Largest DeFi exploit of 2022 wipes out $80 million from Qubit's Ethereum-BSC bridge

- $80 million worth of cryptocurrencies were hacked from Qubit Finance's Ethereum-BSC bridge.

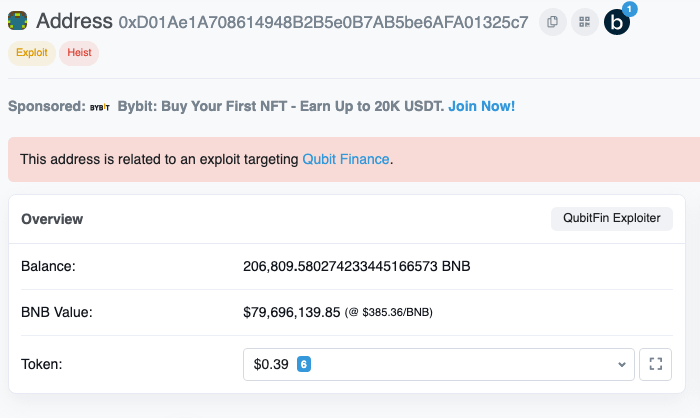

- In the largest DeFi exploit to date, the attacker's address still holds $80 million in BNB tokens.

- Qubit Finance's token QBT has posted 26.5% in loss overnight due to the hack.

Ethereum-BSC bridge of Qubit Finance suffered a hack to the tune of $80 million in the largest DeFi exploit of 2022. Hackers exploited the "deposit" function to steal cryptocurrencies from Qubit Finance.

Qubit Finance suffers largest DeFi hack of 2022

Qubit Finance, a decentralized lending and borrowing platform, was hacked for $80 million. The bridge collapsed in the largest DeFi hack of 2022. The money market platform connects lenders and borrowers efficiently and securely.

Qubit's Ethereum-BSC bridge connects the two blockchains in a way that users deposit ERC-20 tokens and receive BEP-20 in return. The bridge was targeted by attackers, exploiting the "deposit" contract.

Attackers input malicious data in the bridge's infrastructure and withdraw tokens on the Binance Smart Chain. The attacker's address still holds $80 million in BSC tokens.

An official report by the Qubit team reads:

In summary, the deposit function was a function that should not be used after deposit ETH was newly developed, but it remained in the contract.

Protocol Exploit Report

— Qubit Finance (@QubitFin) January 28, 2022

This report includes an analysis of the attack in its entirety in order to ascertain the nature of the exploit and, to prevent any similar exploits in the future.https://t.co/0152W0X553

The team at Qubit Finance is still monitoring the address and network partners, including Binance.

Qubit Finance attacker's BNB address

The hack highlighted two key issues in Qubit Finance's cross-chain bridge, interoperability between blockchains and lack of security in the infrastructure.

Despite several DeFi hacks in 2021, the industry remains prone to attacks. Grim Finance, Cream Finance, pNetwork was hacked over the past few months.

In response to the hack on Qubit, the platform's token QBT suffered a drop of 26% in its price overnight.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.