Is November going to be bullish for the cryptocurrency market?

Bulls may have started fixing their profit as all of the top 10 coins have entered the red zone on the last day of the week.

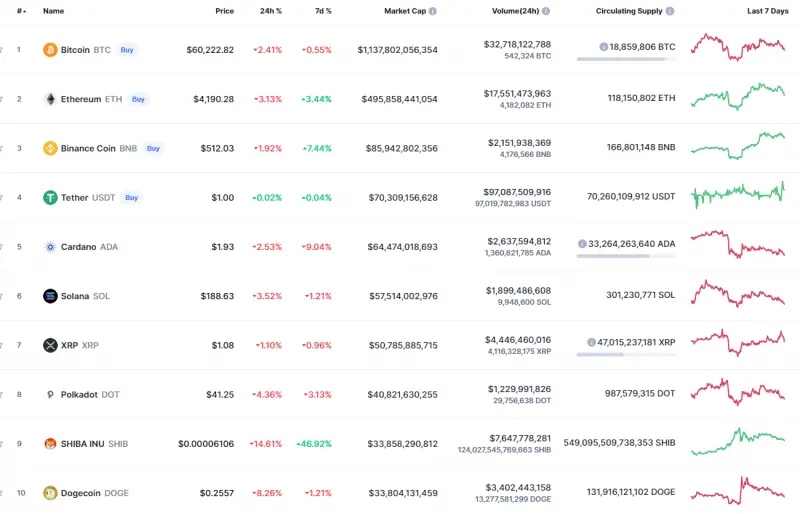

Top coins by CoinMarketCap

BTC/USD

The rate of Bitcoin (BTC) has gone down by 2% since yesterday while its price has remained the same over the past seven days.

BTC/USD chart by TradingView

After a false breakout of the support at $56,560, Bitcoin (BTC) could not keep the rise and fixed above the $62,000 mark. Even though the selling trading volume is low, the decline may continue as buyers do not seem very interested in buying at the moment.

In this case, if bears break the support, the fall may lead BTC to $53,000 next week.

Bitcoin is trading at $60,390 at press time.

ADA/USD

Cardano (ADA) is the main loser from the list, declining by 2%.

ADA/USD chart by TradingView

Cardano (ADA) is looking even worse than Bitcoin (BTC) as it is coming back to the support after a false breakout. Respectively, the breakout of $1.822 might be a huge bearish signal and get ADA back to $1.50 soon.

ADA is trading at $1.937 at press time.

BNB/USD

Despite today's decline, Binance Coin (BNB) has risen by 8% over the last week.

BNB/USD chart by TradingView

Binance Coin (BNB) is about to break the support at $509.70 as bulls are out of power to keep the rise going. In this regard, there is a high probability of seeing the continued decline of the native exchange coin to the area of the most liquidity around $487 soon.

BNB is trading at $513.40 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.