Open interest in XRP zooms to $1B as Ripple tests RLUSD stablecoin

-

Open interest in XRP has surged past $1 billion amid growing enthusiasm for Ripple's forthcoming RLUSD stablecoin, currently in private beta testing on both XRP Ledger and the Ethereum blockchain.

-

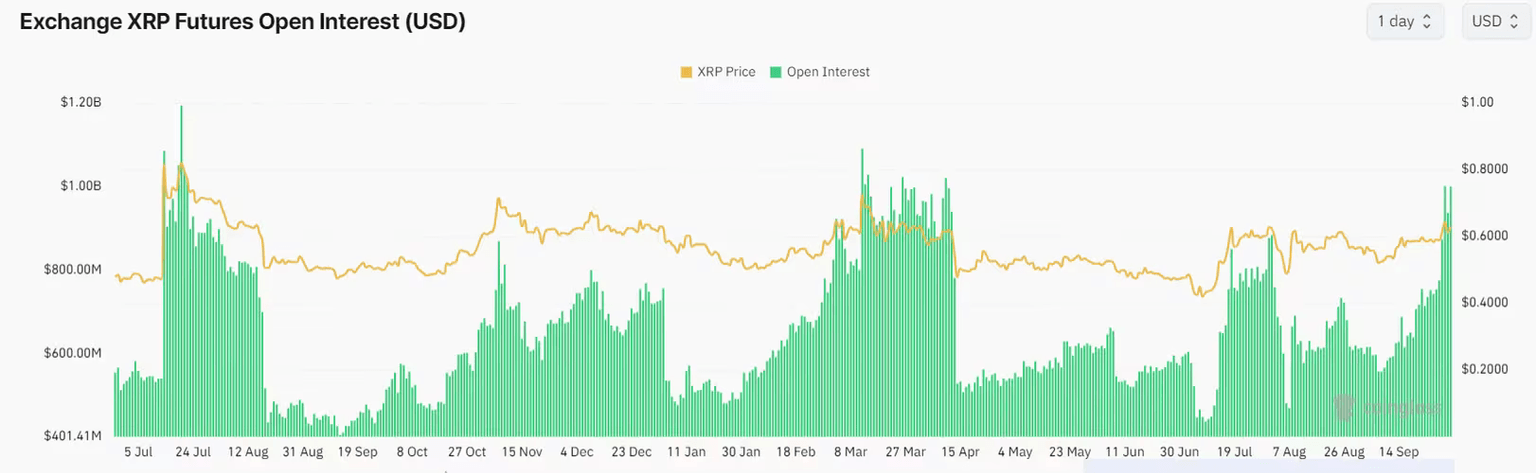

Bets on XRP futures grew to over $1 billion over the weekend, a level last seen in March and June last year.

Open interest in XRP (XRP) tokens has zoomed in the past few days with enthusiasm buoyed by tests of RLUSD, a stablecoin being developed by closely related Ripple Labs.

Recent activities include minting significant amounts of RLUSD, suggesting that the testing phase might be wrapping up or moving into a more active phase of development. This has created speculative buzz around RLUSD on platforms like X, with users tracking the minting activities closely.

Open Interest (OI) refers to the total number of outstanding derivative contracts not settled for an asset. An increase in OI and a price increase typically indicate that new money is coming into the market. On the other hand, if the price rises but OI falls, the rally might be driven by short covering rather than new buying, potentially signaling a weaker trend.

On Monday, Ripple reiterated that RLUSD remains in private beta on XRP Ledger and the Ethereum blockchain. In a post on X, it warned of scams using the stablecoin as bait.

Ripple plans to use RLUSD in its cross-border payments product, providing liquidity, facilitating faster and cheaper transactions, and potentially integrating with various decentralized finance (DeFi) protocols across multiple blockchains.

Bets on XRP futures grew to over $1 billion over the weekend, a level last seen in March and June last year. Crypto exchanges Binance and Bybit account for almost half of the placed bets, open interest data tracked by Coinglass show. Spot trading volumes more than doubled in the past week to as high as $2.5 billion on Sunday, data shows.

(Coinglass)

The XRP price has added 7.4% in the past seven days, beating a flat bitcoin (BTC) and a 2.7% gain in the broader crypto market tracked by the liquid CoinDesk 20 index (CD20).

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.