3s will serve a different purpose to scaling by providing “customized functionality.” A third layer on the blockchain makes sense only if it provides a different function to layer-2s, he said at the time.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.