MATIC price primed for prompt recovery, Polygon bulls target $2.40

- MATIC price seems bound for a bullish impulse.

- After dropping by more than 25% in the past five days, Polygon presents a buy signal.

- A spike in buying pressure could see this cryptocurrency rise to $1.45 or $1.60.

MATIC price presents a buying opportunity at a crucial support level that could see it surge by over 15% over the next few days.

MATIC price looks primed to rebound

After surging to a high of $1.71 on June 15, MATIC price took a 25% nosedive. The sudden sell-off saw Polygon drop to a low of $1.28 recently.

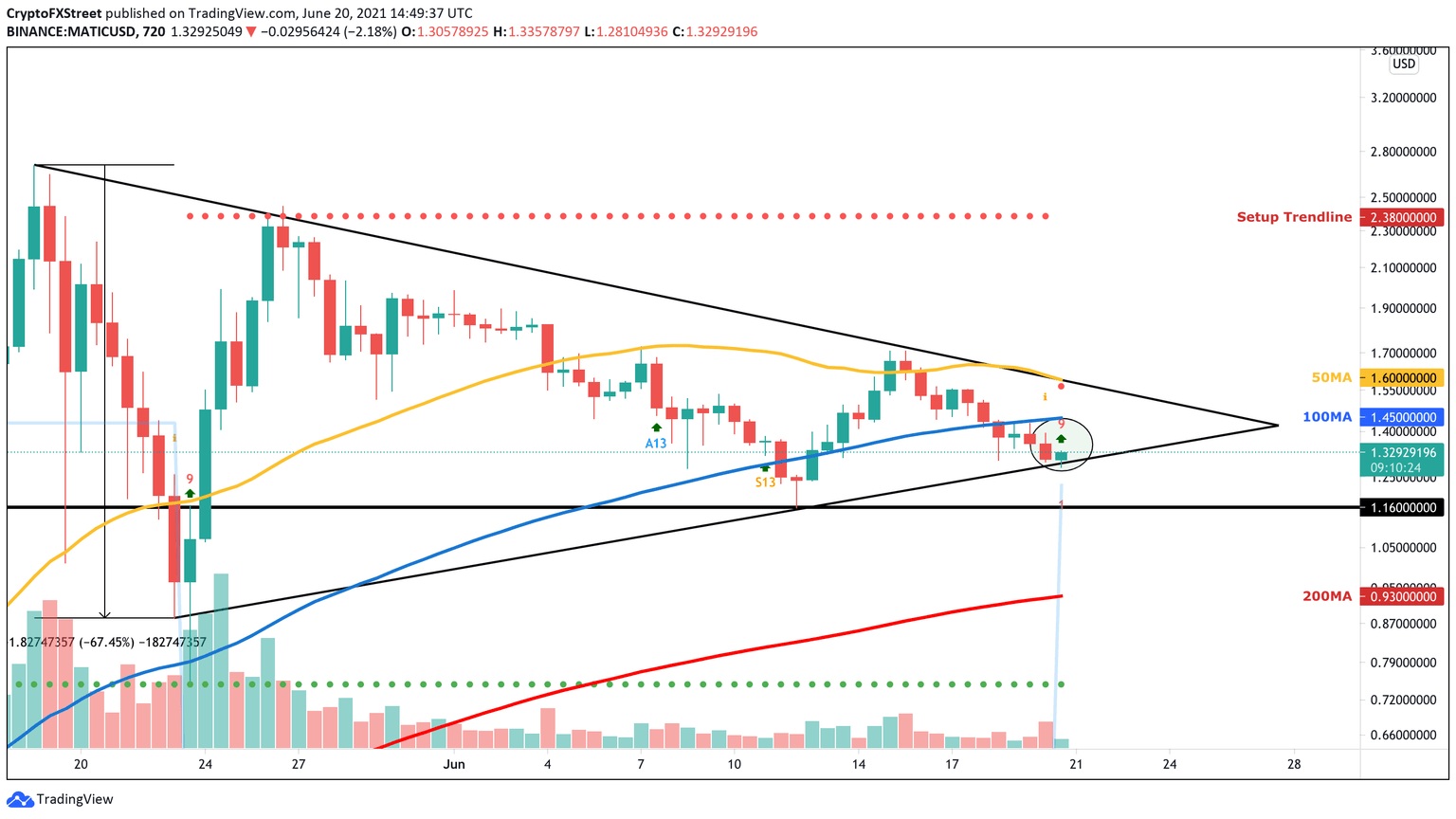

Now, it seems like the rising trendline of a symmetrical triangle where MATIC price has been contained since May 18 could keep falling prices at bay.

While this support area seems significant enough to hold, the Tom DeMark (TD) Sequential indicator flashed a buy signal on Polygon’s 12-hour chart. The bullish formation developed as a red nine candlestick, which is indicative of a one to four 12-hour candlesticks upswing.

MATIC/USDt 12-hour chart

A spike in buying pressure around the current price levels could see MATIC price rise toward the 100- or 50-twelve-hour moving average. These crucial areas of resistance sit at $1.45 and $1.60, respectively.

If Polygon manages to break through the 50-twelve-hour moving average, the symmetrical triangle suggests that a new uptrend may start. Under such unique circumstances, MATIC price could surge by nearly 50% to the setup trendline at $2.38.

Nonetheless, investors must pay close attention to the $1.28 support level. Failing to hold above this key area of support might lead to significant losses. MATIC price could fall to the $1.16 support level or even the 200-twelve-hour moving average at $0.93.

Author

FXStreet Team

FXStreet