Global crypto market cap tops $3 trillion as White House prepares major trade deal reveal

- The cryptocurrency market trades in the green on Thursday, with Bitcoin breaking above $99,000.

- US President Donald Trump announced a major trade deal with major nations in the Oval Office on his Truth Social post.

- The total crypto market cap reaches $3 trillion, wiping out 71.4% of leverage short positions, according to Coinglass.

The crypto markets trade in green on Thursday, with Bitcoin (BTC) breaking above $99,000. The Asian markets also followed suit, and traded higher. This rally was mostly triggered by US President Donald Trump announcing a major trade deal with major nations in the Oval Office on his Truth Social post. The total crypto market cap reaches $3 trillion, wiping out 71.4% of leverage short positions, according to Coinglass.

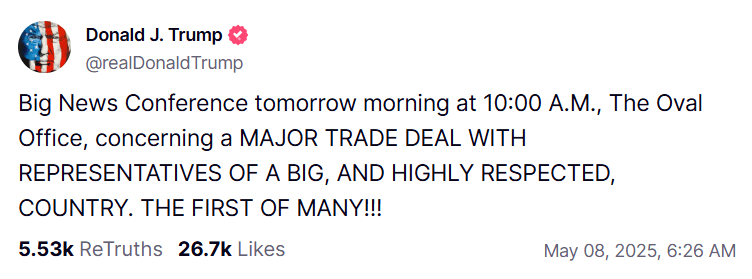

Trump announces major trade deal

US President Donald Trump announces on his Truth Social account that a “major trade deal” which would mark the first such agreement to be announced since he imposed tariffs on dozens of America's trading partners.

Trump said on the Truth Social platform that he would hold a news conference at 10:00 in Washington, DC (15:00 BST), to announce an agreement with "representatives of a big, and highly respected, country."

