IOTA Market Update: IOT/USD directionless ahead of Coordicide testnet launch

- IOTA team gets ready for a maojor testnet launch.

- IOTA/USD is locked in a tight range amid the market uncertainty.

IOTA developers announced the upcoming launch of the test network for Coordicide protocol also known as IOTA 2.0. The team explained that it had been working on several important updates that will take the network to the next level.

IOTA is a blockchain project focused on the Internet of Things (IoT) applications. According to Angelo Capossele, chief researcher at the IOTA Foundation, the new version of the protocol will replace the centralized coordinator node and make the network much faster.

For the upcoming #Coordicide testnet we really want you to actually see and better understand how our Fast Probabilistic Consensus protocol works. I hope that with the new integration of #Grafana and #Prometheus we can accomplish this!

Earlier this month, the IOTA Foundation launched a new version of Hornet v.0.4.0 software for node operators. The update increased the network throughput up to 20 times.

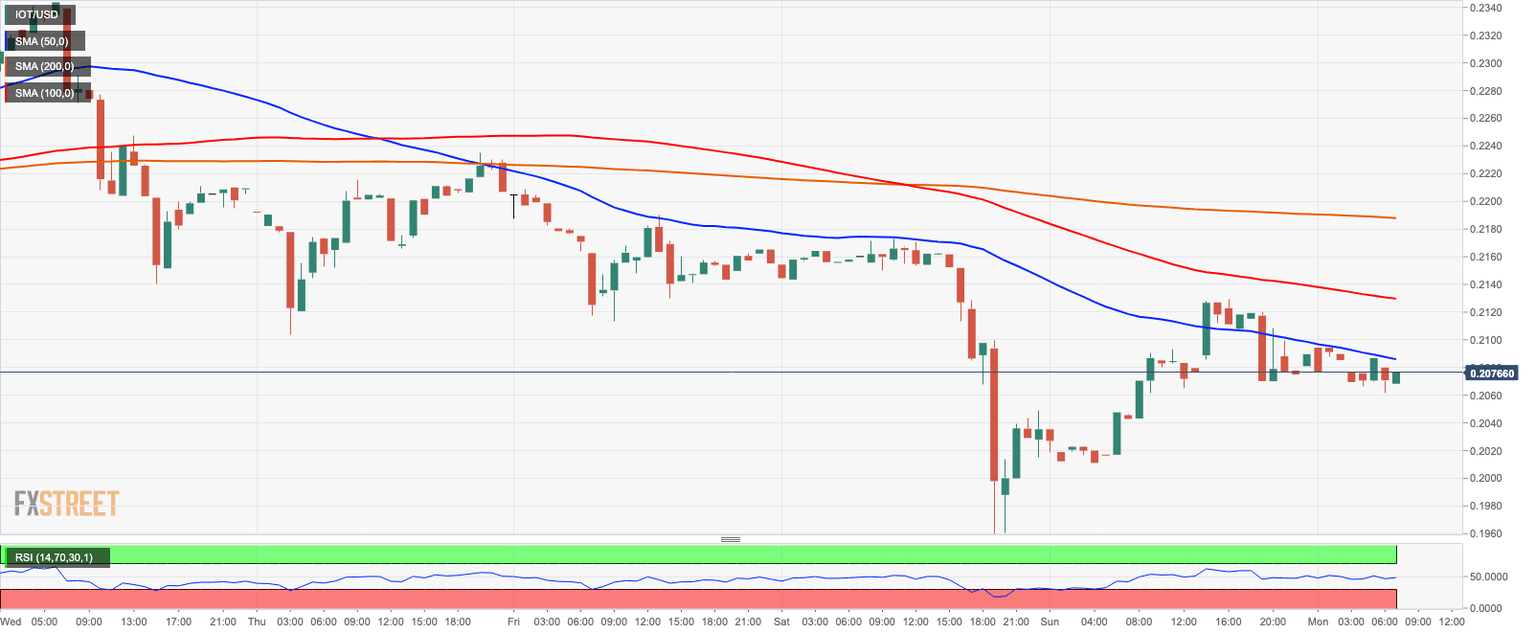

