Pi Network dips as gaming partnership impact wanes ahead of December token unlock

- Pi Network ticks lower by 4% on Friday after three consecutive days of trading in the green.

- The recent partnership between Pi Network and CiDi Games expands the PI token's utility in the real world.

- A surge in CEXs' inflows signals increased selling pressure ahead of the 186 million PI token unlock in December.

Pi Network (PI) is down 4% by press time on Friday, after three days of an uptrend fueled by the CiDi Games partnership announcement on Wednesday. The intraday pullback risks erasing this week's gains as Centralized Exchanges (CEXs) witness large deposits ahead of the scheduled unlock of 186 million PI tokens in December.

CiDi Games' announcement loses its charm ahead of the December token unlock

Pi Network’s partnership with CiDi Games expands the real-world utility of the PI token in the gaming industry. Building on the mobile mining cryptocurrency, the PI token will now serve as the primary currency for payments, transactions, and incentives across CiDi Games’ titles.

Beyond this, an open framework is in the works by CiDi Games to extend Pi Network, which is scheduled for initial testing in early 2026.

However, the intraday pullback in PI aligns with a surge in CEXs' wallet balances, reaching 1.71 million tokens over the last 24 hours, indicating large deposits from traders losing confidence.

The sudden supply shock after the gaming expansion boost aligns with the upcoming 186 million PI tokens to be unlocked in December, which accounts for 43% of the total supply of 431.48 million PI available on CEXs. Typically, token unlocks can boost selling pressure when investors' confidence is low.

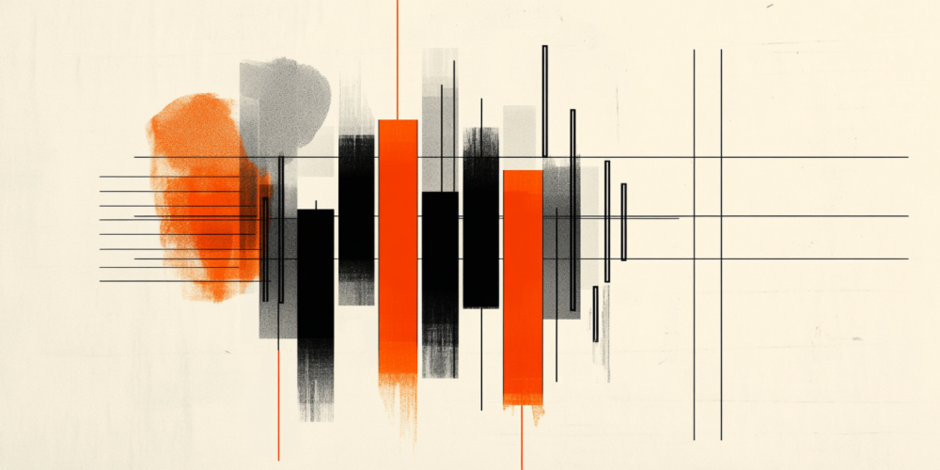

Pi Network loses strength near the 100-day EMA

Pi Network trades near the $0.2600 mark after a 4% drop by press time on Friday, nearly erasing the 6.88% gains from Thursday. A bearish close to the day would mark the end of the short-term recovery run, threatening the reclaimed 50-day Exponential Moving Average (EMA) at $0.2446.

If PI drops below $0.2446, it could further extend the pullback to the $0.2000 psychological level.

The technical indicators on the daily chart suggest that buying pressure has cooled, as the Relative Strength Index (RSI) has dropped to 61, signaling a retracement from the overbought territory.

However, the Moving Average Convergence Divergence (MACD) and signal line are holding steady above the zero line. If the pullback extends, the red line could cross below the blue one, triggering a sell signal.

Looking up, a potential rebound in PI could test the 100-day EMA at $0.2921, followed by the August 1 low at $0.3220.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.