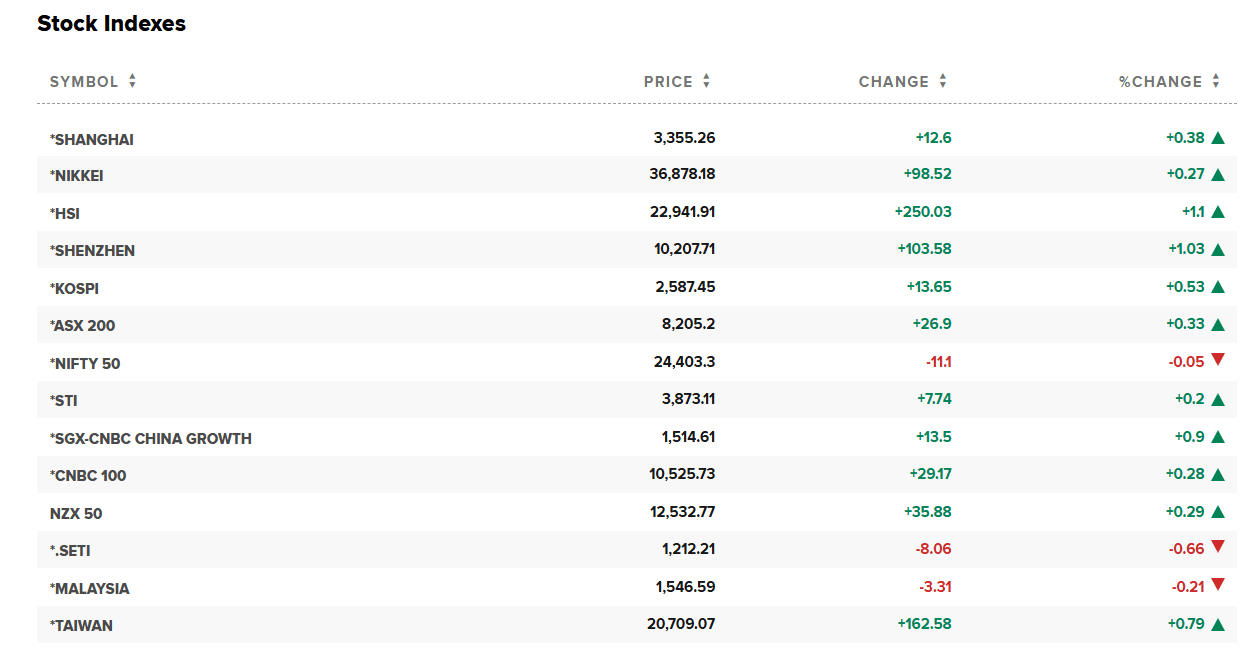

This news announcement had a positive reaction for the Asian equity markets, which traded green on Thursday. The tariff deals with major countries would ease the ongoing uncertainty in the global economy. The crypto market also reacted positively to this news as Bitcoin reached above $99,000 during the early Asian trading session.

Asian Markets chart

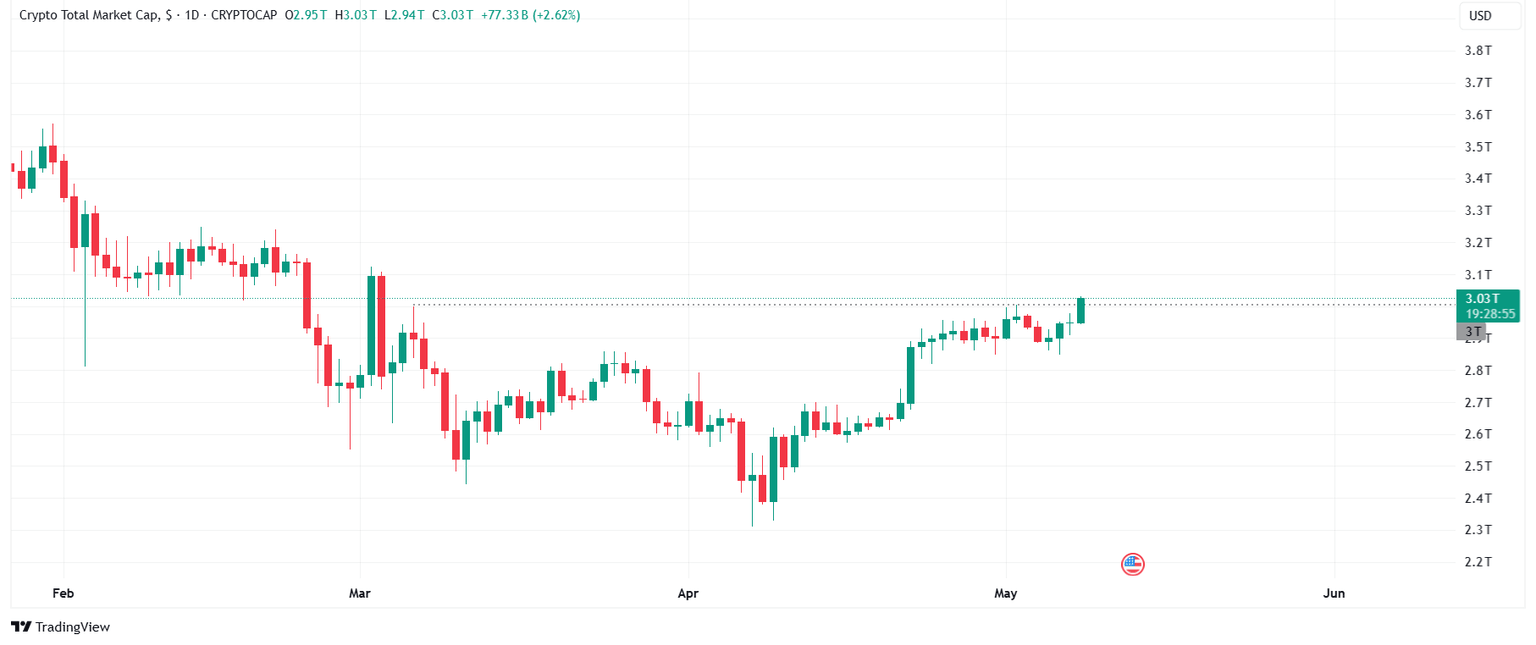

Crypto market cap reaches $3 trillion and wipes out 71% of short positions

The total cryptocurrency market capitalization reached above $3 trillion on Thursday, as shown in the chart below.