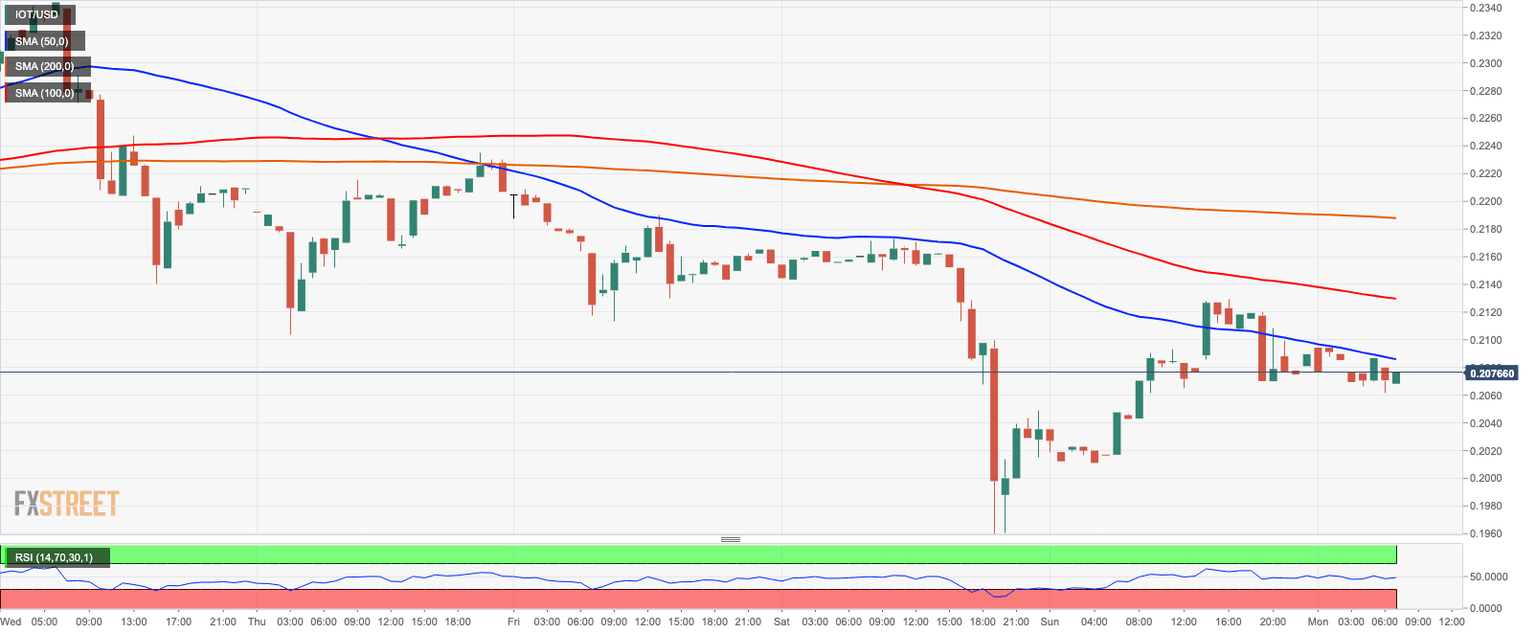

IOTA/USD: Technical picture

IOTA is changing hands at $0.2070. The coin has barely changed since the beginning of Monday and gained over 2% on a day-to-day basis. IOTA is currently the 24th largest digital asset with the current market value of $575 million and an average daily trading volume of $10 million. The coin is most actively traded on OKEx against USDT.

On the intraday chart, IOT/USD is still moving within the downside trend, while the recovery is capped by 1-hour SMA50 at $0.2080. Once it is out of the way, the upside is likely to gain traction with the next focus on $0.2100 and $0/2180 (1-hour SMA200). This barrier served as an upper boundary of the previous consolidation channel, thus it has a potential to slow down the bulls.

The intraday RSI shows signs of the upside reversal, though the momentum remains slow. On the downside, the initial support comes at $0.2060 (the lower boundary of the recent range0bound pattern. If it is broken, the sell-off may be extended to the psychological $0.2000 and the weekend low of $0/1960.

IOT/USD 1-hour chart

Author

Tanya Abrosimova

Independent Analyst