Here is how XRP holders can prepare to claim Spark tokens in the upcoming airdrop

- The Flare Networks platform will conduct an airdrop on December 12 for XRP holders.

- Anyone holding XRP is eligible to claim the tokens.

Flare is a protocol created to solve some of the inherent issues with Proof of Stake consensus algorithms. Flare will optimize the way smart-contract platforms scale. The Spark token is a fundamental pillar of the network and will be airdropped to XRP holders on December 12.

At launch, the platform will use a protocol called FXRP to safely enable the issuance and redemption of XRP on Flare. There will be 45 billion Spark tokens available to claim at a ratio proportional to their XRP balance before the snapshot.

What’s the best way to claim Spark tokens?

Most of the largest exchanges will be supporting the airdrop, including Binance, Bitstamp, Huobi and even eToro. For a comprehensive list of all exchanges support check this article. If your exchange is not on the list, you should still check any email sent by the platform just in case the list hasn’t been updated accordingly.

If your exchange supports the airdrop, you will simply need to hold your XRP coins to be eligible. In other cases, you will simply need to send your XRP to an exchange that supports the airdrop or remove them to self custody. You need to do this before the snapshot date which is the first validated XRP ledger with a timestamp greater than or equal to 00:00 GMT on 12th December 2020.

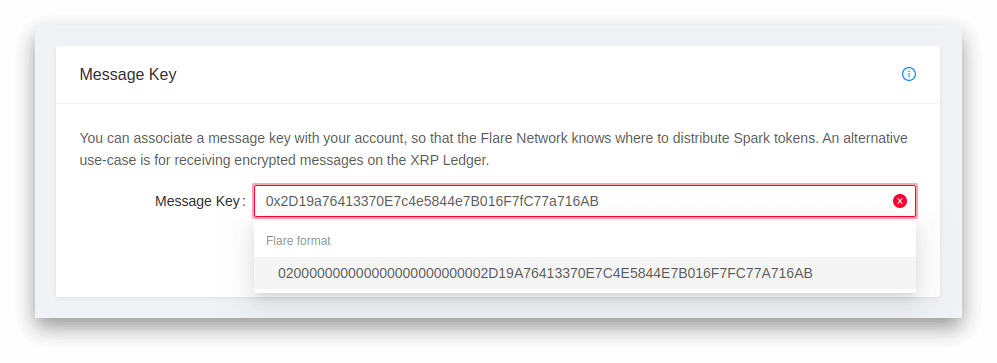

A full list of all the wallets that support the airdrop can be found here. You will also need a non-custodial Ethereum address like MetaMask or MyEtherWallet. Once you have created your own Ethereum wallet, you will need to copy the address and use it inside https://www.xrptoolkit.com/.

XRPtoolkit image

Here you will need to set a message key. Simply connect your XRP wallet and then paste your copied address in the message key field. The XRP Toolkit will automatically convert your Flare address to the required format. Once the transaction is signed and submitted you will be set for the airdrop which will happen automatically after the snapshot.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.