Justin Sun’s TRON scooped up by whales as TRX prepares to catch up with rising TVL

- TRON network’s total value locked has climbed 35% since the beginning of 2023, despite a pullback in May .

- Justin Sun’s TRON competes with blockchain-based applications and games on the blockchain.

- TRX price is 66.53% below its all-time high of $0.2316 despite rising TVL and accumulation by whales.

TRON, the native token of a decentralized smart contract network, registered a large increase in its Total Value Locked (TVL) since the beginning of the year. TVL is a metric used to measure the value of assets locked in a blockchain protocol: the higher the value of tokens locked is, the healthier the protocol.

TRON’s TVL posted a 35% increase YTD, but the token’s price is yet to catch up with the rising adoption of the blockchain network.

Also read: Shiba Inu likely to launch Shibarium layer-2 in July

TRON TVL on the rise despite decline in number of stakers

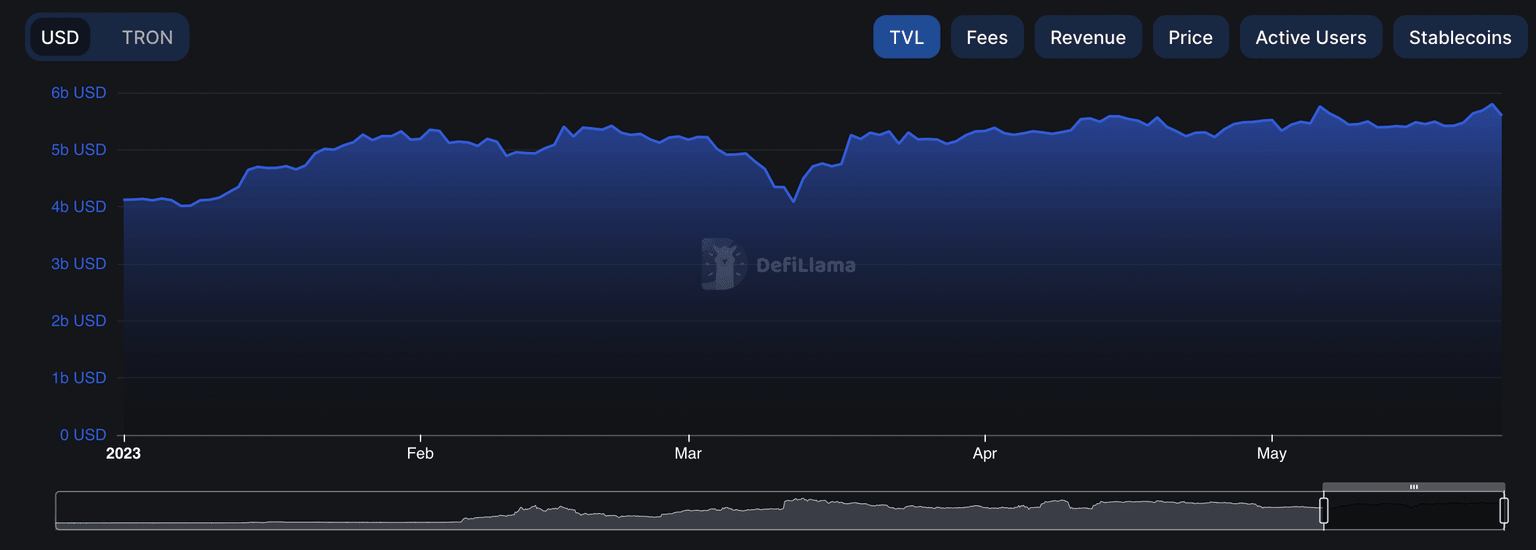

TRON network, founded by crypto influencer Justin Sun, saw a significant gain in terms of TVL. TRON’s TVL climbed from $4.123 billion in January to $5.6 billion in May. The Total Value Locked on a blockchain represents the total value of all tokens (staking included) on the network, giving clues about the health and adoption of the protocol.

TRON Network’s TVL

TRON’s rising TVL is a sign of higher adoption among market participants. Still, despite a considerable growth in TVL this year so far, the number of stakers on the TRON network has recently declined.

