Polkadot to present buy opportunity before DOT makes new all-time high

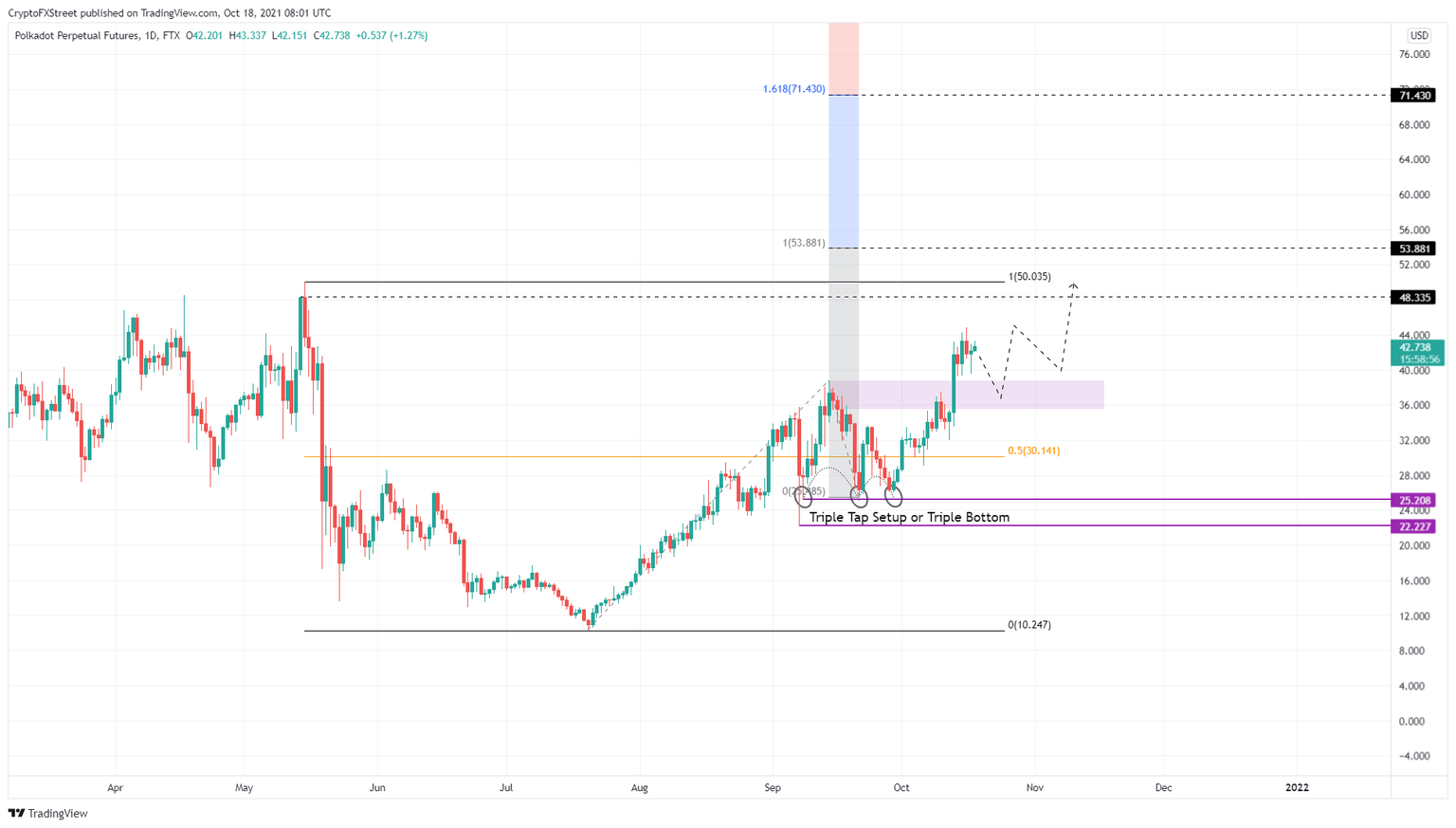

- Polkadot price saw a 33% upswing on October 13 and set up a swing high at $44.84.

- Investors can expect DOT to retrace to the $35.48 to $38.76 demand zone before rallying higher.

- A breakdown of the 50% Fibonacci retracement level at $30.14 will invalidate the bullish thesis.

Polkadot price formed a triple tap set up between September 7 and September 29, triggering a massive uptrend. DOT set up a new swing high as a result and is currently mapping its next moves.

Polkadot price loads ammo for next leg-up

Polkadot price rose a whopping 71% between September 29 and October 16, setting up the third higher high at $44.84. This run-up was exhaustive as it has given rise to a consolidation phase.

Investors can expect DOT to retrace at least 10% to retest the demand zone ranging from $35.48 to $38.76. A dip into this support area will allow the buyers who rode the recent run-up to book profit and provide the sidelined investors an opportunity to accumulate for the next leg-up.

However, Polkadot price needs to stay above this area. Such a situation sets up DOT for another leg-up to retest the range high at $50.04.

A decisive close above this level will open the path for a new all-time high at $53.88m, coinciding with the 100% trend-based Fibonacci extension level.

If the buying pressure persists, Polkadot price could continue its ascent to 161.8% level at $71.4. This climb would represent a 68% ascent from the current position and would be a new all-time high.

DOT/USDT 1-day chart

Regardless of the optimism around Polkadot price, a breakdown of the demand zone, extending from $35.48 to $38.76, will hurt the bullishness around DOT.

Such a move will likely knock Polkadot price down to the 50% Fibonacci retracement level at $30.14. If the sellers produce a decisive close below this barrier, it will invalidate the bullish thesis and trigger a correction to $25.21 or $22.23.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.