Litecoin Price Analysis: LTC upside potential capped at $54

- Litecoin network difficulty has reached its highest levels since October 2019.

- The MACD also shows that market momentum is about to reverse from bearish to bullish.

LTC has been on an uptrend after it bounced up from the $47.24 support line and managed to go up to $49.44 over the last seven days. The buyers tried to break past the $50.85 resistance level in the interim but got immediately thwarted.

As of now, the goal for the buyers is pretty straight forward. The present candlestick is the green seven, meaning it still has some room to grow. The buyers must now aim to go above the $50.83, which it had previously failed to do so. The MACD also shows that market momentum is about to reverse from bearish to bullish, so that’s another positive sign.

LTC/USD daily chart

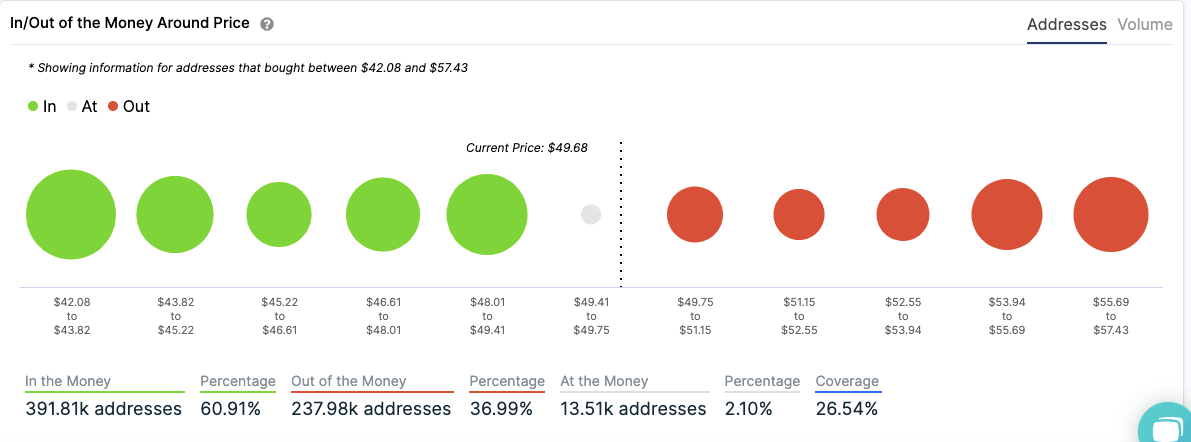

LTC IOMAP

The IOMAP is a pretty helpful tool that helps us realize the upside and downside potential of a particular asset. In this case, we can see that LTC can potentially go up to $53.94 before it encounters a strong resistance level. On the downside, the price is sitting on top of a healthy support level, so downside movement (for now) is somewhat limited.

LTC Network Metrics

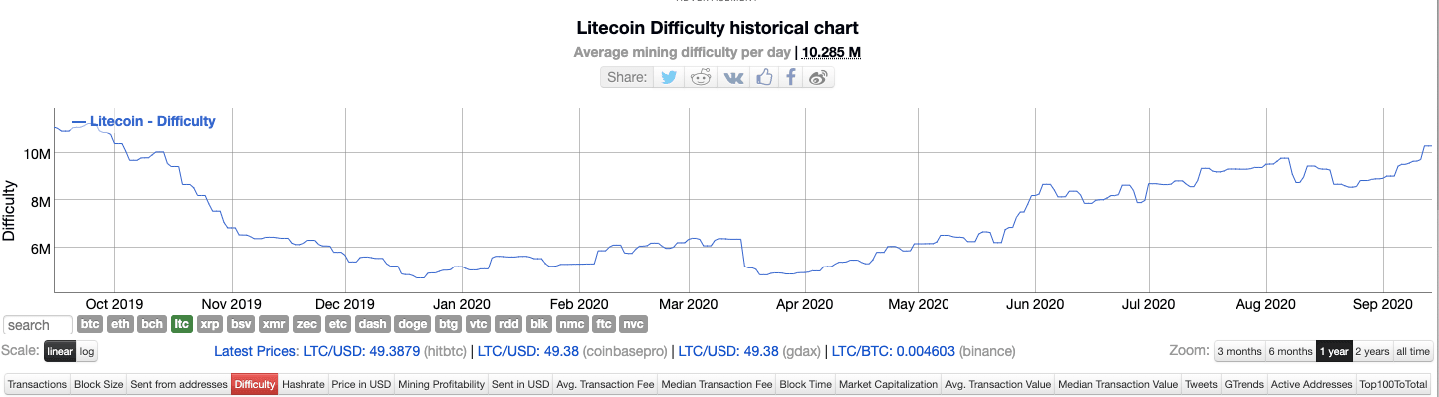

Difficulty

For POW (proof-of-work) coins like Litecoin and Bitcoin, “difficulty” is a metric that determines how time-consuming the mining process is. It keeps in check the rate at which the blocks are getting mined. As you can see in the graph above, difficulty has reached its highest levels since October 2019.

So, how have the miners responded to this? Pretty well, actually.

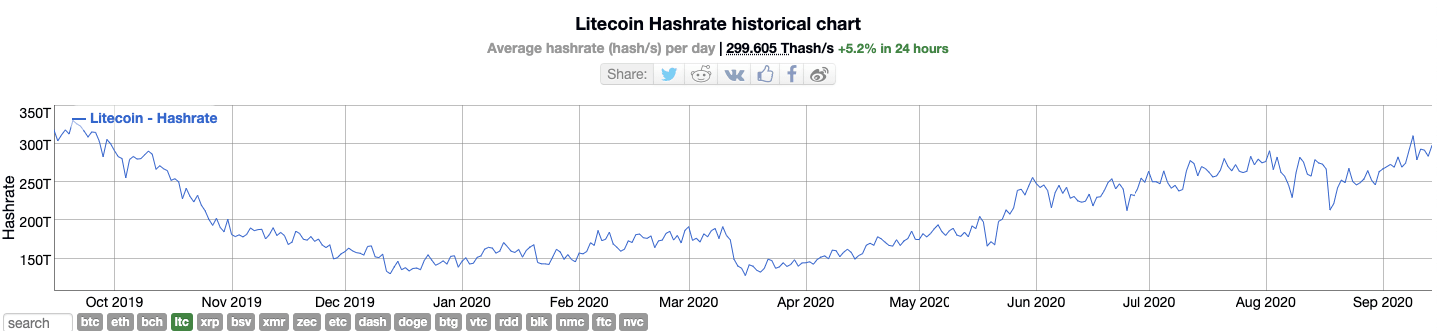

Hashrate

Hashrate is a metric that determines the computational ability of a network and is directly proportional to miner activity within the network. More the hashrate, more the speed and overall security. As you can see in the screenshot above, the hashrate has increased proportionally with the difficulty. This is an excellent sign for the bulls since a healthy network can attract more investments.

Key levels

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

-637357430484075548.png&w=1536&q=95)