Litecoin Price Forecast: LTC targets $260 as whales go into a buying frenzy

- Litecoin price is contained inside an ascending parallel channel on the 12-hour chart.

- LTC bulls have just defended a crucial support level and aim for a significant rebound.

- A key indicator is on the verge of presenting a strong buy signal for LTC.

Litecoin price is still down by 30% since its 2021 peak of $247. However, the cryptocurrency market is showing signs of a recovery, and Litecoin bulls are planning to take advantage of it.

Litecoin price poised for greatness as whales continue to accumulate

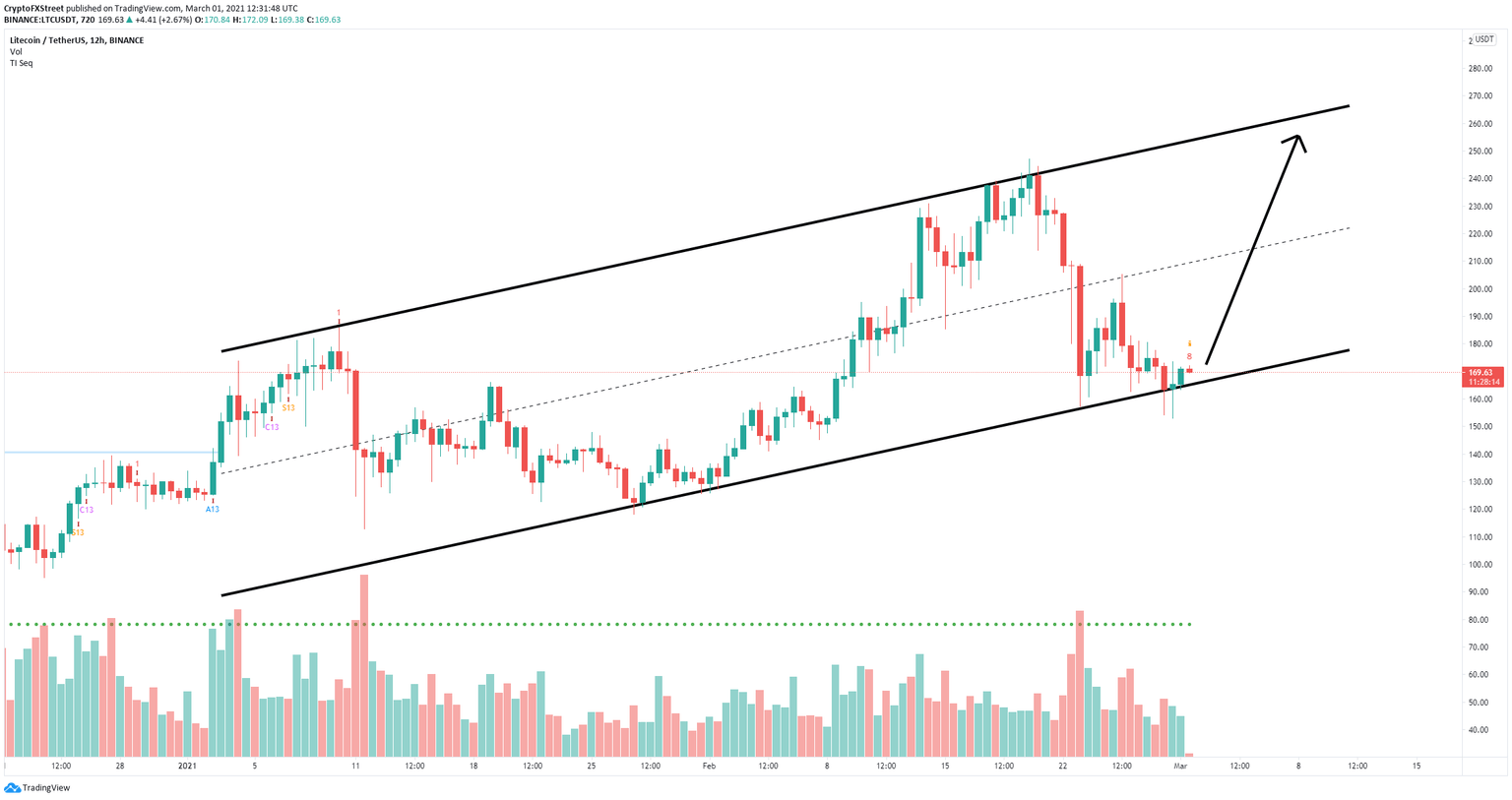

On the 12-hour chart, Litecoin price remains contained inside an ascending parallel channel and has just defended the lower trendline support. Additionally, the TD Sequential indicator has presented a red ‘8’ candlestick which is usually followed by a buy signal.

