Pi Network Price Forecast: PI edges higher after Chengdiao Fan's keynote at Token2049

- Pi Network recovers over 4% on Wednesday, bouncing off a key support level.

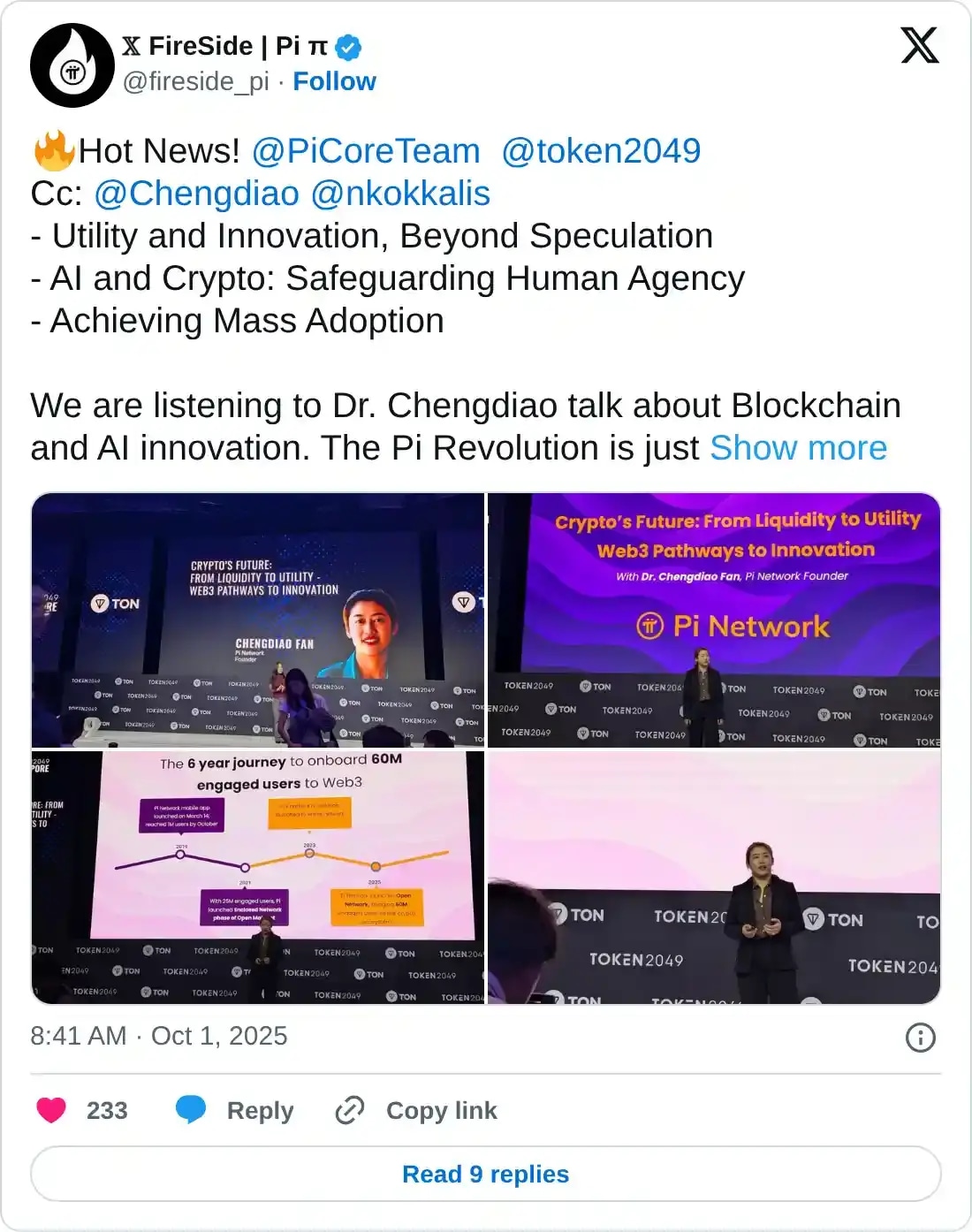

- Chengdiao Fan, co-founder of Pi Network, delivered a talk at the Token2049 conference in Singapore.

- The technical outlook signals a potential rally if intraday gains are sustained.

Pi Network (PI) edges higher by over 4% at the time of writing on Wednesday, as investor sentiment improves amid co-founder Chengdiao Fan delivering a talk on Blockchain and Artificial Intelligence (AI) at the Token2049 event in Singapore.

Chengdiao Fan at the Token2049

Unlike the previous public appearances of Pi Network co-founders, which led to sharp corrections, Chengdiao Fan’s visit to Token2049 helped PI recover on Wednesday. Fan delivered a keynote on Blockchain and AI, with presentation images highlighting the mobile app launch, Know Your Customer (KYC) feature integration, and the launch of Mainnet over the last six years, bringing 60 million engaged users to a single platform.

