Is Solana poised to regain competitive edge as markets digest Trump's push to replace Fed Chair Powell?

- Solana extends its rally above $140 as Bitcoin and altcoins regain strength on Monday.

- US President Donald Trump's direct attack on Fed Chair Jerome Powell was interpreted as threatening the central bank's independence.

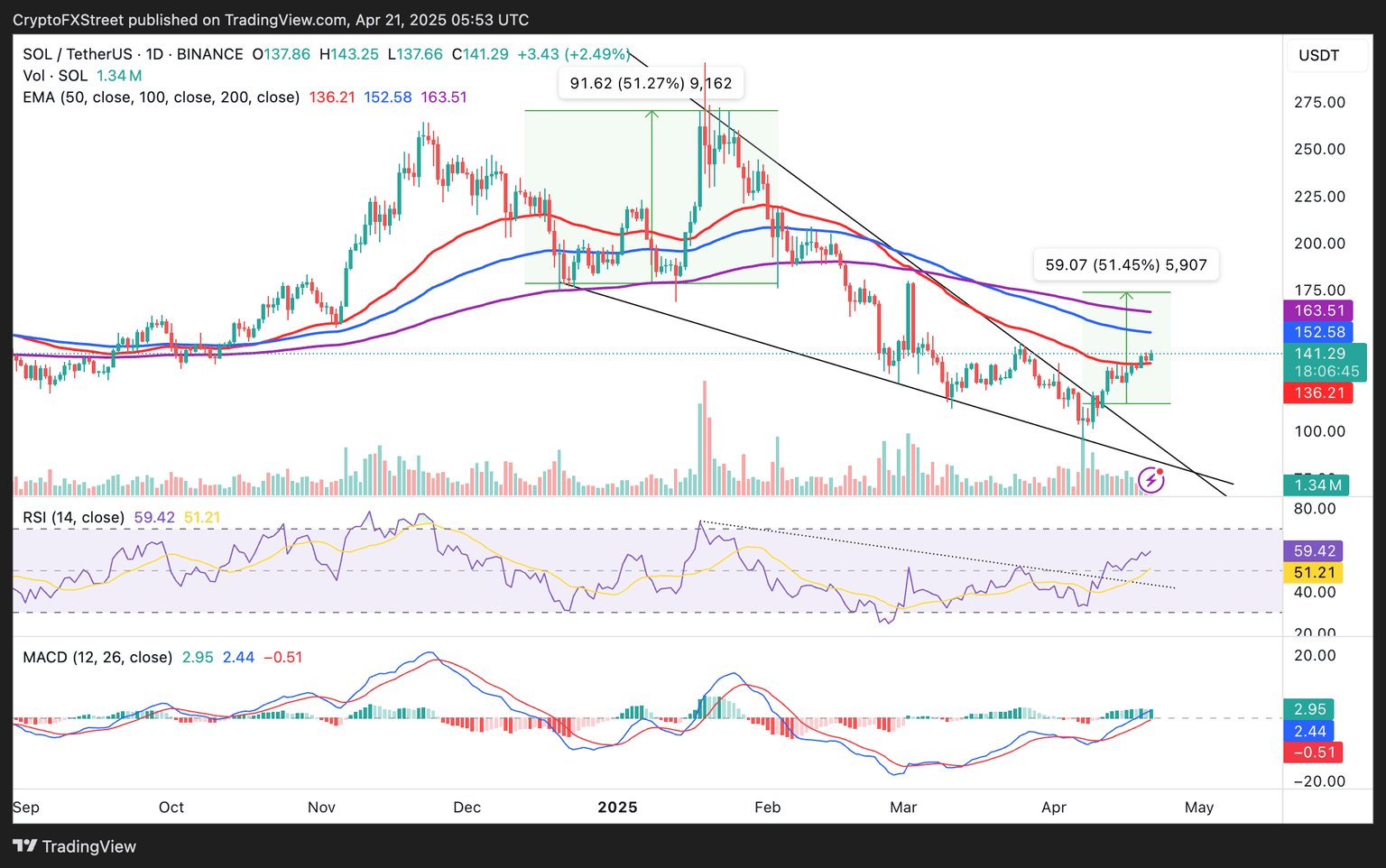

- SOL holds 50-day EMA support amid an ascending RSI and a MACD buy signal.

