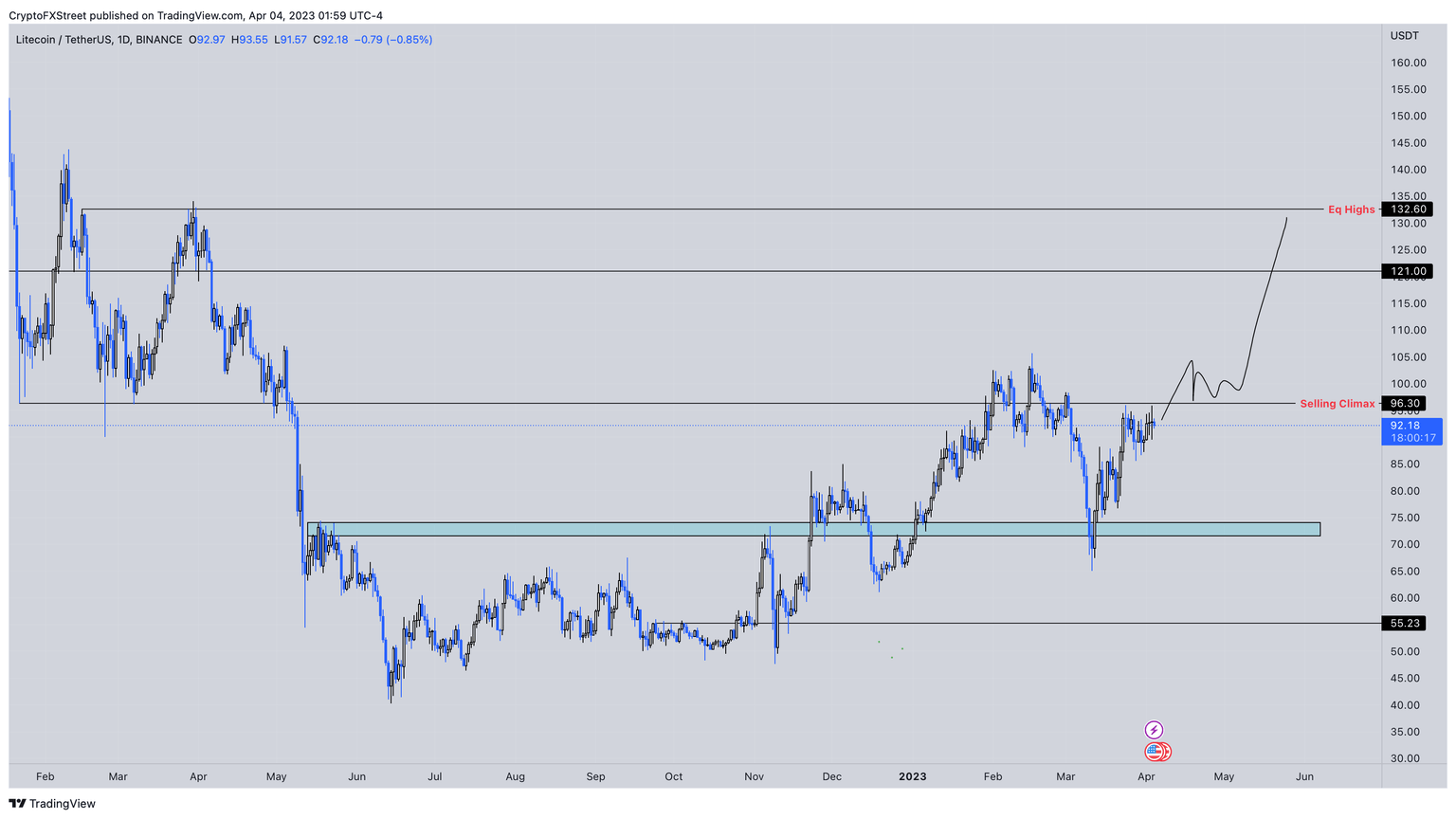

Litecoin price at critical juncture, LTC bulls need to conquer this level for a 45% rally

- Litecoin price has seen a second attempt to breach the $96.30 hurdle.

- A successful flip of this blockade will allow LTC to scale 44% and tag the $132.60 barrier.

- A daily candlestick close below the $74.02 to $71.60 support area will invalidate the bullish thesis.

Litecoin price has shown incredible momentum after it overcame a significant hurdle in the first week of January 2023. Since then, LTC has tried to breach the next critical level twice but has failed. Investors need to pay attention to the altcoin as it hovers below the aforementioned resistance level, plotting another attempt to break out.

Read more: Litecoin price could explode to $100 due to this LTC accumulation pattern

Litecoin price at crossroads

Litecoin price flipped the $74.02 to $71.60 hurdle into a support area on January 6, 2023. Since then, LTC has rallied 40%, briefly slicing through the $96.30 hurdle and setting up a local top at $105.71 on February 16. A full retracement that tagged the aforementioned support area gave LTC a similar thrust, which propelled it 42% this time and is currently forming a lower high at $96.00.

If Litecoin price overcomes the $96.30 hurdle and flips it into a support floor, it could trigger a 44% upswing to $132.60.

Investors should note that this bullish outlook for Litecoin price is contingent on LTC bulls managing to flip the $96.30 hurdle. Failure to do so could result in a tight consolidation or a steep correction to the next significant support level at $74.02.

LTC/USDT 1-day chart

On the other hand, if Litecoin price produces a daily candlestick close below the $74.02 to $71.60 support area, it will create a lower low and will invalidate the bullish thesis. Such a development could see LTC slide 22% to tag the $55.23 foothold.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.