How to catch the next 50% Cardano price rally if you missed the first one

- Cardano price is undergoing a bullish retracement after the recent 55% upswing.

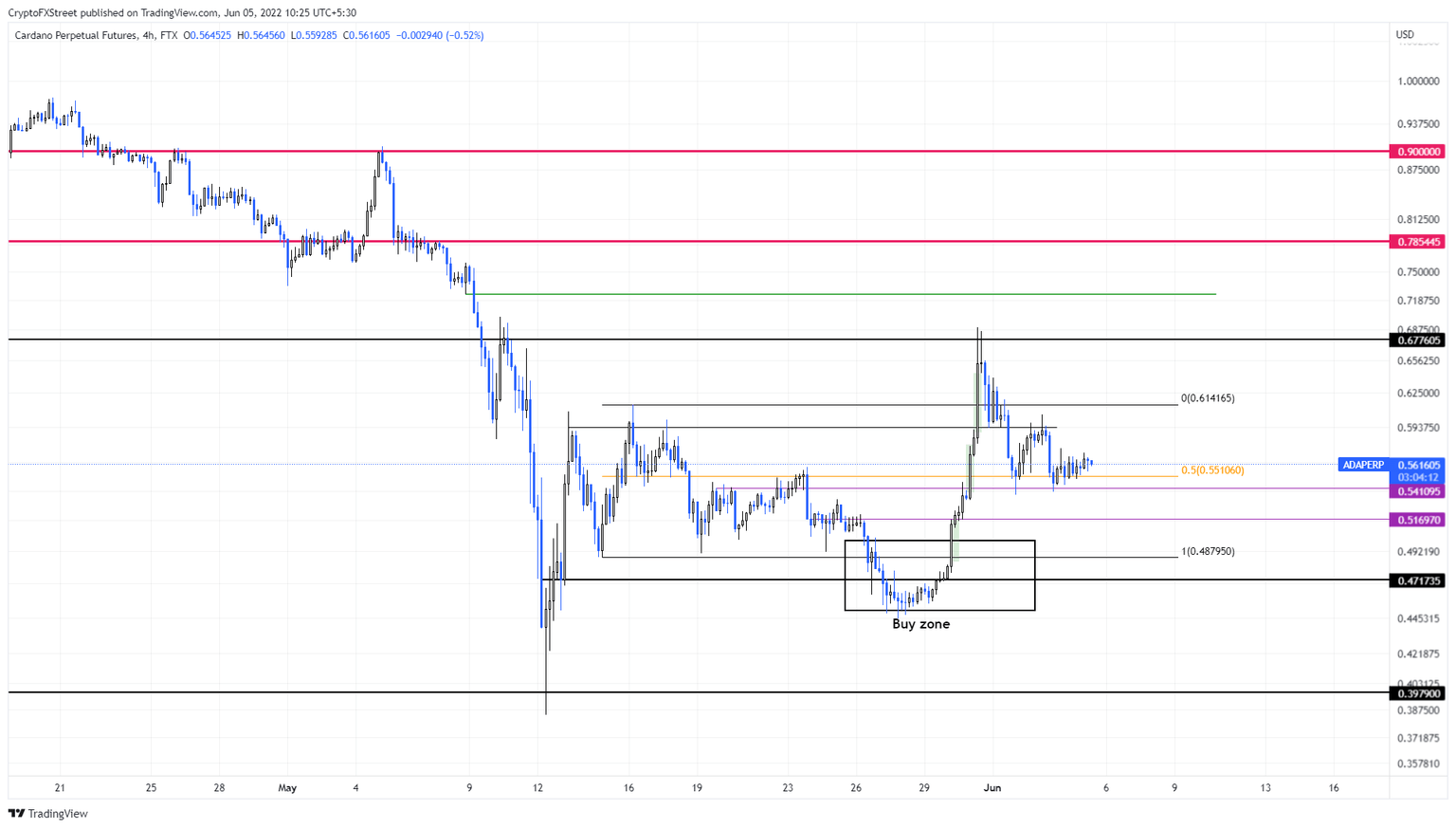

- A bounce off the $0.516 support floor is likely to trigger another attempt to retest and overcome the $0.677 hurdle.

- A four-hour candlestick close below $0.471 will create a lower low and invalidate the bullish thesis for ADA.

Cardano price witnessed impressive returns last week as the altcoin underwent an explosive upswing. ADA was among other altcoins like WAVES, KAVA and more that rallied the previous week and are now undergoing a retracement in preparation for the next leg-up.

ADA price thinks two steps ahead

Cardano price deviated below the range, extending from $0.487 to $0.614 on May 26, which was a bullish signal. As this development was followed by an explosive, up-only move that propelled ADA by 55%.

The run-up broke through the range high at $0.614 and attempted to flip the $0.677 hurdle. While exhaustion and profit-taking went hand in hand, ADA kick-started its retracement. In search of stable levels, Cardano price has tagged the midpoint of the aforementioned range at $0.551.

Investors can expect ADA to breach the $0.541 barrier that it is currently grappling with and dive deep to retest the subsequent support level at $0.516. A bounce off this barrier will put ADA in a deep discount mode relative to the midpoint and is likely going to attract sidelined buyers.

A resurgence in buying pressure, as a result, could trigger another leg-up that lifts Cardano price by 52% to tag the lower limit of the $0.785 to $0.900 hurdle.

ADA/USDT 1-day chart

Regardless of the bullish outlook, if sellers continue to dump the tokens, a breakdown of the $0.516 support floor seems plausible. Under these conditions, if Cardano price produces a four-hour candlestick close below $0.47, the bullish thesis will face invalidation by producing a lower low. Such a development could see ADA could crash to the $0.397 foothold.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.