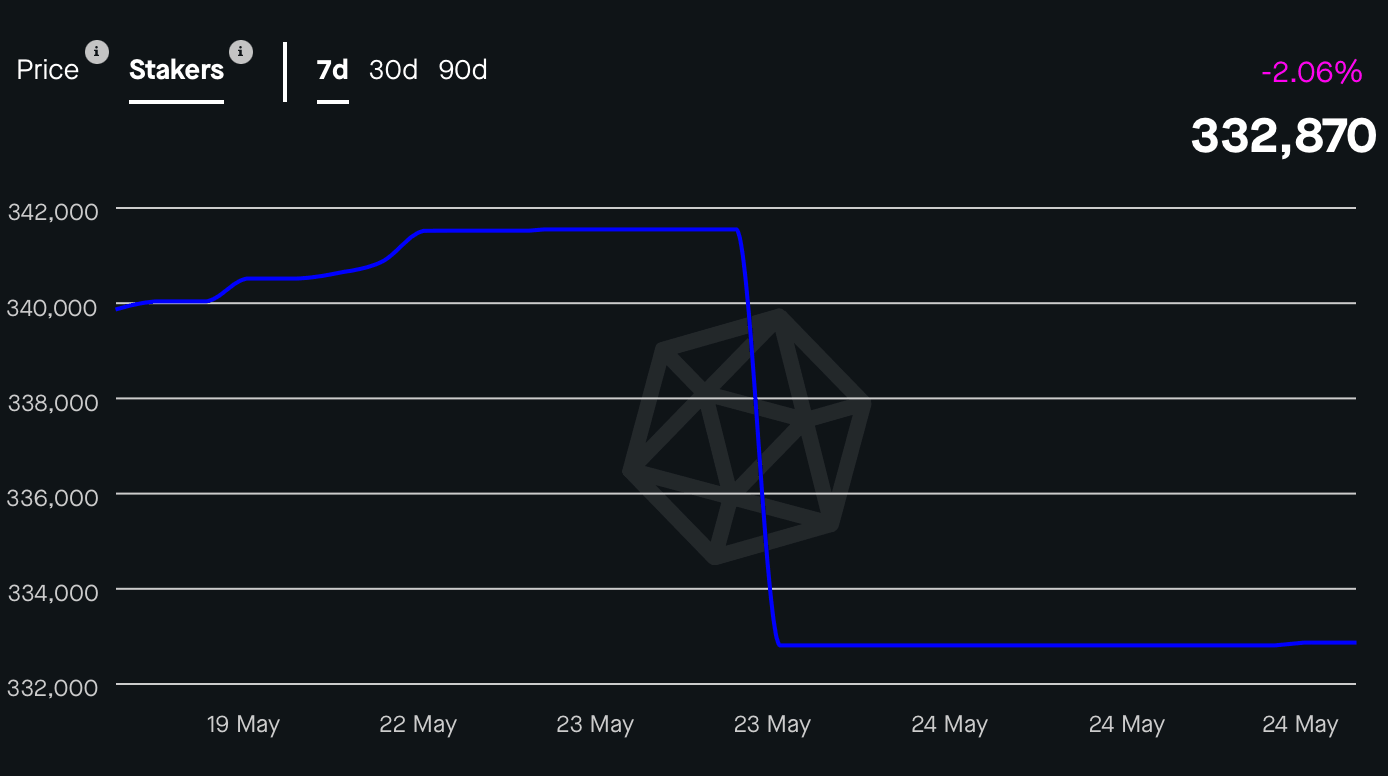

TRX stakers 7-day chart from StakingRewards.com

The number of stakers fell from 341,550 on Tuesday to 332,870 at the time of writing. This marks a 2.5% decrease in stakers on TRON.

Users lock their tokens (stake) to earn rewards and incentives, therefore a decline in the number of stakers is indicative of a shift in sentiment among TRX holders and network participants.

TRON’s competitors or smart contract networks like Cardano have a relatively large volume of stakers on their network. ADA ranks second with 1.2 million stakers, based on data from StakingRewards.com.

TRX supply held by whales rises

TRX token’s supply held by large wallet investors, also known as whales, has grown from 18.49% in June 2022 to 47.88% in May. The remarkable increase is typically considered a bullish development for the token.

Based on data from crypto intelligence tracker Santiment, large wallet investors consistently added TRX to their holdings over the past year despite its price volatility.

%2520%5B13.26.40%2C%252025%2520May%2C%25202023%5D-638206032699038861.png&w=1536&q=95)

Supply held by top addresses (as % of the total supply of TRX)

Growth in the percentage of supply held by top addresses is likely to act as a catalyst for TRX price recovery.

TRON price yielded 40.7% gains for holders Year To Date (YTD), rallying from $0.054 to $0.076 over the past five months. Still, the token is 66.53% below its all-time high of $0.231 and bullish catalysts like whale accumulation, rise in TVL and adoption of the token could fuel a recovery.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.