MATIC continues to march higher with $3 in sight

- MATIC price defies broader market concerns and weaknesses by moving higher and higher.

- Bulls slap away any bears attempting to take control.

- Early evidence of a short-term market top beginning to appear.

MATIC price action has certainly been some of the most dramatic post flash crash. Multiple vigorous attempts by short-sellers to push MATIC lower have all failed and have led to MATIC pushing towards new all-time highs.

MATIC price may have one final push before correcting

MATIC price action, in case you missed it, has gained over 66% from its flash-crash lows. This is a fantastic gain by any standard and one that could continue higher or face a solid but temporary pullback. Options and trade setups exist for bulls and bears.

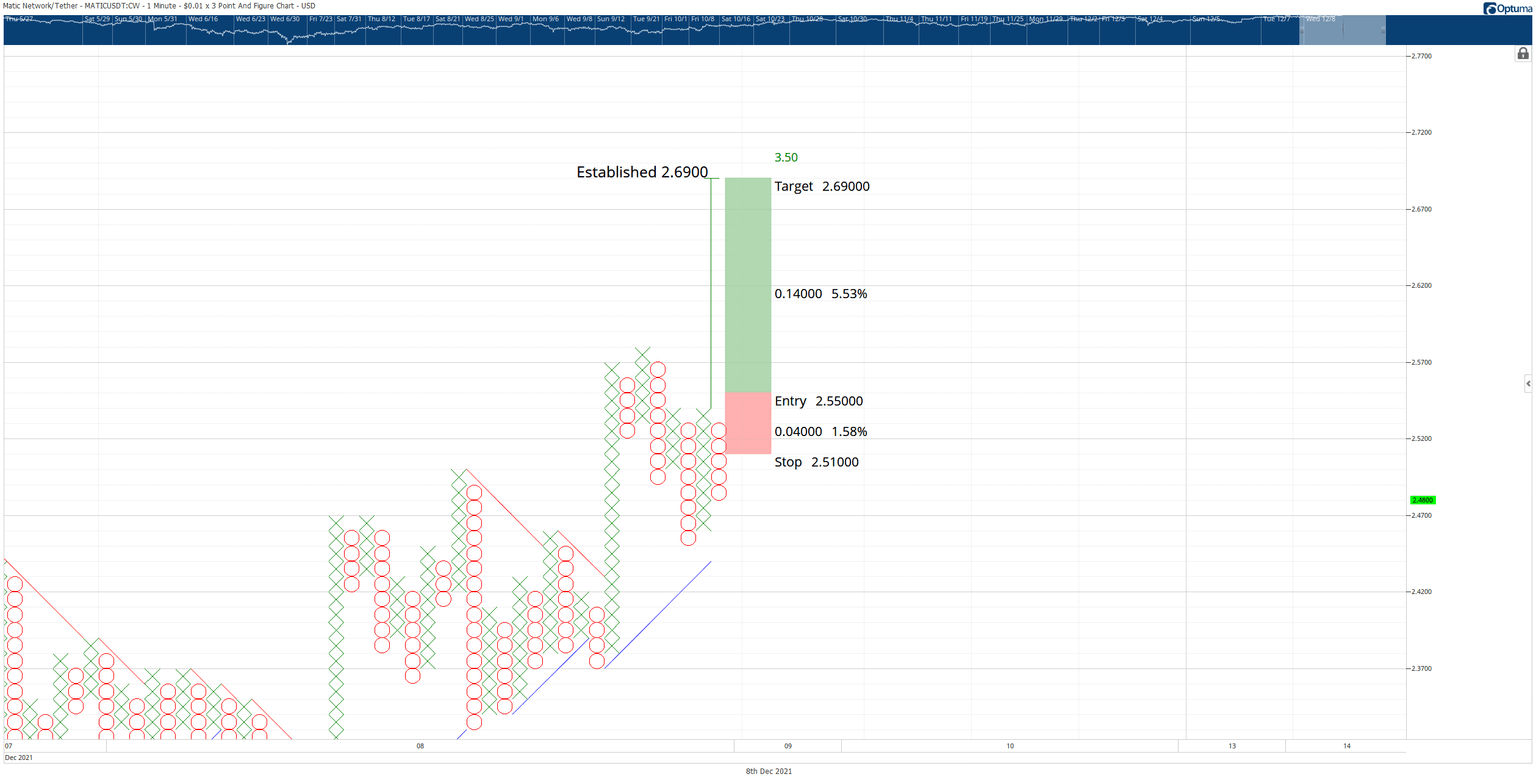

On the long side of the market, a hypothetical entry would be a buy stop at $2.55, a stop loss at $2.51, and a profit target at $2.69. The entry is based on the breakout above a triple top. A trailing two-box stop would help protect any implied profits.

