Optimism rolls out new testnet to solve Ethereum's scaling issues

- Ethereum network is plagued with clogged transactions and high fees.

- The second-layer solution launched by Optimism may become a game-changer.

The startup Optimism launched Optimistic rollups, a limited version of its testnet to improve the Ethereum scalability.

Ethereum scalability woes

Over the past few months, the Ethereum network has faced heavy overloads. The spectacular growth of the decentralized finance (DeFi) industry resulted in the long waits if the transactions and skyrocketing gas prices.

The community put hopes on Ethereum 2.0, a major network update that is supposed to fix the scalability problems. The developers expect to start rolling out the solution by the end of the year; however, many ETH-based projects cannot wait that long. As the FXstreet previously reported, the prohibitive transaction fees forced some projects to shut up or move to another blockchain.

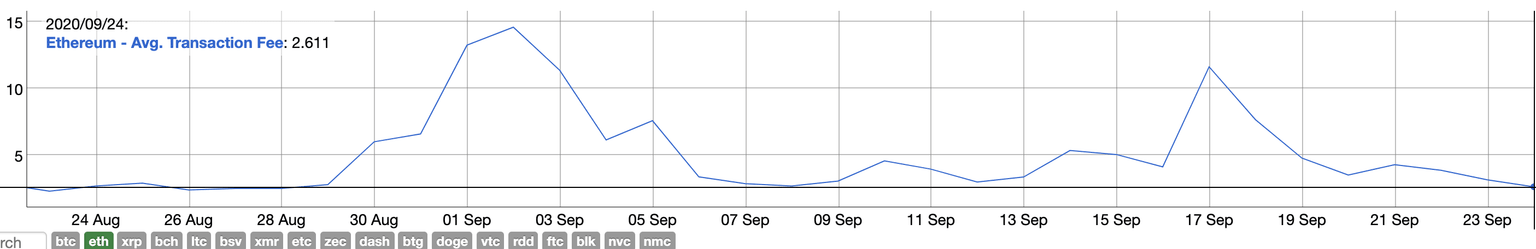

At the time of writing, ETH users have to pay $2.6 on average for any transaction on the network. While it is way lower from an all-time high of $14.53 hit on September 2, it is still a heavy burden on users' budgets.

Ethereum transaction fees

Source: Bitinfocharts

Cause for Optimism

The team announced the Optimistic rollups project in January 2020. According to the official blog post definition, it is "a layer 2 scaling solution that scales general smart contracts and enables instant transactions on Ethereum."

The solution is based on the Optimistic Virtual Machine (OVM), fully compatible with the EVM. It is supposed to allow to scale Ethereum network up to 2000 transactions per second. Now that the test version has gone live, the team promises to roll out the solution gradually, integrating small cohorts of projects set by step.

The decentralized cryptocurrency exchange Synthetix is the first project registered with the testnet. They will give away 200,000 SNX in rewards to their users willing to participate in the tests. Uniswap and Chainlink also announced that they would want to participate in the project.

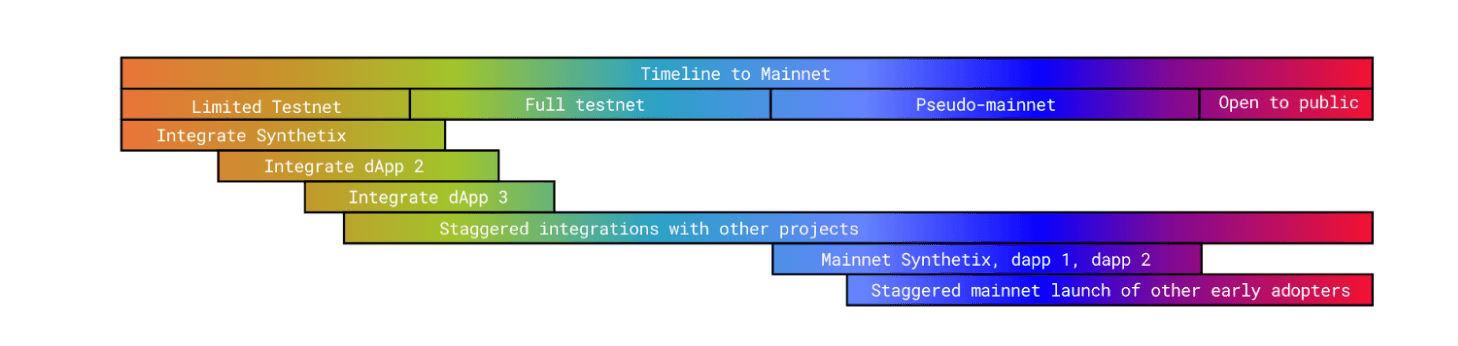

Optimistic roadmap

Source: Official blog of the project

At this stage, the network is open for public use; however, the team will be adding features gradually to ensure the system's stability.

On Phase A, users will be allowed to mint & burn sUSD and claim staking rewards. Phase B will unlock deposits. Also, users will be able to increase their staked SNX. And finally, in Phase C, withdrawals will be enabled. To receive the testnet reward on the mainnet, the participants will have to perform a successful withdrawal.

The community was enthusiastic about the announcement, with some Twitter users comparing the Optimistic rollups launch with moving from dialup internet to 5G.

Author

Tanya Abrosimova

Independent Analyst