PancakeSwap announces boost of BEL-BNB farm as CAKE price eyes retest of $26

- CAKE price might need to retrace 15% before it kick-starts a 36% upswing.

- PancakeSwap recently announced the boost of BEL-BNB farm by 1x for a week.

- A breakdown of $19.03 will temporarily invalidate the bullish thesis.

CAKE price is currently grappling with a crucial resistance level and is likely to retrace before heading on an uptrend. Investors should note that a spike in buying pressure can trigger an upswing, postponing the pullback.

PancakeSwap enables farm boost

PancakeSwap announced on August 19 their plans to boost for BEL-BNB farm in the Syrup Pool. The increase will be 1x for seven days, starting August 20, with 175,000 BEL tokens allocated to the Syrup Pool.

According to the blog,

A boost is an increase in the farm multiplier over a set period of time, offered in exchange for additional tokens from the boosted projected, which are then put into the new Syrup Pool.

PancakeSwap faced a tough time a few months ago when its projects became an attraction to hackers, who exploited unaudited projects with buggy code leading to losses in the millions.

While this was a major bump in the road, things seem to have come around for PancakeSwap as it is the top dApp in terms of users.

The past month saw roughly 2.2 million users interact with PancakeSwap. Alien Worlds came in at the second spot with 730,700 users over the last 30 days.

CAKE price needs to take a break

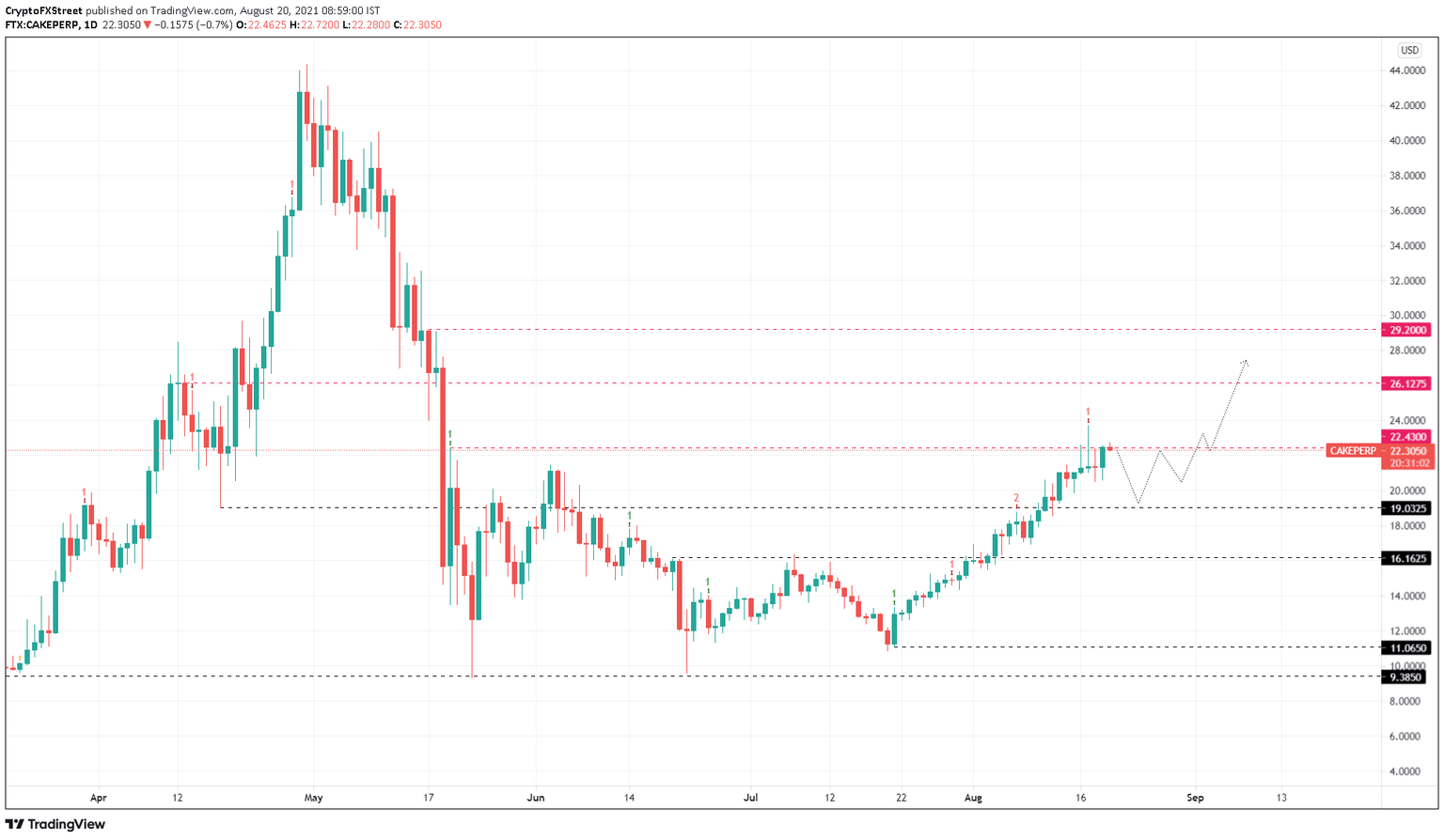

CAKE price rallied roughly 109% over the past month, rising from $10.83 to $22.70. It is currently trying to breach through the $22.43 resistance level, which served as a stiff barrier stunting the May 20 upswing.

Therefore, this supply area will be tough to crack, especially considering the 22% upswing over the past week. The bulls will likely take a sabbatical, allowing the bears to push CAKE price to retrace 15% to the immediate support level at $19.03.

Since the market structure is bullish, investors can expect a resurgence of buying pressure around $19.03 to kick-start a new leg-up. This upswing will target the $26.13 and $29.20 resistance barriers in the short-to-mid term, a roughly 36% upswing from $19.03.

CAKE/USDT 12-hour chart

On the other hand, things might turn awry if the bullish market structure begins to lose ground. For CAKE, a breakdown of the $19.03 stable support barrier will create a short-term lower low, indicating a shift in trend favoring the bears.

In such case, CAKE price might crash to retest the $16.16 demand level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.