Optimism price rises 6% after 24.16 million OP tokens unlocked with investors anticipating immediate delivery

- Optimism price is up 6% after the July 30 event, where 24.16 million tokens were unlocked.

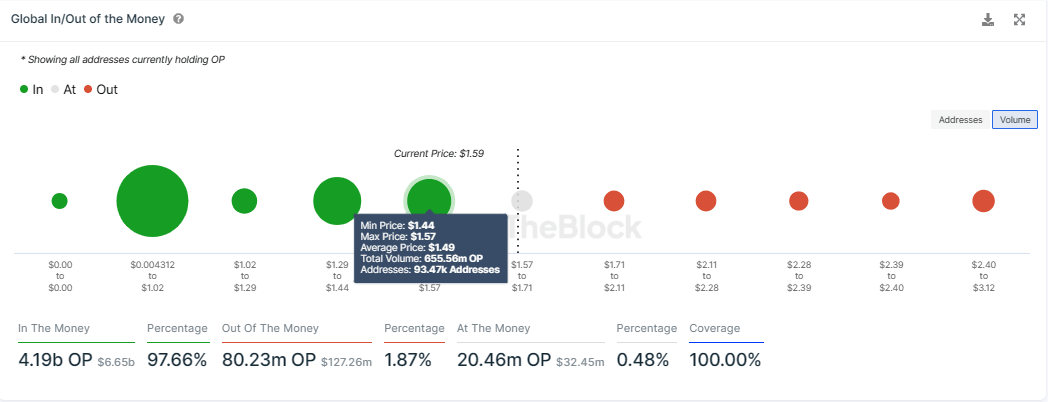

- The rally follows a strong buyer influx of 93.47K addresses that bought 655.56 million OP tokens at an average price of $1.49.

- The move could be attributed to spot traders who bought the L2 token in anticipation of immediate delivery.

Optimism (OP) price is trading with a bullish bias, a rather unusual occurrence given the increased token supply in the ecosystem. It comes after a token unlocks event a few hours following this publication, where 3.56% of the total supply was unleashed.

Also Read: Litecoin trading volume rises 50% to $5 million in the final countdown to LTC halving.

Optimism price surges post-token unlocks

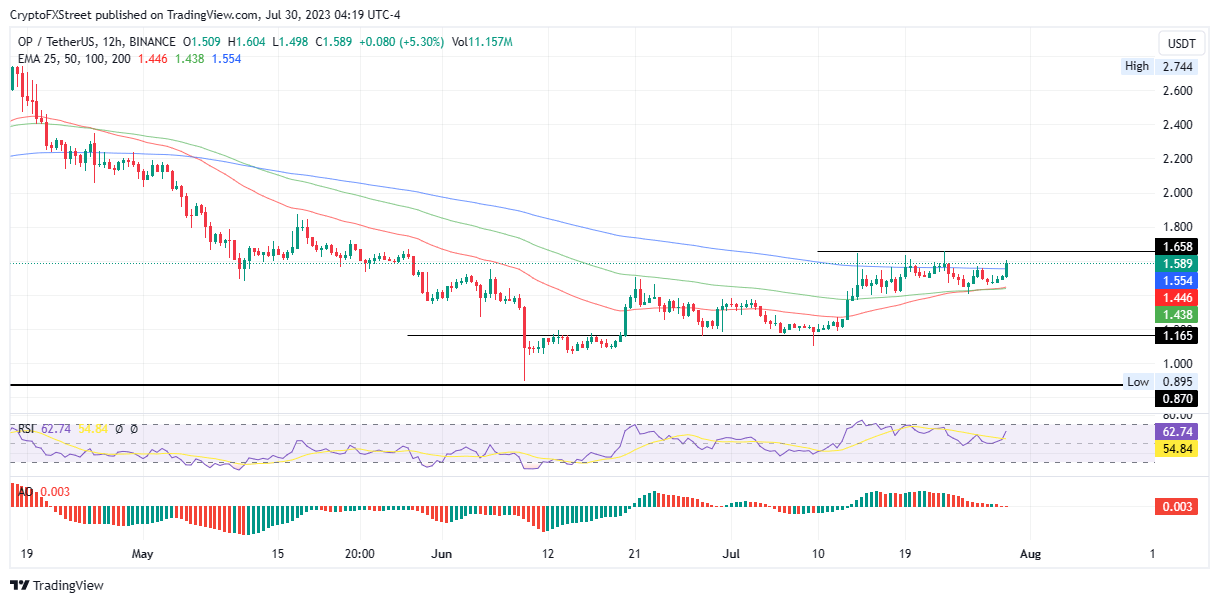

Optimism (OP) price is on an uptrend, recording 6.23% in gains on the day that saw the Ethereum Layer 2 (L2) token breach the resistance presented by the 200-day Exponential Moving Average (EMA) at $1.554. The rally took off on July 27, ahead of the token unlocks event, as investors aligned with the “buy the rumor, sell the news” narrative.

On the morning of July 30, the Optimism network unleashed 24.16 million tokens into the supply, representing 3.56% of the entire token bucket. Occasionally, an asset’s value would dip post-event as retail traders cash in on the “sell the news.” In other cases, however, investors capitalize on the opportunity to buy the tokens at low prices and grow their portfolios. This explains the current Optimism price surge and can be attributed to spot traders.

Spot traders leverage the characteristic ability of spot markets to allow asset purchases with immediate delivery. This means a trader can buy an asset with their own money and wait for the price to rise. It differs from futures markets, where a trader does not own the underlying asset. While futures trading lets a trader make money in the short term, spot trading is better suited for longer-term traders.

It appears traders are buying OP at a low price in anticipation of their value increasing before selling them. A big move could be imminent for Optimism price.

Optimism price forecast

Optimism (OP) price is $1.589 at press time, with a growing 24-hour trading volume of +30%, suggesting increasing interest for the token. With both momentum indicators heading north, the Relative Strength Index (RSI) and the Awesome Oscillators (AO), Op could rally further, potentially breaching the immediate barricade at $1.658 to record a new range high.

OP/USDT 12-hour chart

Data from IntoTheBlock’s Global In/Out of the Money (GIOM) shows that the Optimism price has robust support downward, offered by 93.47K investors who bought 655.56 million OP tokens at an average price of $1.49. As this price marked the July 29 low, this cohort of investors is already in profit, with more to come if the rally continues.

Conversely, if the investors succumb to their profit appetite, Optimism price could be rejected from the $1.658 resistance level, as it has happened almost four times before since July 14.

Such a move could see Optimism price flip back below the foothold of the 200-EMA and expose it to a possible retest of the support confluence between the 50- and 100-day EMA at $1.446. Such a move would constitute a 10% slump.

Like this article? Help us with some feedback by answering this survey:

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.