Grayscale watches these six assets for gains in Q4 2024, predicts significant risk event for crypto

- Grayscale adds SUI, TAO, OP, HNT, CELO, and UMA to its updated list of the top 20 cryptocurrencies for Q4.

- The assets in the top 20 have high price volatility and are considered high risk by the asset management giant.

- The US election poses a significant risk for crypto according to the giant’s recently published report.

Grayscale introduced six new cryptocurrencies to its Top 20 cryptocurrencies watchlist on September 26. The asset management giant published its report to highlight promising sectors within crypto for Q4 2024.

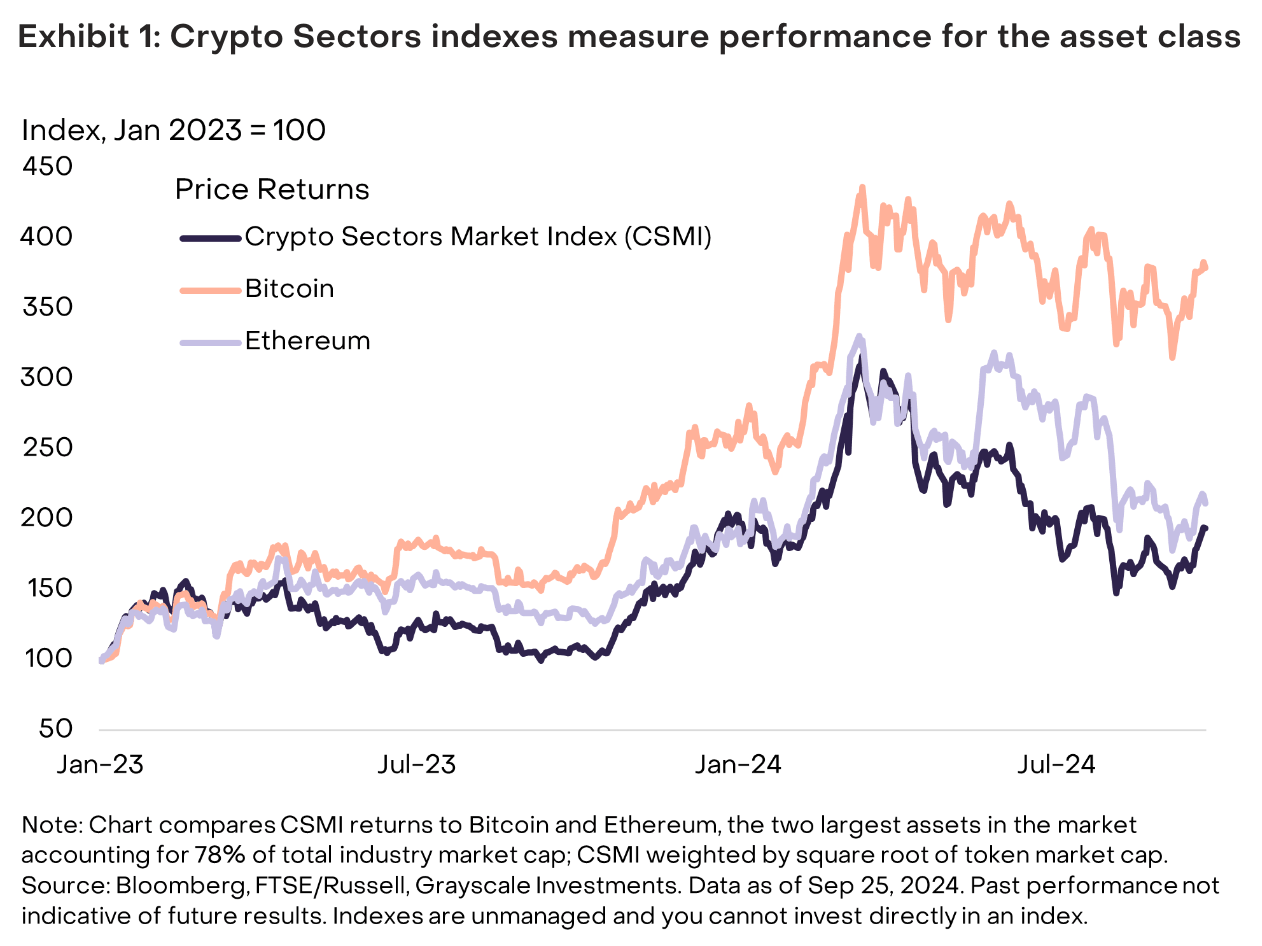

Bitcoin and Ethereum outperform the Crypto Sectors Market Index

Bitcoin and Ethereum, the top two cryptocurrencies by market capitalization maintain their lead by outperforming the Crypto Sectors Market Index (CSMI), per Grayscale’s Research Insights: Crypto Sectors in Q4 2024, published on September 26.

The report outlines the performance of altcoins, alongside the top two crypto assets. Notable sectors are decentralized Artificial Intelligence (AI) platforms like Bittensor TAO, tokenization of Real World Assets (RWA) projects that include Ondo Finance (ONDO), OM and GFI. Meme coins like Pepe (PEPE), Dogwifhat (WIF), and Floki (FLOKI) led gains in the sector.

Crypto Sectors performance

The asset management giant added six new assets to the list,

- Sui (SUI): A high-performance Layer 1 smart contract blockchain

- Bittensor (TAO): An AI project building a platform to facilitate the development of open and global AI systems

- Optimism (OP): An Ethereum Layer 2 chain

- Helium (HNT): A Solana-based decentralized wireless network

- Celo (CELO): A mobile-first blockchain project with a plan to transition to an Ethereum Layer 2 payments network

- UMA Protocol (UMA): An optimistic oracle network providing services to one of the largest crypto prediction markets, Polymarket

Grayscale notes in its report that the US Presidential election could pose significant risks for the cryptocurrency industry. The asset management giant highlights how former US President Donald Trump prepares to embrace crypto as an industry while Presidential candidate Kamala Harris said that her administration will encourage innovative technologies while protecting investors.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.