Optimism price could fall in the wake of $33.34 million worth of OP tokens flooding markets in a cliff unlock

- Optimism price is up 15% in the last week, recording higher highs to reclaim early October highs.

- The rally could be cut short with 24.16 million OP tokens worth $33.34 million due to flood the market soon.

- Token allocation will go to investors and core contributors; they are expected to book early profits.

- A decisive candlestick close above the $1.723 level would confirm the uptrend.

Optimism (OP) has been overly volatile over the past several months, with the price action oscillating in a wave-like motion. Momentum indicators have mirrored this outlook as investors ride the trend. Meanwhile, key developments in the OP network have played critical roles in determining the upside potential.

Also Read: Optimism spikes 5% ahead of upcoming token unlock

Optimism price 15% gains could be written off soon

Optimism (OP) price surged 15% in the last week, recording higher highs before facing opposition from the $1.449 resistance level. Countered by selling pressure from this supplier congestion level, it appears momentum is dropping for OP, indicated by the falling Relative Strength Index (RSI).

Increased selling pressure could see Optimism price drop further towards the $1.231 support level, a 10% drop from the current value. In the dire case, the slump could see OP dwindle further to collect buy-side liquidity resting underneath.

OP/USDT 1-day chart

Nevertheless, the position of this momentum indicator still supports the case to the upside. For a confirmed uptrend, however, Optimism price must shatter the $1.449 resistance level and ascend to the supply zone extending from $1.653 to $1.818. Confirmation will happen after the price makes a decisive move above the midline of this order block at $1.723.

A breach of the aforementioned level, signifying the conversion of a supply zone into a bullish breaker, would clear the path for a move towards the $2.000 psychological level, 45% above current levels.

OP tokens worth $33.34 million to flood markets

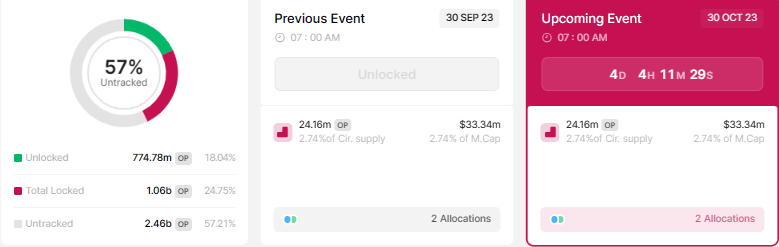

Meanwhile, the Optimism network has a cliff token unlocks due on October 30. The event will see 24.16 million OP tokens worth approximately $33.34 million flood the markets as the allocation will go to investors and the core contributors on a 47:53 ratio. These recipients are likely to cash in for quick profit.

OP Unlocks

It is worth mentioning that in the previous unlock event, allocations were similar with investors and core contributors receiving the mentioned number of tokens. Around the event, Optimism price recorded significant volatility within two weeks of the event. If history repeats, the Layer-2 (L2) token’s market value could fall 15%, potentially finding support at around $1.231.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.