LTC/USD 12-hour chart

The confirmation of the buy signal has the potential to drive Litecoin price towards the middle trendline of the channel at $220 and up to the upper boundary at $260.

LTC Holders Distribution

Additionally, the number of whales holding between 100,000 and 1,000,000 LTC has significantly increased since February 8, from a low of 110 to 117 currently, which indicates large holders believe Litecoin price will rise even more.

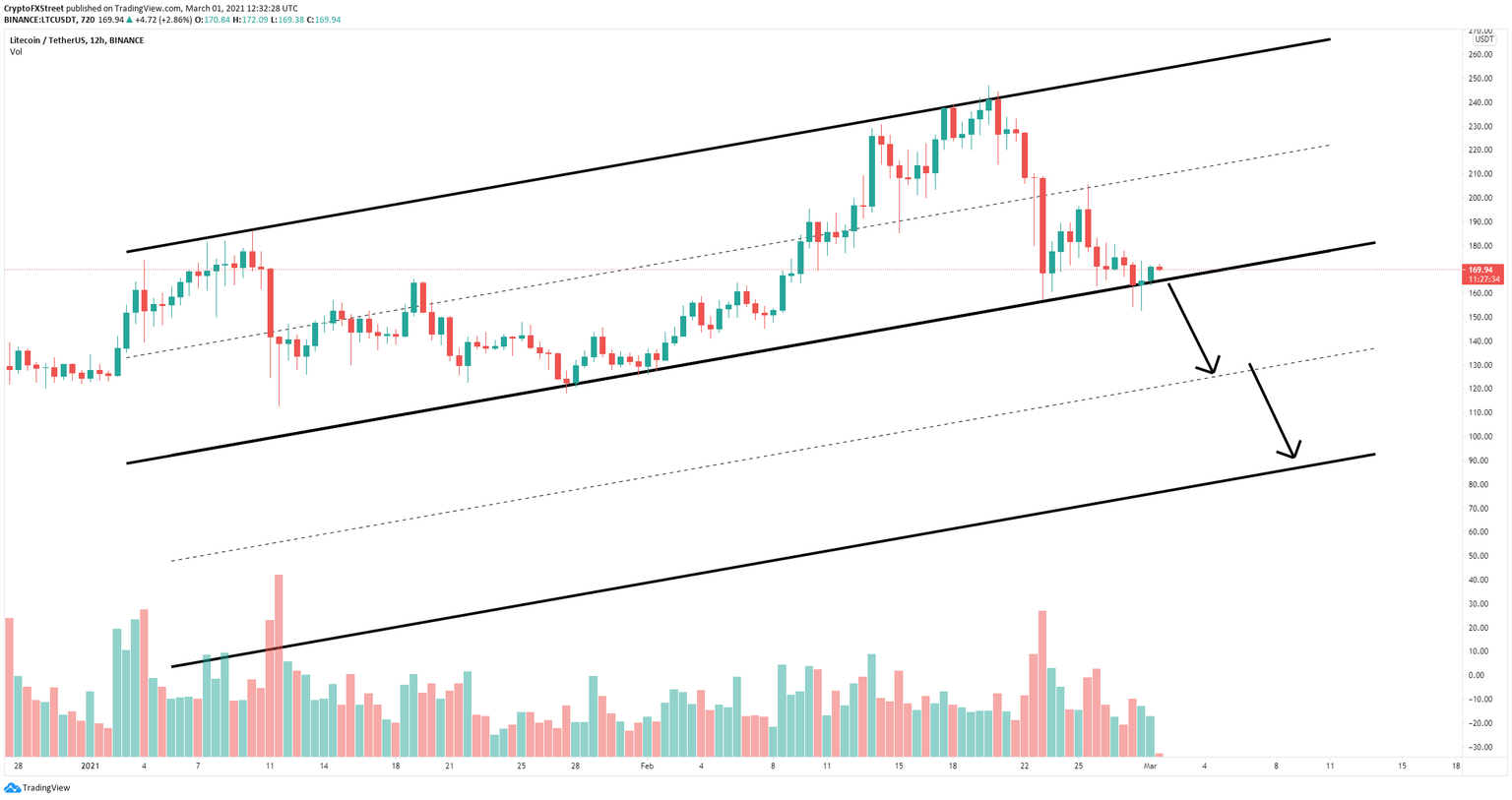

LTC/USD 12-hour chart

On the flip side, if the bears can push Litecoin price below the key support level of $165, the digital asset can quickly fall towards $130 and as low as $90 in the longer-term.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B13.30.02%2C%252001%2520Mar%2C%25202021%5D-637501988347505601.png&w=1536&q=95)