MATIC/USDT $0.01/3-box Reversal Point and Figure chart

The hypothetical long trade is invalidated if MATIC moves below $2.44.

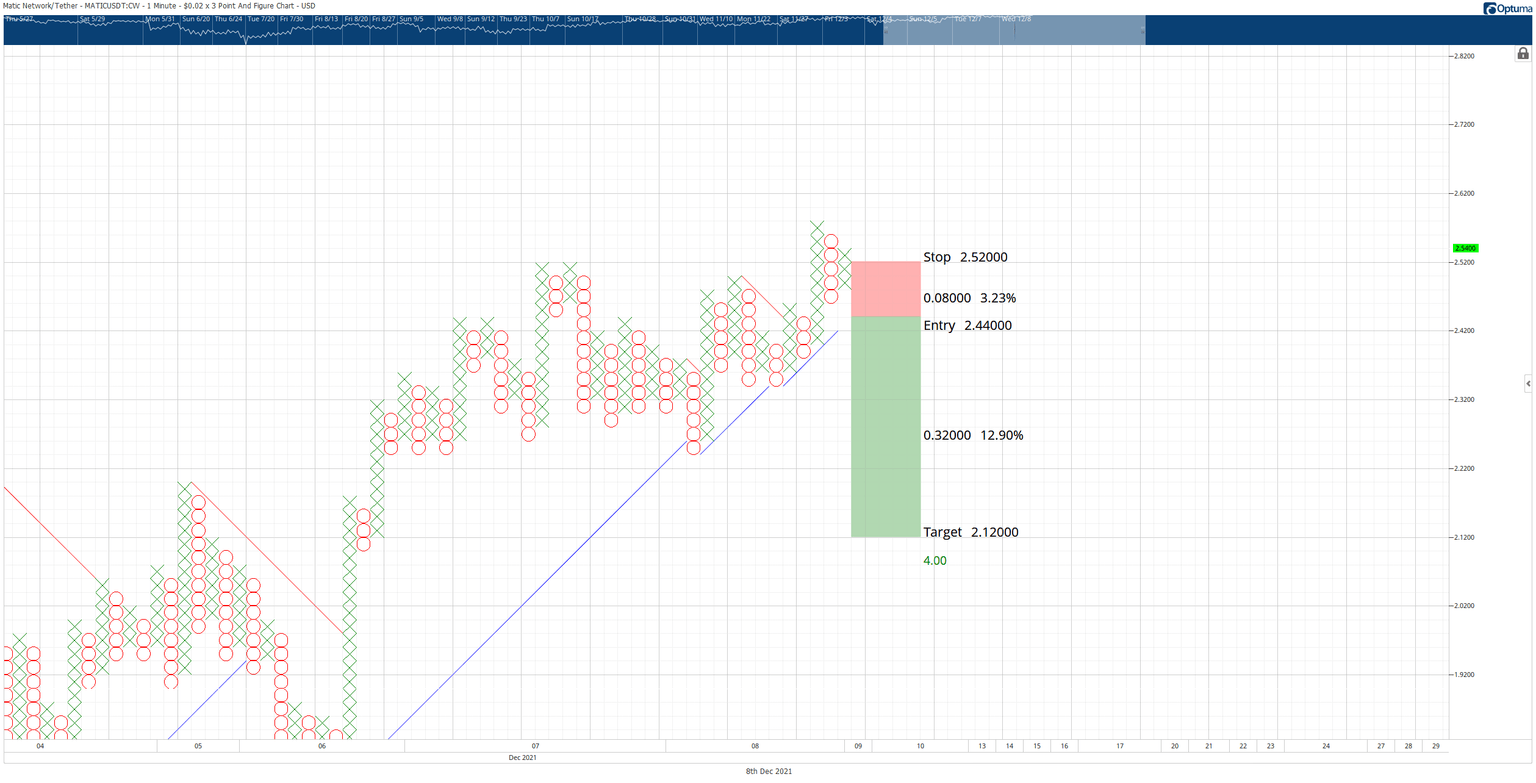

The short trade idea is a theoretical sell stop order at $2.44, a stop loss at $2.52, and a profit target at $2.12. The entry is based on a sell entry from a Pole Pattern retracement. Additionally, the entry would convert the $0.02/3-box reversal Point and Figure chart into a bear market.

MATIC/USDT $0.02/3-box Reversal Point and Figure chart

This trade is invalidated if the long entry identified above is triggered.

Traders on the short side are more at risk here than the longs. This is due to the proximity of MATIC price to new all-time highs and the persistent, sustained momentum higher in the short-term.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.