Ondo Finance to acquire SEC-regulated Oasis Pro in attempt to expand tokenized securities

- Ondo Finance announced that it has agreed to acquire Oasis Pro and all its subsidiaries.

- The acquisition is aimed at developing regulated frameworks for offering tokenized securities to US investors.

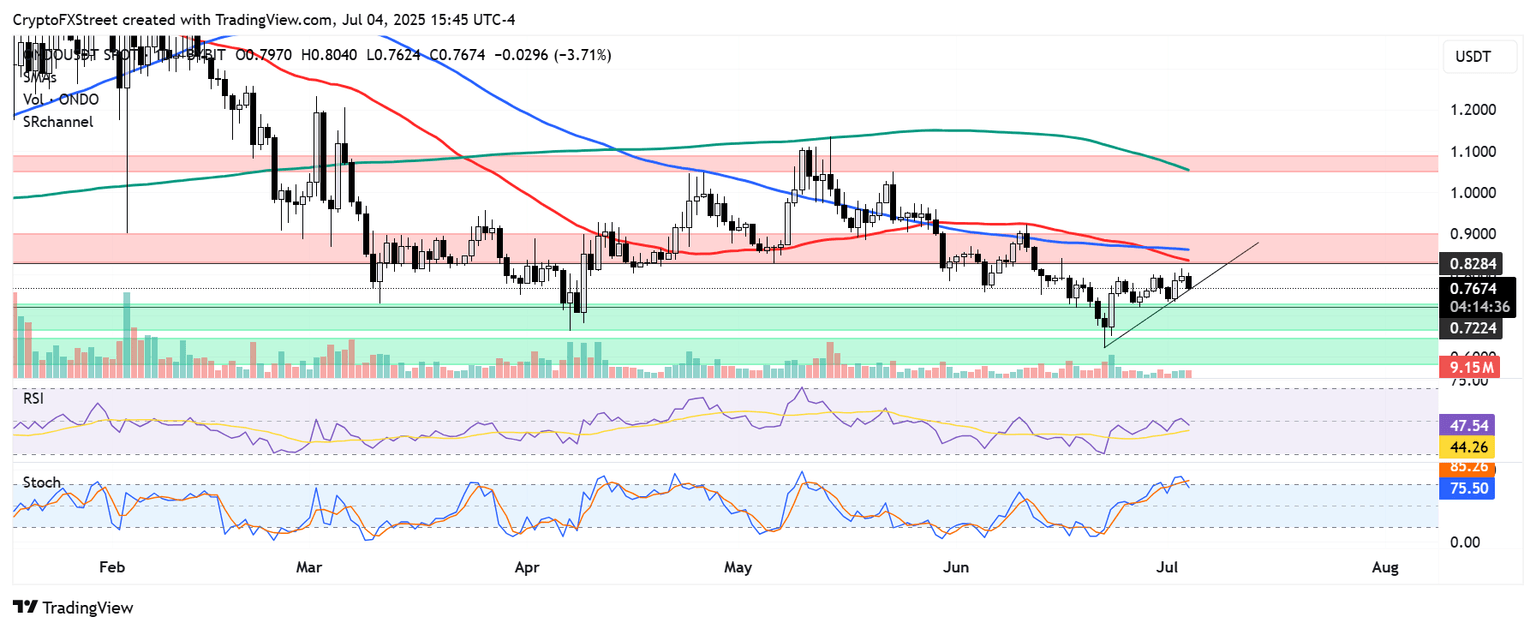

- ONDO is down 3% despite the announcement and is looking to find support near a rising trendline.

Ondo Finance (ONDO) experienced a 3% decline on Friday, despite announcing an agreement to acquire Oasis Pro, a Securities and Exchange Commission (SEC)-regulated broker, to expand its tokenized securities product suite.

Ondo Finance agrees to acquire regulated brokerage firm Oasis Pro

Real-world assets (RWA) tokenization platform Ondo Finance has announced plans to acquire Oasis Pro, a regulated brokerage firm, according to a Friday press release.

The DeFi platform noted that the deal would help it establish a regulated framework for offering tokenized securities, expanding access to blockchain-based financial products for US investors.

While terms of the deal were not disclosed, the acquisition provides Ondo access to Oasis's SEC-regulated broker-dealer, Alternative Trading System (ATS) and transfer agent.

"This acquisition will empower us to realize our vision of building a robust and accessible tokenized financial system, backed by the strongest regulatory foundations," wrote Nathan Allman, CEO of Ondo Finance.

The move comes less than a day after Ondo Finance announced plans to deepen its focus on RWAs through a $250 million investment initiative with venture firm Pantera Capital. The new fund, Ondo Catalyst, will support early-stage projects by acquiring both equity and token positions, according to Ian De Bode, Ondo's Chief Strategy Officer.

Ondo has also been instrumental in JPMorgan's blockchain unit, Kinexys, completing its first few cross-chain Delivery versus Payment (DvP) transactions involving tokenized US Treasuries on the Ondo Chain testnet. The move reflects a broader shift among financial institutions toward tokenizing traditional assets, including stocks and bonds.

Crypto platforms Bybit, Kraken, and Robinhood have launched services that allow European investors to access tokenized versions of major US stocks and exchange-traded funds (ETFs).

Other major players in the tokenization space include asset managers BlackRock, with its tokenized US Treasury fund BUIDL, and Franklin Templeton's OnChain US Government Money Fund (FOBXX).

ONDO is down 3% despite the announcement and is looking to find support near a rising trendline that extends from June 22. A decline below this trendline could send ONDO toward $0.72.

The bearish thesis is strengthened by a death cross, where the 50-day Simple Moving Average (SMA) crossed below the 100-day SMA last weekend. This shows that the short-term momentum is weaker than that of the long-term.

ONDO/USDT daily chart

On the upside, ONDO faces resistance at these SMAs near the $0.82 key level.

The Relative Strength Index (RSI) experienced a rejection near its neutral level and is trending downward, while the Stochastic Oscillator (Stoch) has retreated from the overbought region, signaling a weakening bullish momentum.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi