Litecoin price needs to climb above this vital resistance level to reach $93

- Litecoin price is currently trading in a short-term uptrend but faces one last resistance level.

- On-chain metrics are in favor of Litecoin and suggest the digital asset is poised for a breakout.

Litecoin is up by 17% since the last local bottom at $69 established on December 11. The digital asset has established a short-term uptrend and only needs to crack one last resistance level at $84 to aim for $100.

Litecoin price aims for $93 as bullish momentum increases

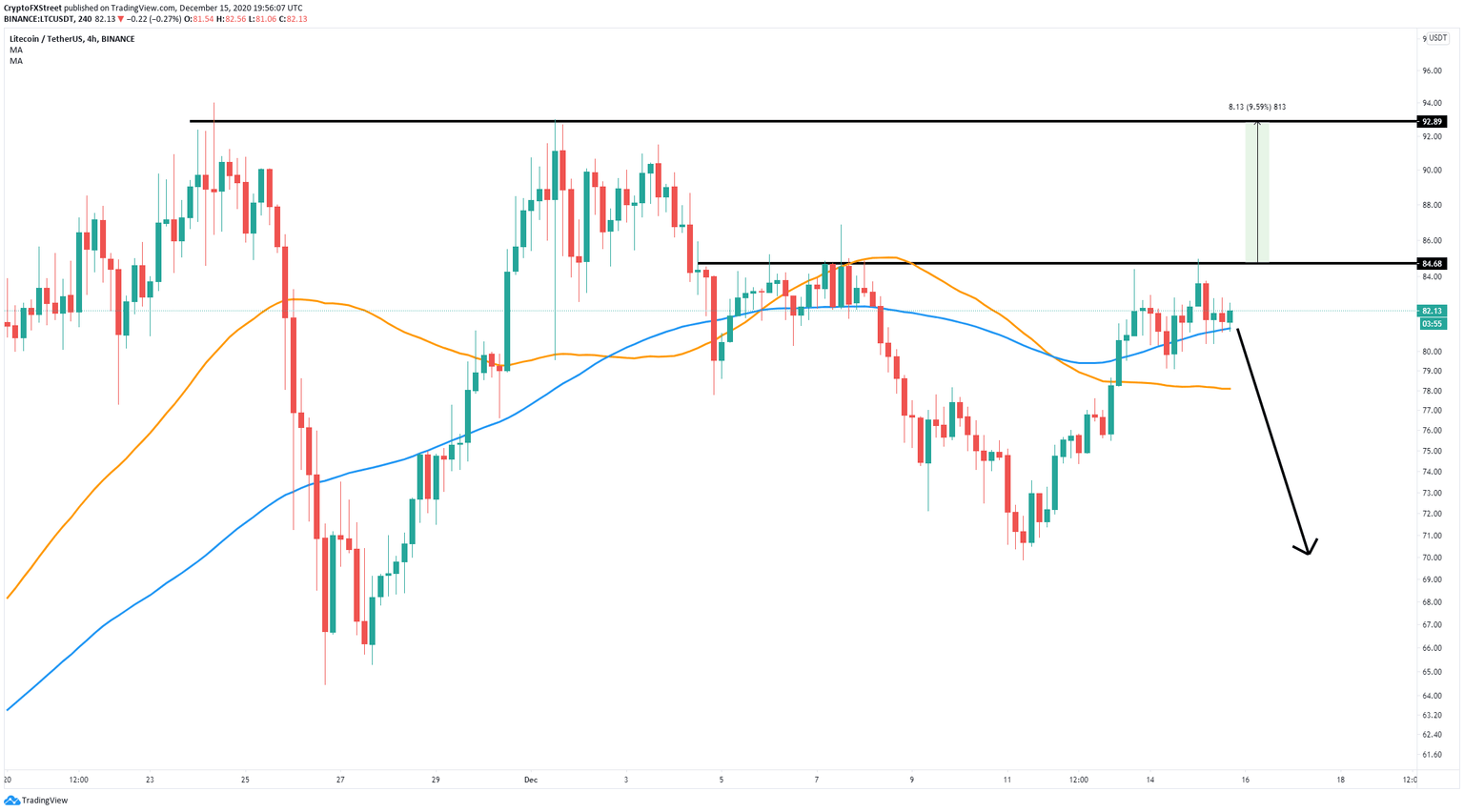

On the 4-hour chart, Litecoin has formed an uptrend after establishing several higher lows and higher highs. Additionally, bulls have conquered the 50-SMA and 100-SMA levels as support,

LTC/USD 4-hour chart

The next hurdle in the way of bulls is the resistance level at $84 which has been tested several times in the past. A breakout above this point would quickly push Litecoin price towards $93 with the potential to aim for $100.

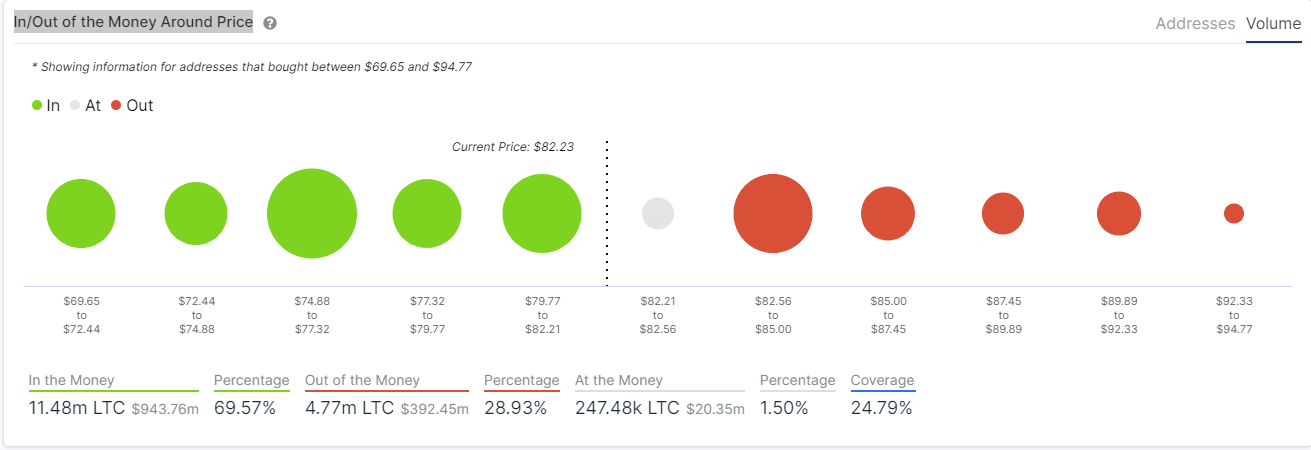

LTC IOMAP chart

The In/Out of the Money Around Price (IOMAP) chart shows almost no resistance on the way up with the most significant level at $84 which gives credence to the bullish outlook above. On the other hand, the IOMAP does indicate Litecoin has a lot of support on the way down from $80.

However, the inability from the bulls to hold the 50-SMA support level could quickly drive Litecoin price to at least the 100-SMA at $78 and as low as $70 in the long-term if selling pressure continues mounting after the initial breakdown.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.