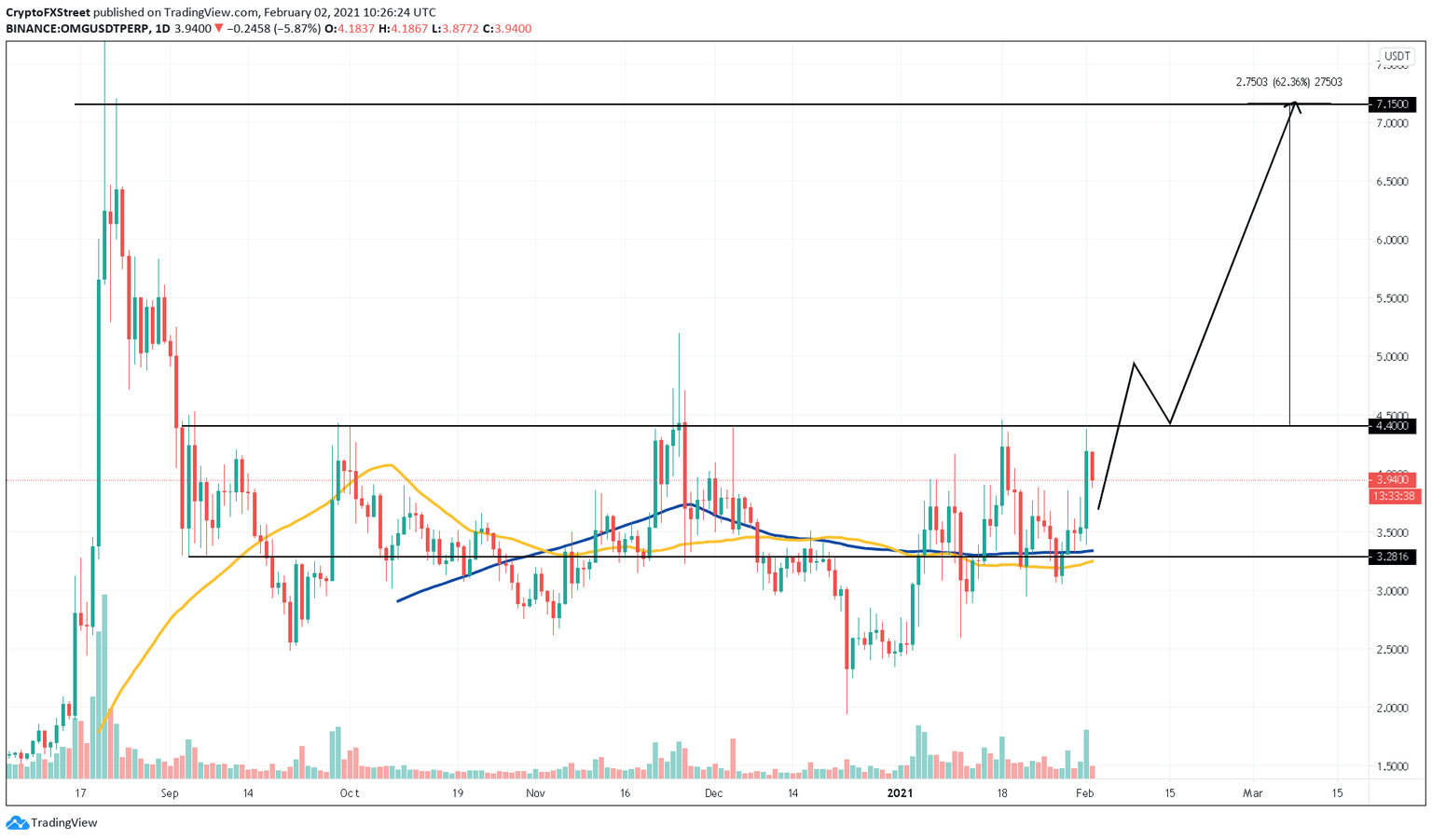

OMG Network price will skyrocket if it breaks the $4.40 resistance level

- OMG Network price needs to breach a critical resistance at $4.40 to seize the opportunity to almost double.

- This supply barrier has caused four rejections over the past five months.

- Several on-chain metrics point at a reliable uptick in user adoption and whale activity, suggesting a breakout is possible.

OMG Network price shows a considerable increase in volume as the token tests the $4.40 resistance barrier. If breached, OMG has an opportunity for a quick 60% upswing.

OMG Network price looks primed to double

Ever since OMG sliced through the 50 and the 100 day SMA, it presented a robust bullish opportunity backed with increasing investors' activity. Now, a successful breach of the $4.40 resistance will seal OMG Network’s bullish fate.

This price hurdle has managed to reject every bullish impulse OMG has experienced since early September 2020. However, the most recent attempt seems promising as multiple technical and on-chain indicators have turned bullish.