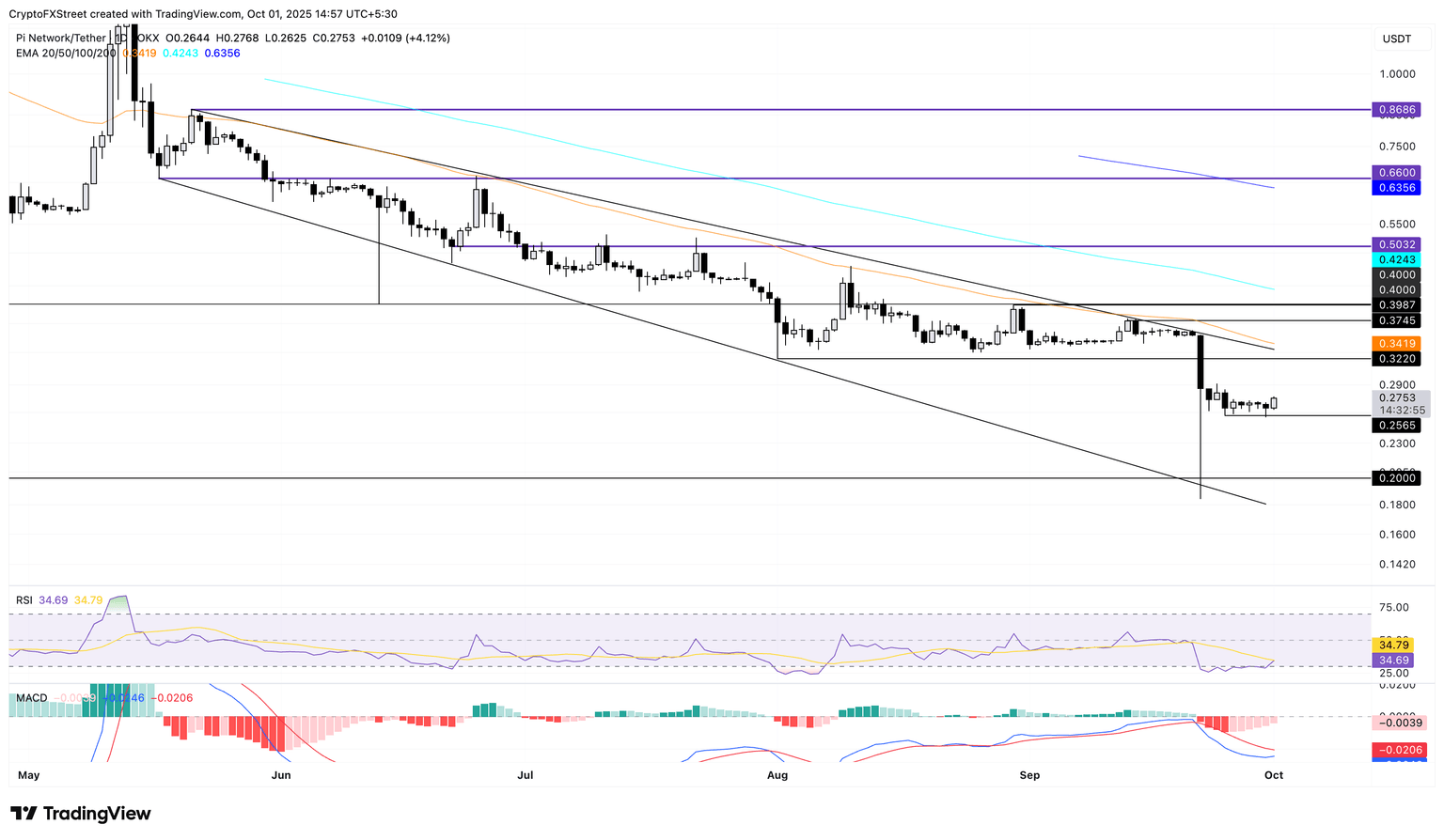

Pi Network’s rebound signals further growth

PI rises by over 4% on Wednesday after five consecutive days of consolidation, indicating a surge in buying pressure. Validating the surge, the Relative Strength Index (RSI) at 34 resurfaces above the oversold zone, indicating a decline in selling pressure with further space to grow before reaching neutral levels.

Additionally, the Moving Average Convergence Divergence (MACD) recovers in the negative territory, hinting at a potential bullish crossover above its signal line. This crossover would provide confirmation of a bullish shift in trend momentum, marked by a rise in the green histogram bars above the zero line.

If PI extends the rally, the immediate resistance stands at the overhead trendline of a falling channel pattern at $0.3220, aligning with the August 1 low.

PI/USDT daily price chart.

However, if the mobile mining cryptocurrency fails to sustain the gains, a clean sweep below Thursday's low at $0.2565 could extend the decline to the $0.2000 round figure.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.