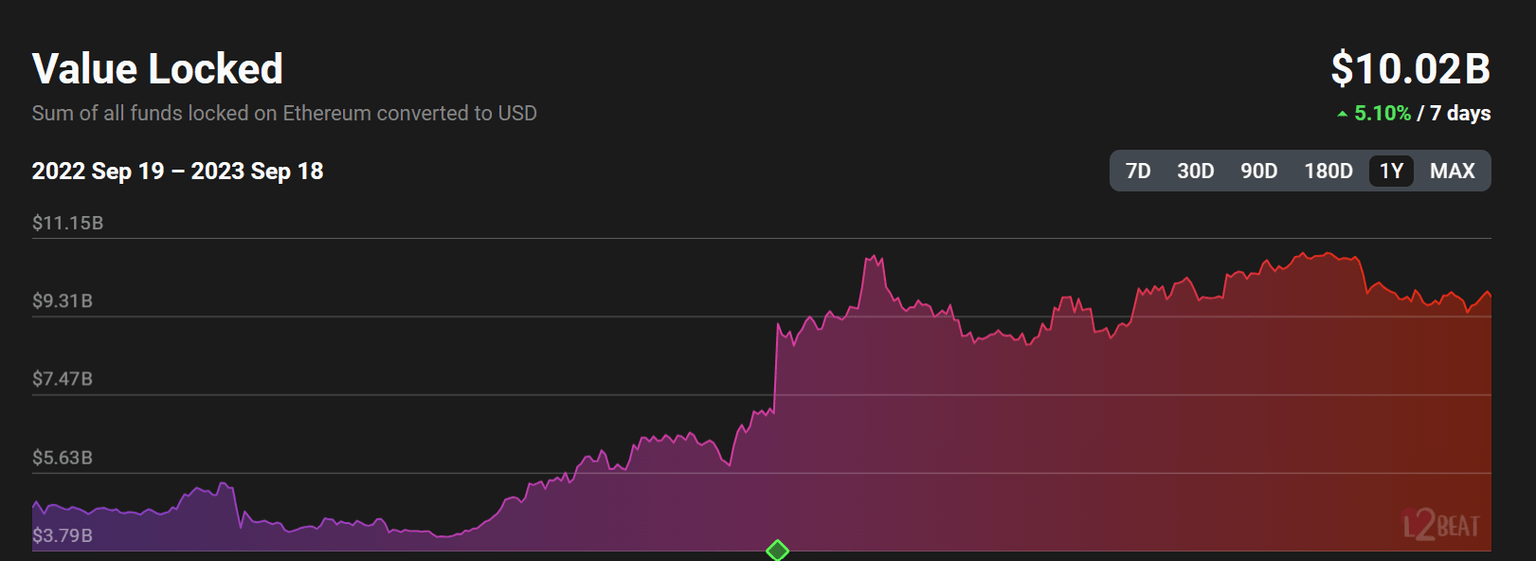

Layer-2 protocols double their value to over $10 billion eclipsing DeFi market growth

- Layer-2 solutions have emerged as the biggest crypto sector of the year, with their value jumping from $5 billion to $10 billion in nine months.

- The total value locked in the DeFi market has seen very little change since the beginning of the year, standing at $65 billion.

- The credit for L2’s growth goes to Arbitrum and Base, with the latter crossing $500 million in TVL in less than two months since its launch.

The crypto market has seen a shift in the flow of capital towards the blockchains running atop other blockchains known as Layer-2 solutions. These chains have managed to attract a whole fleet of investors who are looking to employ cheaper, faster transactions with the support of major crypto players like Coinbase to the sector.

Layer-2 beats DeFi market protocols

While Layer-2 solutions are a part of the Decentralized Finance (DeFi) market, the difference here is measured in the protocols deployed on them and on Layer-1 DeFi chains. The allure of easier and cheaper transactions has drawn investors in flocks, especially since the emergence of Base.

The Coinbase-built L2 chain, Base, was launched less than two months ago, in July this year. Since then, the chain has not been out of the investors' sights, and this is evident from the growth of the L2. Following its launch, Base managed to observe an increase in the total value locked on the chain, touching around $500 million at the time of writing, making it the third biggest L2 solution in the world, presently behind only Optimism and Arbitrum.

Akin to Base, Arbitrum, too, had a run-up this year following the launch of the native ARB token. The L2 solution took over Optimism and emerged as the biggest layer-2 blockchain in the world, with nearly $5.3 billion locked on it. At the moment, Arbitrum controls over half the funds locked in the Layer-2 market, with Optimism taking over another 25.4% of the market share.

Layer-2 solutions’ TVL

The L2s have left L1 chains hurting

While the total number of the protocols and Layer-1 chains clearly outshine the L2 market in terms of the funds flowing through, it has been taken over when one measures the pace of growth. The easiest way to achieve this is by measuring the rate of growth and the total change since a static point of time, such as the beginning of the year.

In the past nine months, L2 protocols have seen the total value locked on them nearly doubled from close to a little over $5 billion to $10 billion at the time of writing. On the other hand, the Layer-1 DeFi protocols have noted no substantial change in the past nine months. The total value locked on the L1 chains has remained closer to the mark it was at in January this year.

DeFi market TVL by chains

This makes for a concerning development as this sector is one of the biggest markets in the crypto space. Furthermore, the emergence of L2 chains is only supposed to encourage the development of faster and cheaper L1 chains.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.