Hyperliquid Price Forecast: HYPE offers recovery signals backed by steady open interest

- Hyperliquid upholds the 50-period EMA support, increasing the chances of a reversal targeting $50.00.

- HYPE futures Open Interest remains steady above the $2 billion mark, underscoring growing retail demand.

- Mentions of Hyperliquid on social media platforms remain relatively elevated despite risk-off sentiment across the crypto market.

Hyperliquid (HYPE) is printing a green 4-hour candle, trading above $45.00 on Monday amid growing risk-off sentiment in the broader cryptocurrency market. Retail demand for HYPE appears steady, backed by steady futures Open Interest (OI) and a robust technical structure.

Traders will be on the lookout for a daily close above $45.00, which could signal readiness for the run-up toward record highs marginally below $50.00

Hyperliquid upholds retail interest

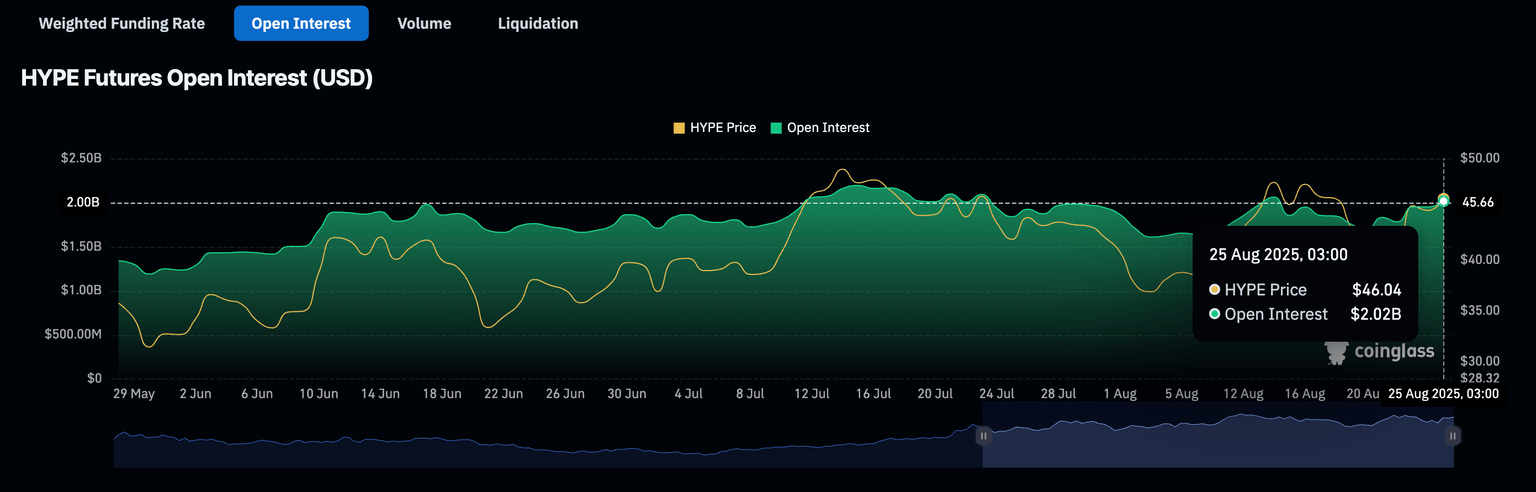

Hyperliquid shows signs of a sustainable recovery toward its record high near the $50.00 mark, driven by rising retail demand. According to CoinGlass data, HYPE futures OI, which refers to the notional value of outstanding futures or options contracts, has been steadily rising and stabilizing above $2 billion despite the widespread risk-off sentiment.