Solana (SOL) price moves higher during the early European session on Monday, with its value growing by more than 2% in the day to exchange hands at $140 at the time of writing. The smart contracts token defied overhead pressure during last week's trading, edging higher than its altcoin peers, including Ethereum (ETH), Ripple (XRP) and Cardano (ADA).

This widespread bullish outlook in the cryptocurrency market comes amid fresh tensions in the United States (US) after President Donald Trump threatened to shake up the Federal Reserve (Fed), a move perceived as a direct attack on the central bank’s independence.

Bitcoin (BTC) responded positively, crossing above $87,000 and increasing the probability of tagging $90,000 in the coming days. The total crypto market capitalization also recovered to $2.845 trillion at the time of writing from $2.756 trillion on Friday, suggesting that risk-on sentiment is gradually returning.

US Dollar tumbles as Solana, Bitcoin and altcoins rebound

On Monday, the US Dollar (USD) falls against major global currencies amid rattled investor confidence in the world's largest economy. President Trump's push to shake up the Fed sent jitters into the currency market, implying a direct threat to the central bank's independence.

As reported on Friday, the President accused Fed Chair Jerome Powell of always being late and not cutting interest rates fast enough. Trump was responding to Powell's remarks regarding the impact of tariffs on the economy, insinuating that inflation could skyrocket, warranting interest rate hikes and slowing economic growth.

The White House National Economic Council Director, Kevin Hassett, confirmed President Trump's intentions on Friday, saying that the government is studying the possibility of firing Fed Chair Jerome Powell, per a Reuters article.

As the US Dollar nosedived, sinking to a decade-low, Bitcoin and other cryptocurrencies shot up into the green, renewing bullish sentiment. This could be the time for digital assets to emerge as a hedge against the uncertain macroeconomic environment, following the Gold price sparkle to new all-time highs.

"The move in Bitcoin to $87,000 appears to be driven by a sharp drop in the US Dollar and a +2% rally in Gold, both triggered by Trump's push to replace Fed chair Powell. While a trade deal with Japan may be announced soon, the key catalyst today is the perceived threat to Fed independence," Markus Thielen, the founder of 10x Research, said regarding Bitcoin's recovery as the US Dollar falters on Monday.

Solana price pumps reclaiming $140

Solana's price pushes for gains above a wedge pattern's breakout explored in the previous week. The growing interest among traders caused an increase in trading volume, elevating SOL past the 50-day Exponential Moving Average (EMA) indicator before successfully taking on resistance at $140.

Based on the current technical picture, the path with the least resistance has shifted upwards. Solana will likely extend the leg from $141 at the time of writing to $174, the falling wedge pattern's target extrapolated above the breakout point.

The Moving Average Convergence Divergence (MACD) indicator flaunts a buy signal, crossing into the positive territory and increasing green histograms, which back Solana’s price uptrend. Similarly, the Relative Strength Index (RSI) indicator sits above midline at 59.37 after recovering from near-oversold conditions on April 7, suggesting increasing bullish momentum.

SOL/USD daily chart

Solana has the potential to rise to $174, but traders must be aware of potential risks to the uptrend, starting with the 100-day EMA at $152 and the 200-day EMA at $163. Depending on the outlook of the global economy and possible threats from tariffs, some investors may book early profits, increasing sell-side pressure and slowing the bullish momentum. Therefore, there's a need to assess prevailing market conditions and make decisions based on new developments, not forgetting risk management techniques like the Dollar-cost average (DCA) strategy to reduce exposure to losses while maximizing profit.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren