Litecoin Price Prediction: LTC has officially doubled since the summer

- Litecoin price is up 100% since the summertime lows.

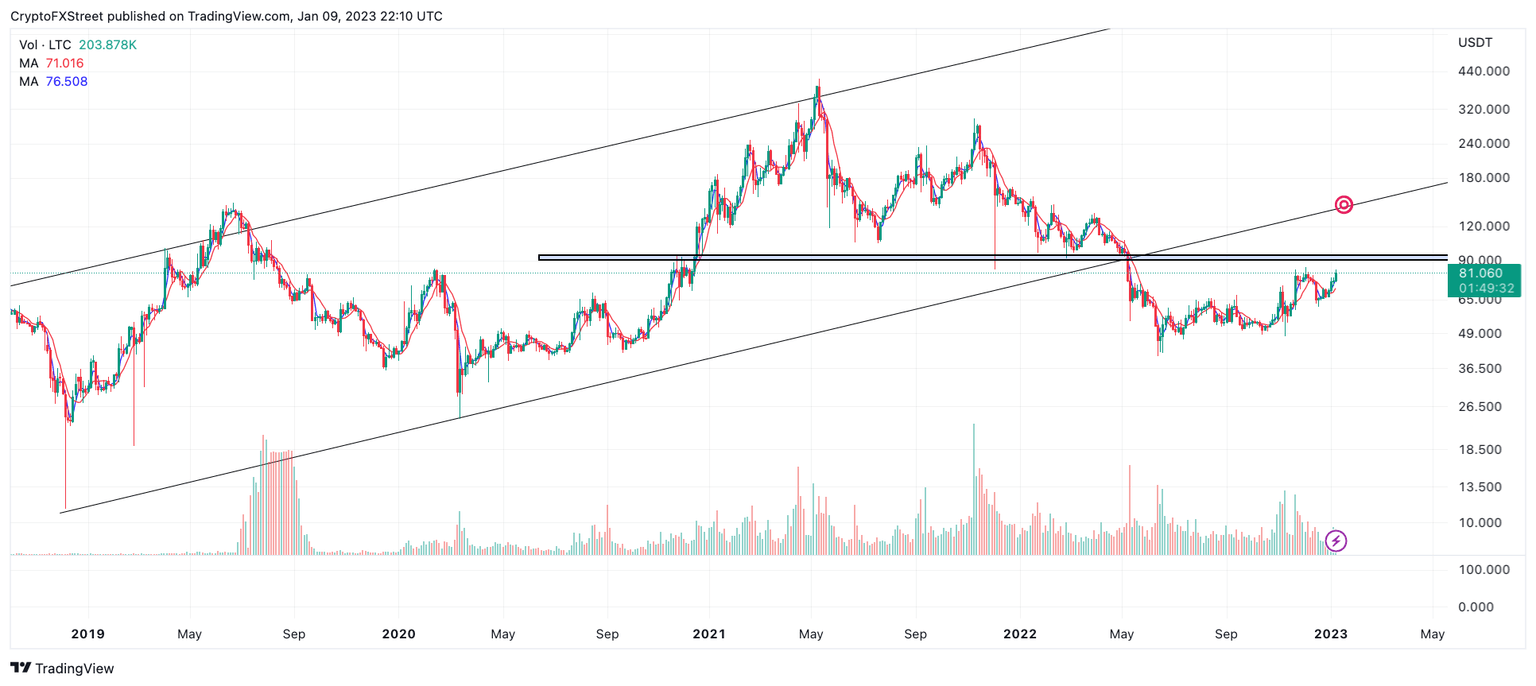

- LTC could rally towards $90 if a pierce above a swing high at $84 occurs.

- The uptrend scenario could fail if the $75 price level were breached.

Litecoin price confirms the bullish bias set forth by FXStreet analysts throughout the weeks. While a rally toward $100 seems imminent, this thesis identifies possible areas of resistance to stifle the LTC bulls.

Litecoin price moves higher

Litecoin price has continued to bolster positive returns to the hands of investors. Since January 1, the LTC price has surged by 16%, taking full control of the $70 zone., On January 9, the LTC price rose by an additional 3.5%, enabling the bulls to negotiate with bears over the psychological $80 barrier.

Litecoin price currently auctions at $80.41. The re-encounter with the $80 zone is a significant milestone as the LTC price has doubled since the summertime lows at $40.36 were established, an accomplishment very few cryptocurrencies can claim. While the LTC price hovers just below a clear liquidity level at $84, the 100% profit is a psychological number that could trigger a cascade of profit-taking from the early bulls.

Thus, traders may want to consider utilizing tight stop losses and practicing healthy risk management moving forward. The next LTC target is the $90 zone, and a second attempt at the $84 swing high should enable the bullish opportunity to manifest.

LTC/USD 1-Day Chart

Invalidation of the bullish thesis could be placed below the 8-day exponential moving average at $75. A breach of the barrier could be an early market reversal warning, as bears have liquidity levels at $70 and $65 that \remain untested since the LTC rally. The downtrend scenario creates the possibility of a 20% decrease from Litecoin’s current market value.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.