How blockchains compatible with ethereum help relieve transaction fee hurdles

Rising transaction fees on the Ethereum network can often make it nearly impossible for some users to move funds in a timely manner, especially when interacting with smart contracts. Blockchains compatible with the Ethereum Virtual Machine (EVM) can help users get past these hurdles.

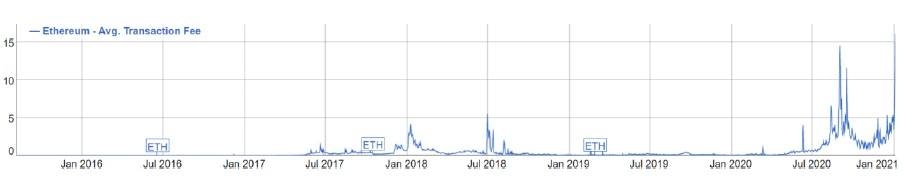

Data from BitInfoCharts shows that one year ago, the average transaction fee on the Ethereum blockchain was less than $0.08. The average transaction fee has since surged to a new all-time high of $15.9, and at press time dropped to $9.9.

The rise of decentralized finance (DeFi) has brought in thousands of new users to the Ethereum network, looking to interact with protocols that let them earn interest on their cryptocurrency holdings, take out crypto-backed loans, or trade on decentralized platforms.

DeFiPulse data shows that platforms like Maker, Aave, Uniswap, Compound, and Curve Finance have well over $1 billion worth of cryptoassets locked in them, with the total on DeFi being $22.35 billion. Interacting with smart contracts on Ethereum, it's worth noting, costs more gas than simple transactions on the network.

Larry Cermak, Director of Research at The Block, pointed out on social media that transaction fees for making swaps on decentralized exchange Uniswap got as high as $100 earlier this year.

While Ethereum has scaling solutions coming down the road, users need solutions they can use now. EVM-compatible blockchains like OKExChain could very well be the answer. Here's why.

What is EVM Compatibility?

Ethereum was the first cryptocurrency blockchain to support smart contracts, but it's currently limited to 15 or so transactions per second. While power users can use advanced solutions to help save gas, most ETH users are only trying to pay small transaction fees to move their funds.

As more users started interacting with an increasing number of smart contracts, Ethereum's network utilization kept on growing, the point its utilization is now at 97.81%, according to Etherscan,

Ethereum 2.0 is a scaling solution expected to help ETH scale to handle a higher number of transactions per second, effectively reducing transaction fees. Deploying Ethereum 2.0 is a slow and complex process.

Its staking contract was launched late last year, and over 2 million ETH are staked on it. The contract launched the Beacon Chain, the first stage in the ETH 2.0 development roadmap. It's a chain running alongside the main Ethereum network, but that uses a Proof-of-Stake (PoS) consensus algorithm. It's Phase 0 of Ethereum's consensus mechanism transition.

Phase 1, which is expected to launch this year, will "address finality and consensus on shard chains", and it will be "more of a ‘test run' for shard chains than the release of an immediately-scalable solution." This means it will not help the network process thousands of transactions per second just yet.

A currently viable solution to the problem are EVM-compatible blockchains. Being compatible with the Ethereum Virtual Machine simply means that smart contracts deployed on the Ethereum network can be easily deployed on such a blockchain.

How OKExChain Can Help

OKExChain is the world's first trading chain — blockchain technology built for trading. It is the next step in the development of decentralized trading, where people can trade anything of value on-chain, and own and control the assets that they trade. OKExChain provides safe and efficient infrastructure for creating decentralized applications for seamless on-chain trading of all kinds of assets within a cross-chain, value-exchange ecosystem.

OKExChain was under development for just under three years and went through three major phases before launch. It's an open-source, trading-focused blockchain. It has a native token, OKExChain Token (OKT), which gives its holders benefits that include staking privileges and voting rights.

OKT has an initial minting of 10 million tokens, and an upper supply limit of about 72.2 million. It uses BTC's halving model, with initial block rewards being of 1 OKT. OKT holders will also be able to become validators to earn block rewards and transaction fees.

The blockchain allows users to trade anything, and it's a high-performing blockchain. On the OKExChain testnet, transaction fees have been steadily at 0.0001 OKT per transaction, with over 500,000 transactions being made per day on the chain.

In comparison, ETH handles about 1.2 million transactions per day. This means that a transaction that costs nearly $10 on Ethereum on average would cost a few cents on OKExChain.

Author

Jay Hao

OKEx

Jay is a tech veteran and seasoned industry leader. Prior to OKEx, he focused on blockchain-driven applications for live video streaming and mobile gaming.