How will Bitcoin price react to another 75 basis point hike?

- Bitcoin price is currently retesting the $21,710 support confluence.

- If bears break down the aforementioned level, BTC could crash by 12%.

- A daily candlestick close below $21,710 will trigger an 11% crash to $19,286.

Bitcoin price is undergoing an uptick in sell-side activity that has led to a retracement after nearly a week of an uptrend, starting July 13. Now, BTC has arrived at a level that will decide its fate and perhaps the directional bias for altcoins.

While the technicals are painting an ‘on the fence’ picture of the markets, one can guess if it is from the expectations of an interest rate hike that is scheduled to take place on July 27. This behavior makes sense, considering the previous rate hikes have generally caused crypto markets to tank.

On July 13, the Fed hiked rates by 75 basis-points, causing BTC to drop 5%, but the short-term loss was eventually offset as Bitcoin price triggered a week-long rally that pushed it from $19,000 to $24,000.

Investors, therefore, need to pay close attention to how the markets will react on July 27.

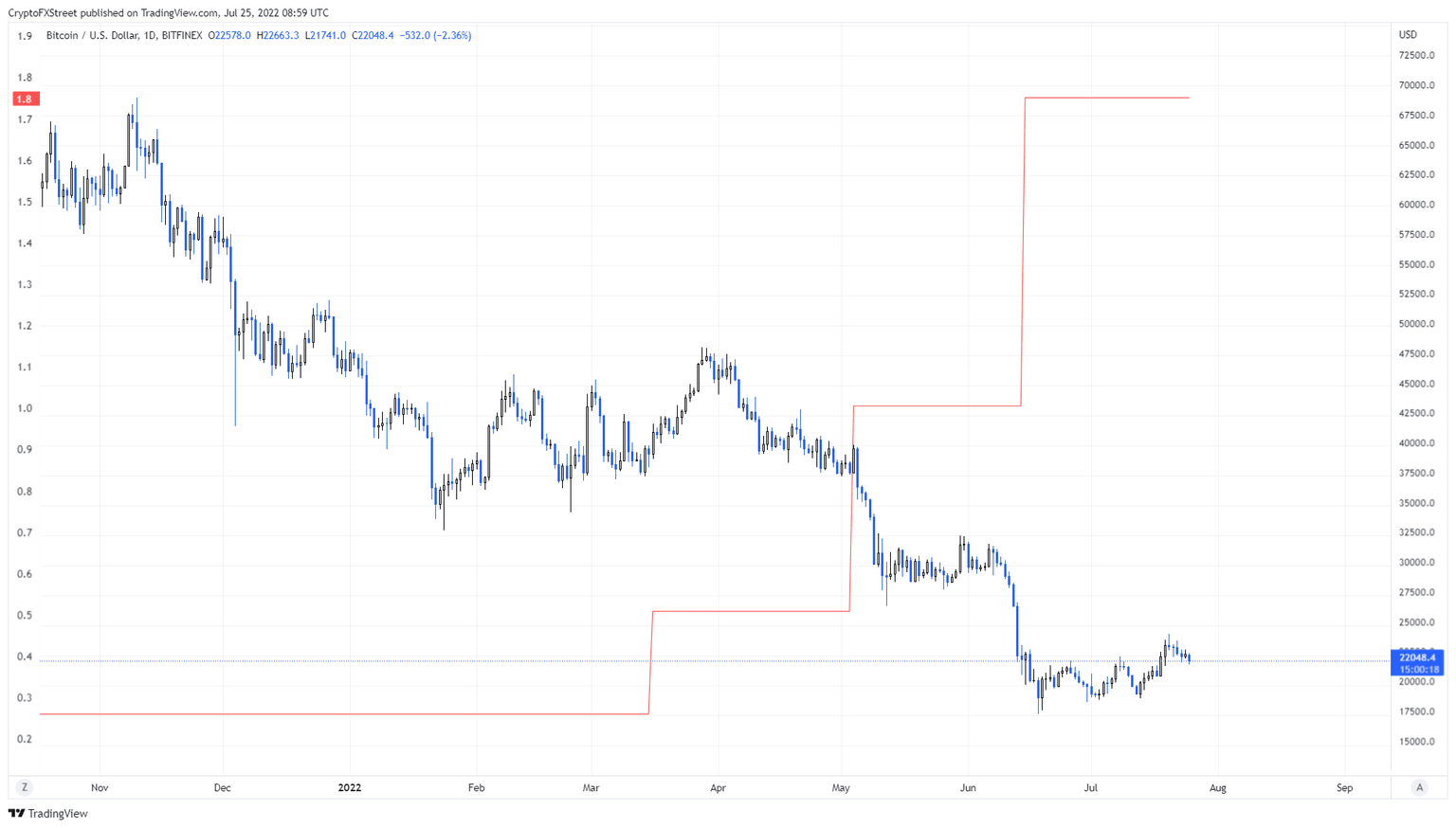

BTC/USD vs Interest rate chart

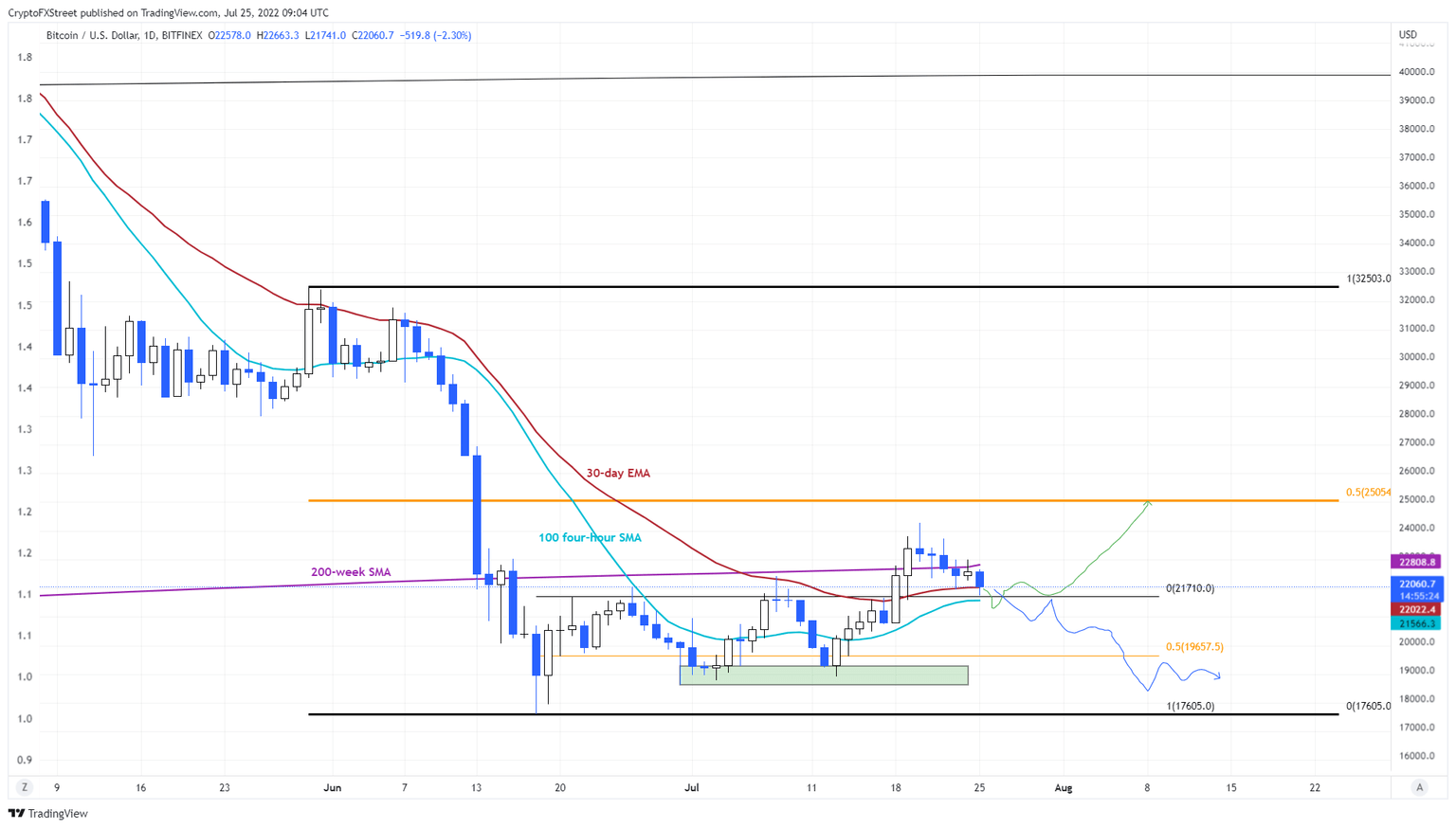

Bitcoin price at a make-or-break point

Bitcoin price produced a daily candlestick close below the 200-week SMA on July 22. This development indicates that there is a weakness among buyers. Since then, BTC has dropped 4% and is currently hovering around $21,943.

Regardless of this downswing, the bulls have another chance to recover due to the presence of the 30-day Exponential Moving Average (EMA) at $22,010 and above the 100 four-hour Simple Moving Average (SMA) at $21,562.

With the Feds stepping in to raise the interest rate by another 75 basis points, investors can expect volatility. A brief sweep of the $21,710 should be expected, but a quick recovery should suggest a bullish sentiment.

A bounce off the aforementioned level could trigger a run-up to the $25,000 level after a 15% rally. This level is more likely to form a local top than the current one at $24,276.

However, traders should keep their minds open for an extension of this move to the $28,000 to $30,000 area in a highly bullish case.

BTC/USD 1-day chart

On the other hand, if the Bitcoin price breaks below the $21,710 support confluence, there is a good chance BTC could revisit the $19,657 support level. A breakdown of this level could see BTC retest the liquidity pool, extending from $18,638 to $19,286. In some cases, a sweep of the range low at $17,605 is also plausible.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.