Hyperliquid Futures Open Interest data | Source: CoinGlass

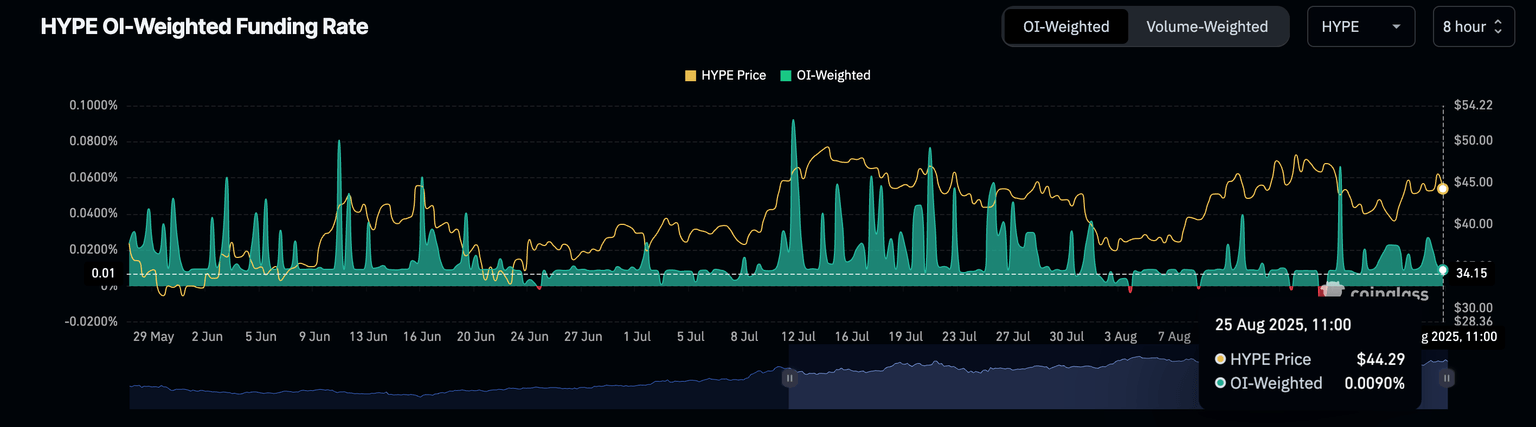

This sustained increase in OI suggests that more traders are betting on short-term price increases. However, traders should tread with caution since the futures funding rate has declined to 0.0090% after peaking at 0.0663% on August 18. In other words, fewer traders are leveraging long positions in HYPE, which could dampen positive market sentiment.

Hyperliquid Futures Weighted Funding Rate | Source: CoinGlass

Santiment's social volume chart below highlights a spike in mentions of HYPE on different social media platforms. Steady increases in this metric, which remain relatively low but below July peak levels, align with the growth in retail demand. Traders should watch out for possible spikes in social volume, which often signal potential price rallies.

%20%5B13-1756123240431-1756123240431.50.19%2C%2025%20Aug%2C%202025%5D.png&w=1536&q=95)

Hyperliquid Social Volume metric | Source: Santiment

Technical outlook: Hyperliquid bulls aim for record highs

Hyperliquid shows signs of extending recovery in upcoming sessions, aiming for a move toward its record high slightly below $50.00. The 50-period Exponential Moving Average (EMA) at $43.91 provides immediate support, backed by the 100-period EMA at $43.68 and the 200-period EMA at $43.13.

The Moving Average Convergence Divergence (MACD) indicator reinforces HYPE’s bullish outlook after maintaining a buy signal since Friday. Traders could consider increasing exposure as long as the blue MACD line remains above the red signal line, underpinned by green histogram bars above the zero line.

A reversal of the Relative Strength Index (RSI) from the midline support to 56 at the time of writing underscores a potential increase in buying pressure. Hyperliquid’s strong technical picture, combined with steady retail demand as shown by the futures Open Interest, suggests that buyers have the upper hand.

HYPE/USDT 4-hour chart

Key areas of interest for traders include the resistance at $47.37, tested earlier in the day, its all-time high of $49.91, and the last line of defense at $40.45, tested on Friday. A continued decline below this support could dampen market sentiment, sending shock waves in the derivatives market ahead of a potential drop to the demand zone at $35.50.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren