Litecoin Price Prediction: LTC trims early gains to retest 138.00, key support lines in focus

- LTC/USD fails to keep the corrective recovery, attacks intraday low.

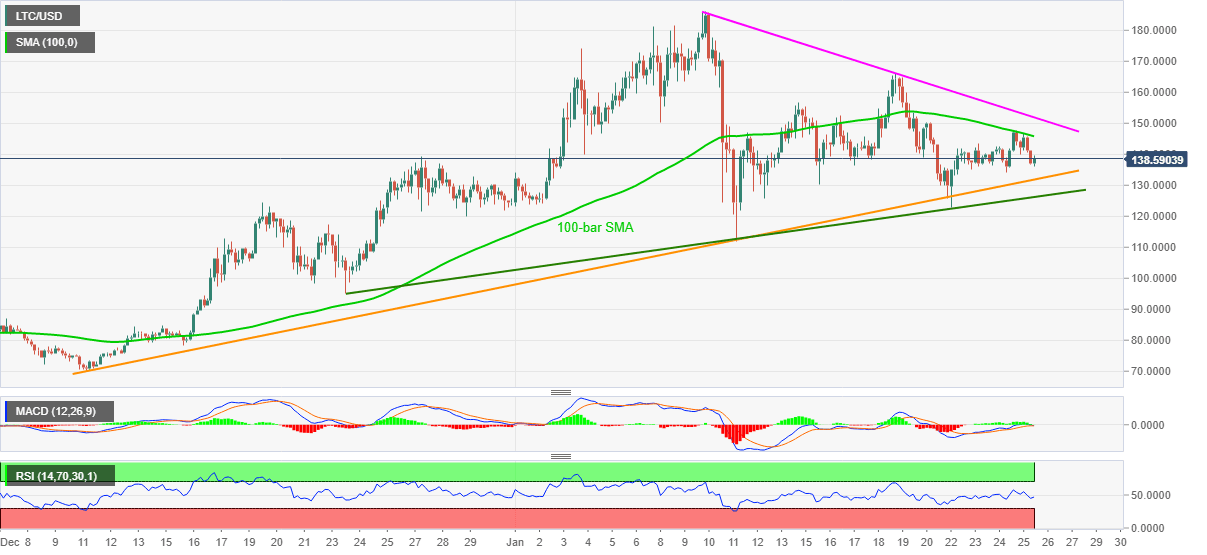

- U-turn from 100-bar SMA, downbeat MACD favor sellers.

- Short-term falling trend line adds to the upside filters.

LTC/USD fades the day-start bounce off 136.15 while stepping back from 139.75, currently around 137.53, during early Tuesday. The altcoin took a U-turn from 100-bar SMA while portraying its weakness the previous day. Also on the negative side could be the MACD histogram that flirts with the LTC/USD bears.

As a result, the LTC/USD is expected to probe Sunday’s low near 134.00 while eyeing an upward sloping trend line from December 11, at 131.80 now.

Though, any further downside past-131.80 will be challenged by a five-week-old support line near 126.20.

Meanwhile, LTC/USD buyers are likely to return on the upside break of 100-bar SMA, currently around 145.80. However, a descending resistance line from January 10, close to 152.00, becomes a tough nut to crack for the bulls afterward.

It should, however, be noted that the quote’s sustained rise beyond 152.00 will have the previous week’s top near 166.00 as an intermediate halt during the rise to the monthly peak surrounding 186.00.

LTC/USD four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.