PancakeSwap Price Forecast: CAKE reveals a 20% opportunity

- PancakeSwap price released from a minor inverse head-and-shoulders pattern earlier today.

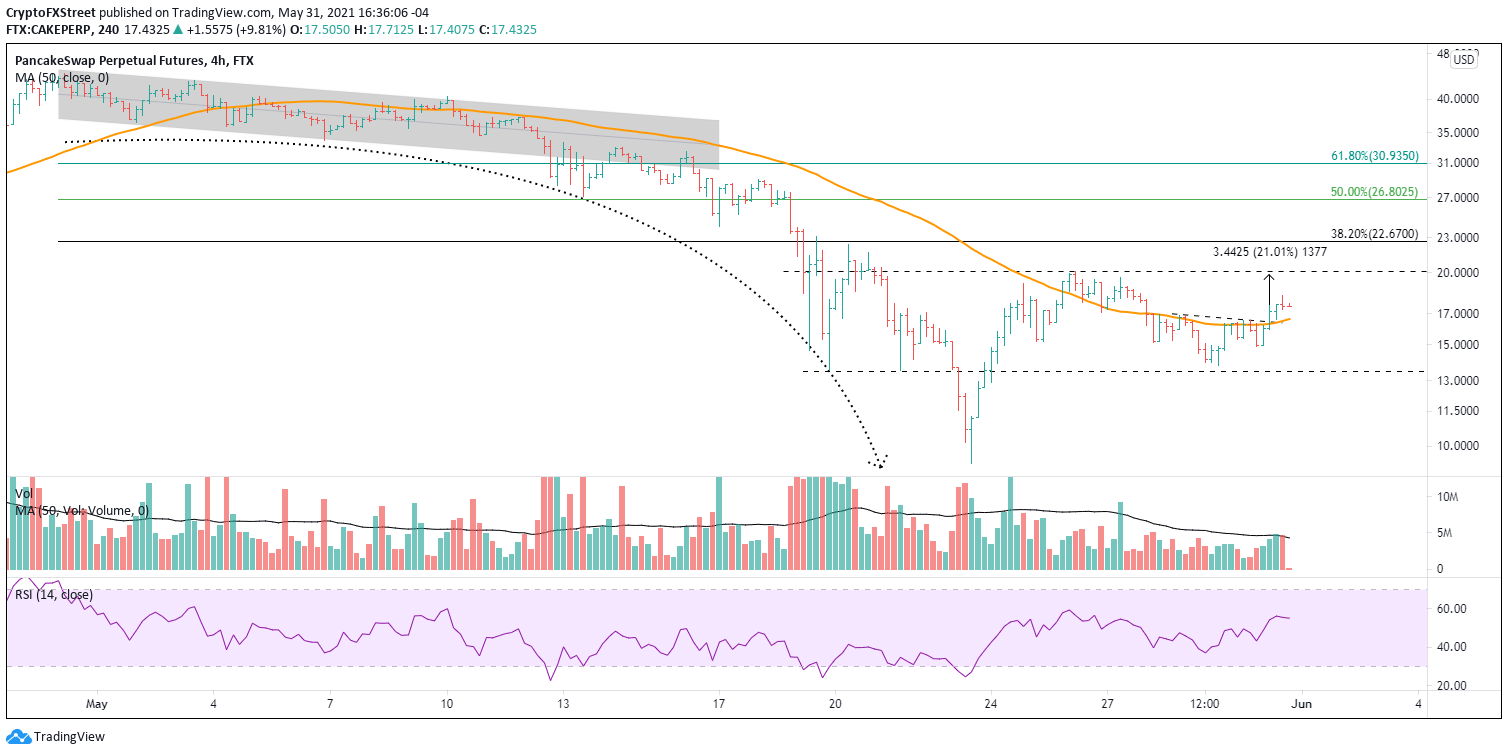

- CAKE 50 four-hour simple moving average (SMA) has been involved in the price action since May 25.

- Current bottoming process is similar to other cryptocurrencies, indicating no relative strength.

PancakeSwap price action in the short-term was clarified with a breakout from a minor head-and-shoulders pattern, but the bigger picture remains clouded. For now, investors are better served with a patient posture, pursuing concise tactical opportunities such as today and allowing CAKE to determine the point of least resistance for the next major trend.

PancakeSwap price predictions tempered after 80% plunge

CAKE is the native token of the PancakeSwap DeFi project built on the Binance blockchain due to the better fee structure and quicker transaction speeds than the Ethereum blockchain.

PancakeSwap price rallied almost 380% from March 15 into the April 30 high due to developers shifting to Binance’s platform and the explosive growth in the popularity of DeFi services. Moreover, the surge in altcoins over that period spread to the DeFi-linked token.

The frenetic rally in March and April quickly dissolved into an 80% decline that erased the gain from March 15 and included a weekly decline of 56%. It was one of the largest weekly declines within altcoins.

PancakeSwap price continues to recover from May’s 80% correction while oscillating a long the 50 four-hour SMA. Today’s breakout from a minor inverse head-and-shoulders pattern does not materially alter the mixed outlook for the digital asset. CAKE relative strength is suffocated by the broader market gyrations, putting it in the same predicament as most cryptocurrencies.

Moving forward, the measured move target of the inverse head-and-shoulders pattern is $19.82, representing a tactically significant 21% gain for CAKE from the neckline. If the target is reached, PancakeSwap price would be very close to the May 26 high at $20.09 and in an area of price congestion from May 21 and 22. It would require a notable surge in buying pressure to overcome the PancakeSwap price resistance that has been absent for most of the last six days.

A return of interest in the crypto market, combined with a Bitcoin breakout from the symmetrical pattern, could lift PancakeSwap price to the 38.2% Fibonacci retracement of the May correction at $22.67.

CAKE/USDPERP 4-hour chart

Outside of the 50 four-hour SMA at $16.63, CAKE has no support until the right shoulder low at $14.85. More engaging support is at $13.50, a level defined by the May 19 low at $13.50 and the May 21 low at $13.48. Further support may not materialize until the May 23 low at $9.29, yielding close to a 50% decline from the current price.

The DeFi craze catapulted several altcoins into new highs with historic gains. Still, the collective collapse of all tokens in May discarded the idea that the prosperous fundamental story of any one cryptocurrency could outrun a widespread sell-off. Despite the promising outlook, CAKE remains a high-risk investment that will always be liquidated first in moments of financial market dislocation.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.