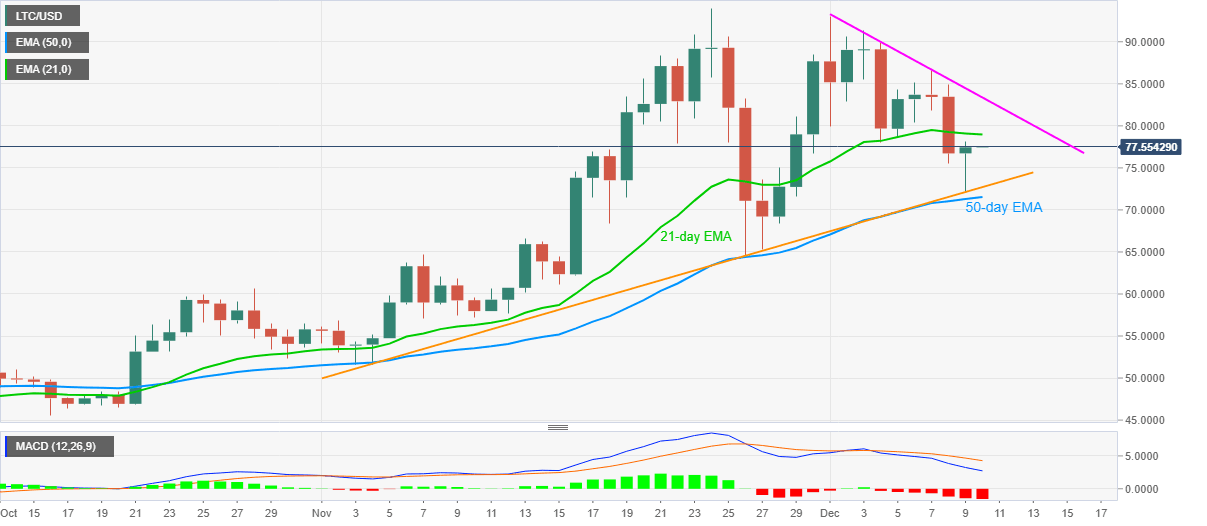

Litecoin Price Prediction: LTC buyers struggle to justify bounce off five-week-old support above 77.00

- LTC/USD fades corrective recovery from short-term key support line.

- Break of 21-day EMA, bearish MACD favor sellers.

- 50-day EMA, 70.00 threshold add to the downside filters.

LTC/USD fails to extend the pullback from an eight-day low, marked on Wednesday, while recently easing to 77.45 during early Thursday. The crypto major dropped after breaking 21-day EMA for the first time in December.

However, an upward sloping trend line from November 04, at 72.12 now, triggered the quote’s U-turn.

Even so, LTC/USD prices keep the EMA breakdown amid bearish MACD signals, which in turn suggest another downbeat session towards breaking the key support line around 72.10.

It should, however, be noted that the 50-day EMA, currently around 71.30, will precede the 70.00 psychological magnet to challenge the pair bears below the stated support line.

On the contrary, an upside clearance of 21-day EMA level of 78.95 needs to cross a falling trend line from the month’s start, close to 83.40, to recall the buyers.

In doing so, the 80.00 round-figure can offer intermediate entertainment to the pair traders.

LTC/USD daily chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.