OMG/USDT 1-day chart

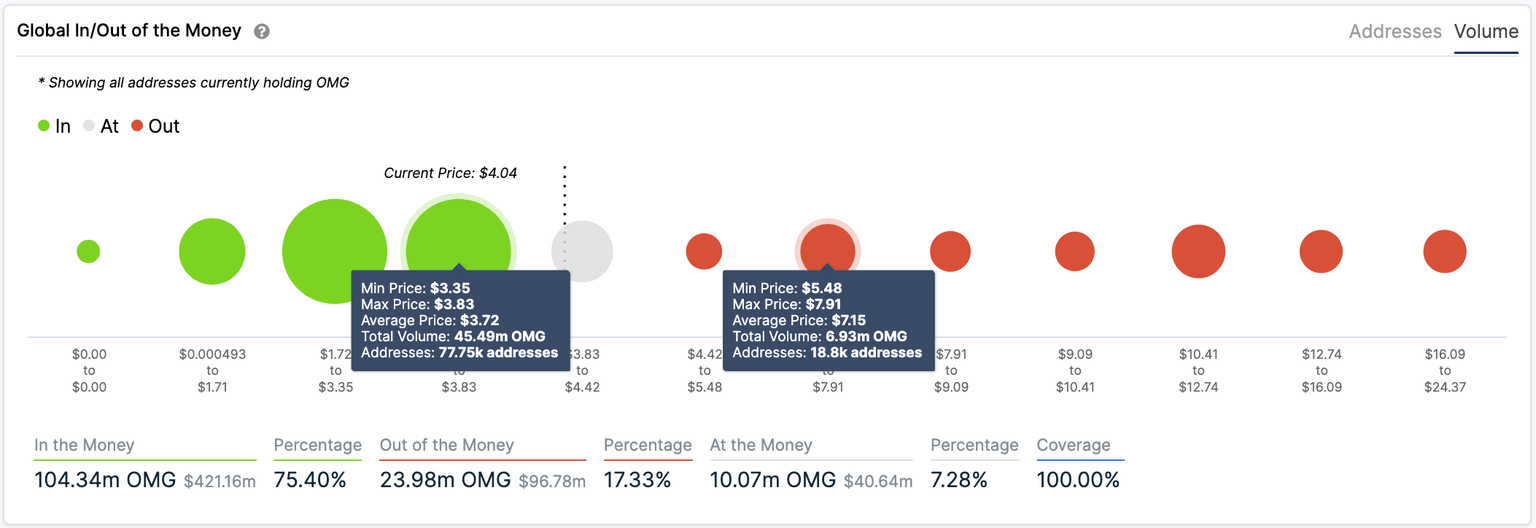

IntoTheBlock’s Global In/Out of the Money model shows that any selling pressure caused by short-term sellers will be absorbed by roughly 78,000 addresses that purchased 45.5 million OMG at $3.70. For this reason, the odds seem to favor the bulls.

As long as OMG Network price can slice through the overhead resistance at $4.40, its market value will be able to rise by 60% towards $7.15. Here, the IOMAP cohorts show that 19,000 addresses are holding 7 million OMG.

