Litecoin Price Prediction: LTC needs to clear one hurdle for 30% ascent

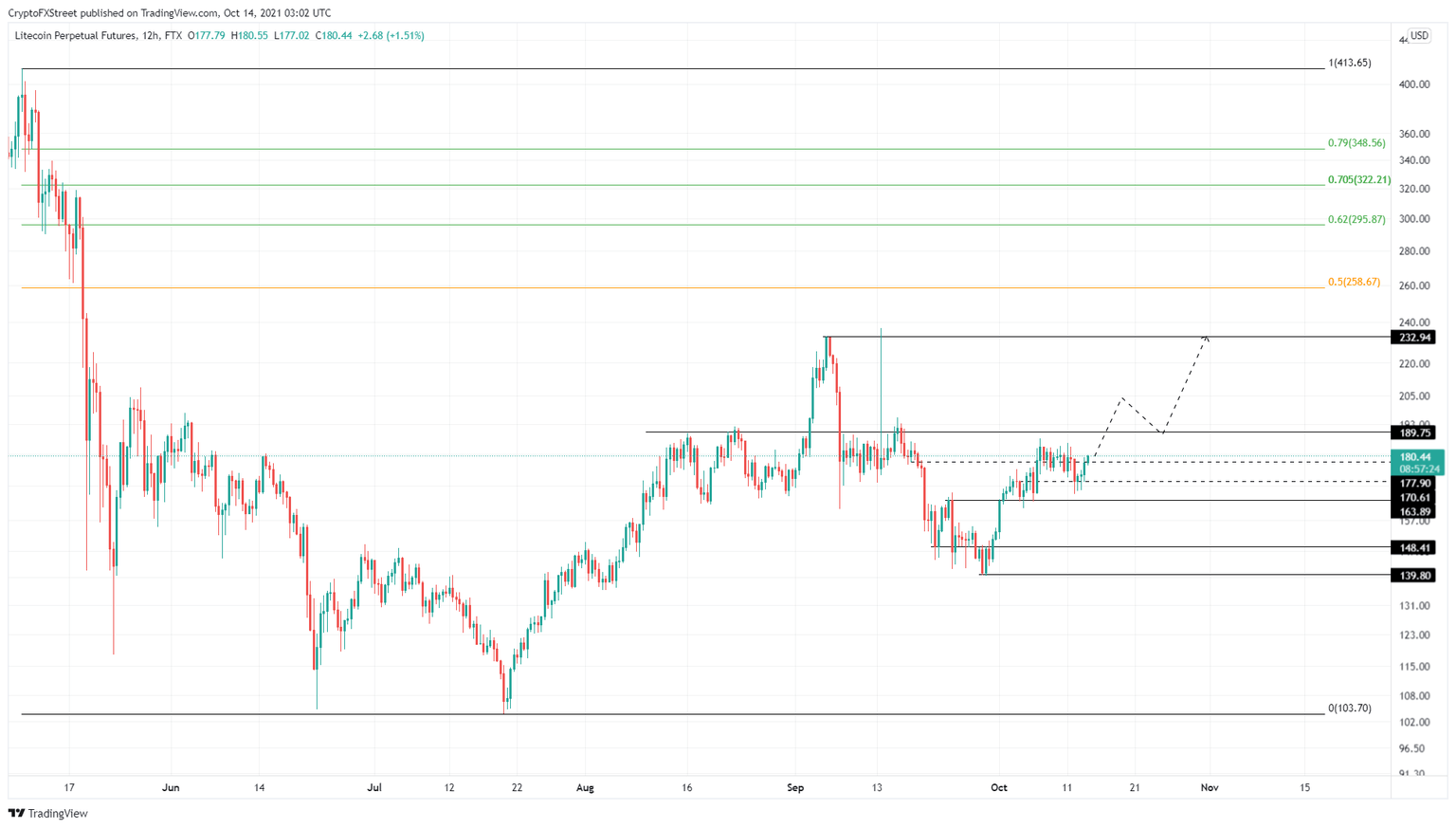

- Litecoin price has been on a slow and steady uptrend after finding a stable platform at $177.90.

- A flip of the $189.75 resistance level into the support floor will likely trigger a 30% ascent to $232.94.

- If LTC breaks below $163.89, it will invalidate the bullish thesis.

Litecoin price has been consolidating below a stiff resistance barrier for 36 days. However, LTC seems to have mustered up the strength and is attempting to cross this hurdle and trigger a new uptrend.

Litecoin price needs to clear crucial barrier

Litecoin price bottomed on September 28 at $139.80 and has rallied roughly 28% to where it currently stands, $180. Since October 4, LTC has set up distinctive higher lows, suggesting a steady uptrend. Moreover, it has also cleared the $177.90 barrier and is currently retesting the resistance level at $189.75.

LTC has failed to breach this blockade thrice over the past month. Hence, clearing $189.75 and flipping it into a demand barrier will attract sidelined investors. This move could trigger a 30% ascent to the subsequent significant blockade at $232.94.

If the buying pressure persists after this barrier, market participants can expect LTC to retest the 50% Fibonacci retracement level at $258.67. This move would constitute a 45% gain from the current position.

LTC/USDT 12-hour chart

While things are looking up for Litecoin price, investors need to watch for bears trying to produce a lower low below $163.89. Doing so will invalidate the bullish thesis and could trigger a 9% descent to $148.41.

In some cases, this downswing might extend to $139.80, where LTC could form a double bottom and give the uptrend another go.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.