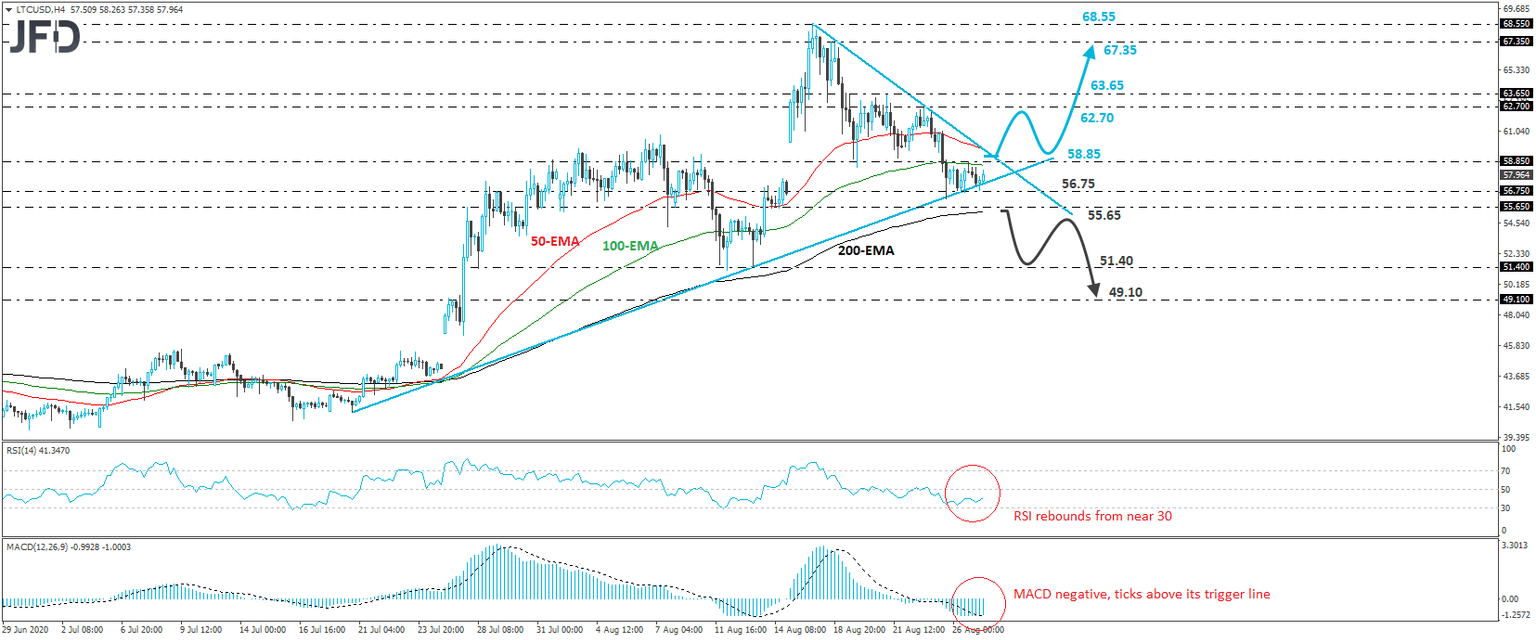

Is litecoin ready to rebound?

LTC/USD traded in a consolidative manner yesterday, staying between the 56.75 support and the resistance of 58.85. Overall, the crypto continues to trade above the upside support line drawn from the low of July 20th, but it is also trading below a new downside one, taken from the high of August 17th. Thus, with these technical signs in mind, we will adopt a flat stance for now.

In order to start examining the resumption of the prevailing uptrend, we would like to see a clear break above 58.85. Such a move may also take the price above the pre-mentioned short-term downside line and may allow the bulls to push the battle towards the 62.70 barrier, marked by the high of August 24th, or the peak of August 21st, at around 63.65. If they are not willing to stop there, a move higher may set the stage for the 67.35 level, or the 68.55 obstacle, marked as a resistance by the peak of August 17th.

Shifting attention to our short-term oscillators, we see that the RSI has rebounded from near its 30 line, but still remains below 50, while the MACD, even though negative, has also bottomed and just poked its nose above its trigger line. Both indicators detect slowing downside momentum and support the notion that a rebound may be looming soon. Nonetheless, as we already noted, we prefer to wait for a break above 58.85 before we get confident on that front.

The move that could give flesh to the bearish case is a decisive dip below 55.65. This will also drive Litecoin below the upside support line drawn from the low of July 20th, and may encourage declines towards the 51.40 level, defined as a support by the low of August 13th. Another break, below 51.40, may extend the slide towards 49.10, marked by an intraday swing high formed on July 27th.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

Author

JFD Team

JFD