OMG Network IOMAP

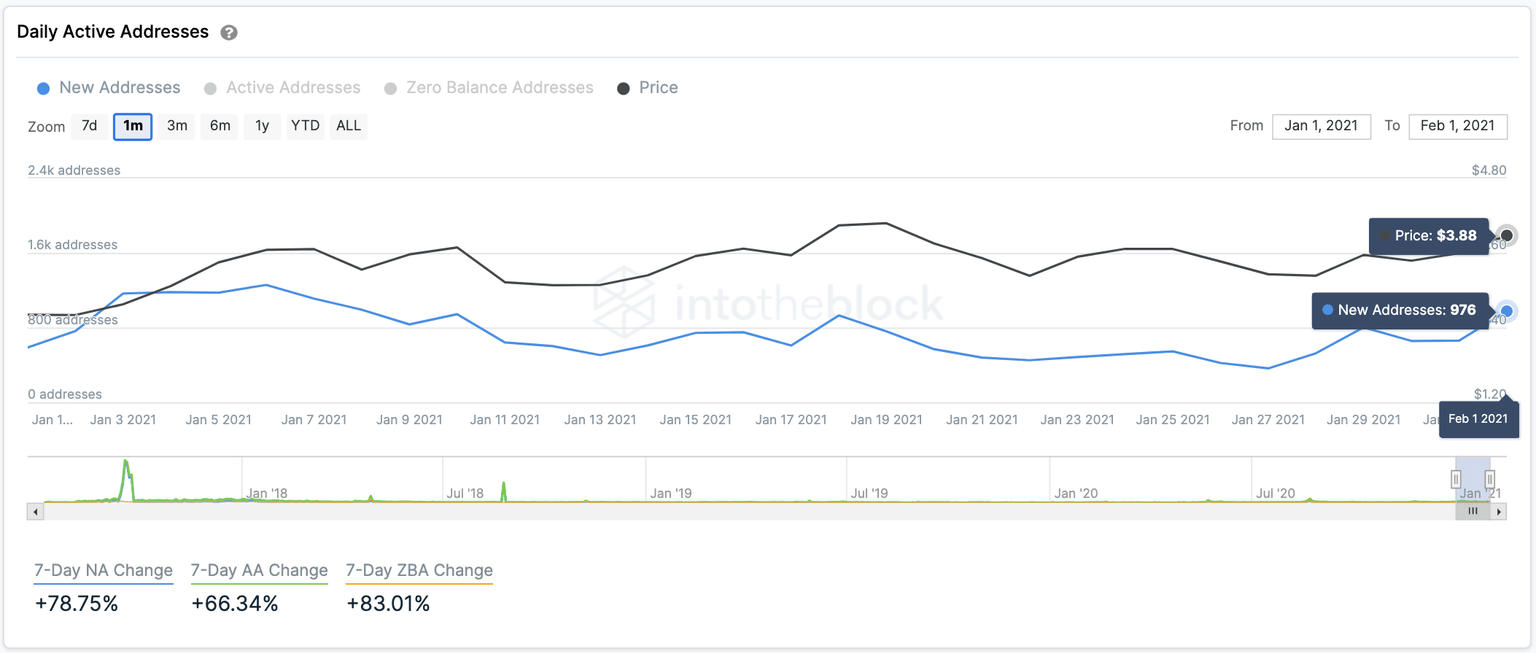

Given OMG Network’s potential for further highs, there has been an uptick in interest from market participants. The number of new OMG addresses being created on a daily basis rose to nearly 1,000, representing a 170% increase in the past week.

OMG Network New Daily Addresses

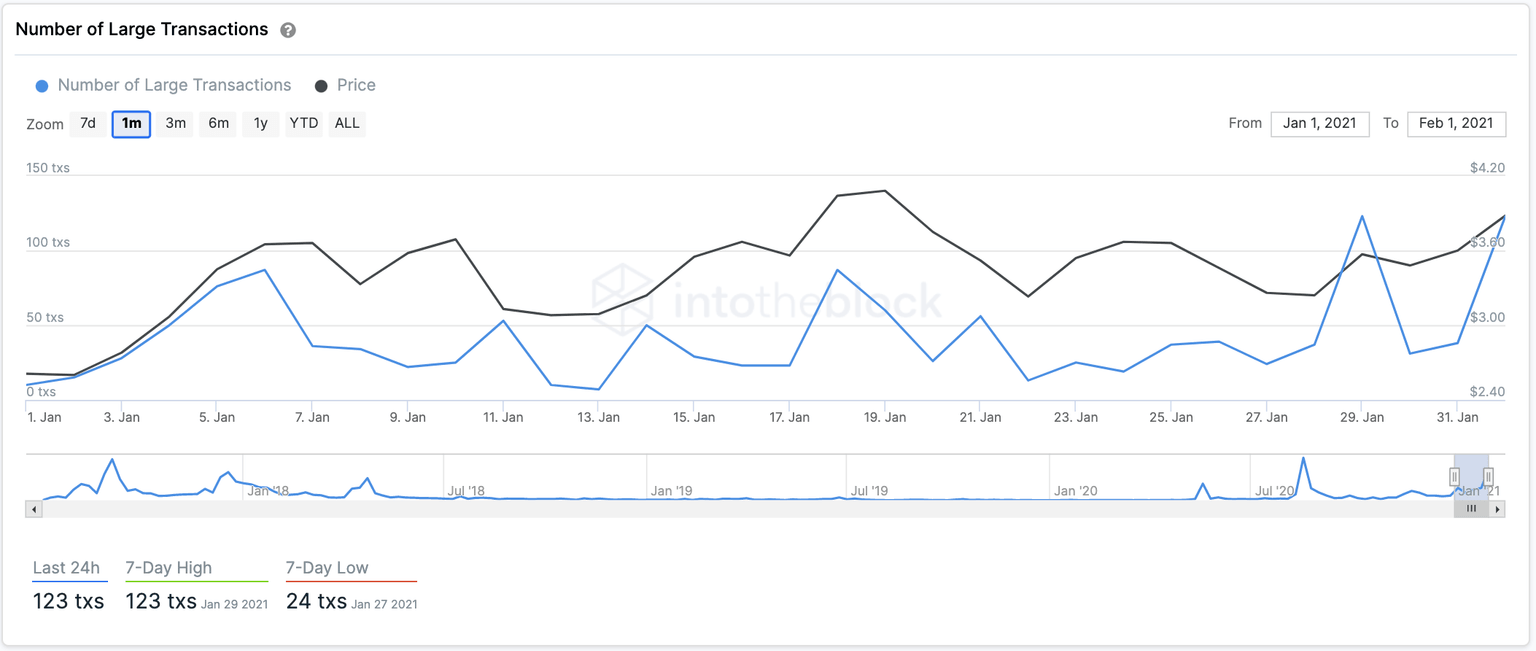

Meanwhile, the number of large transactions with a $100,000 or greater value skyrocketed over the last three days. More than 123 large transactions were recorded today, a significant upswing from the 30 large transactions recorded on January 30. Such market behavior signals the presence of whales during the current price action.

All of these on-chain metrics point to the inevitable breach of the $4.40 resistance level. Since there isn’t any significant supply barrier after this hurdle, a 60% surge seems very likely for OMG Network price.

OMG Number of Large Transactions chart

Conversely, a correction towards the 50 or 100 day SMA is possible if OMG price fails to slice through the resistance.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.