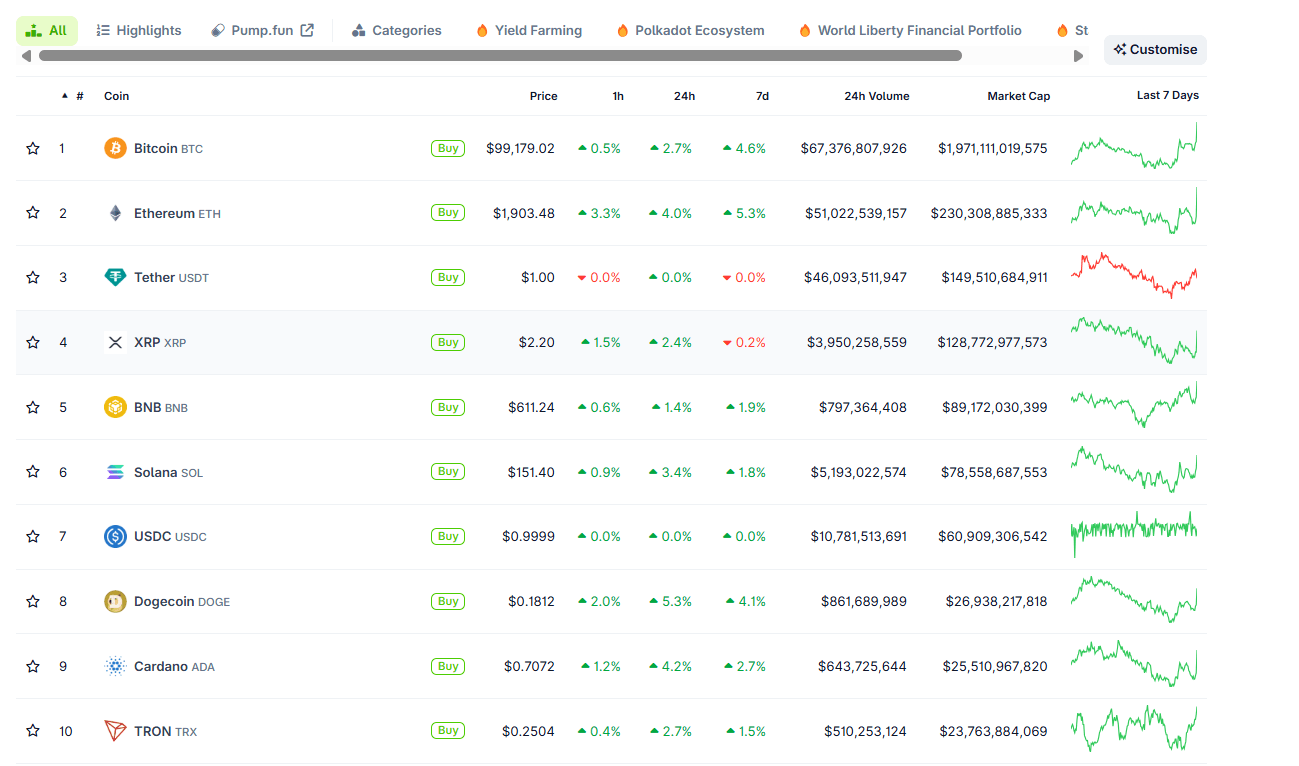

CoinGecko data shows that the top 10 cryptocurrencies trade in green during the early Asian session.

Top 10 cryptocurrencies chart. Source: CoinGecko

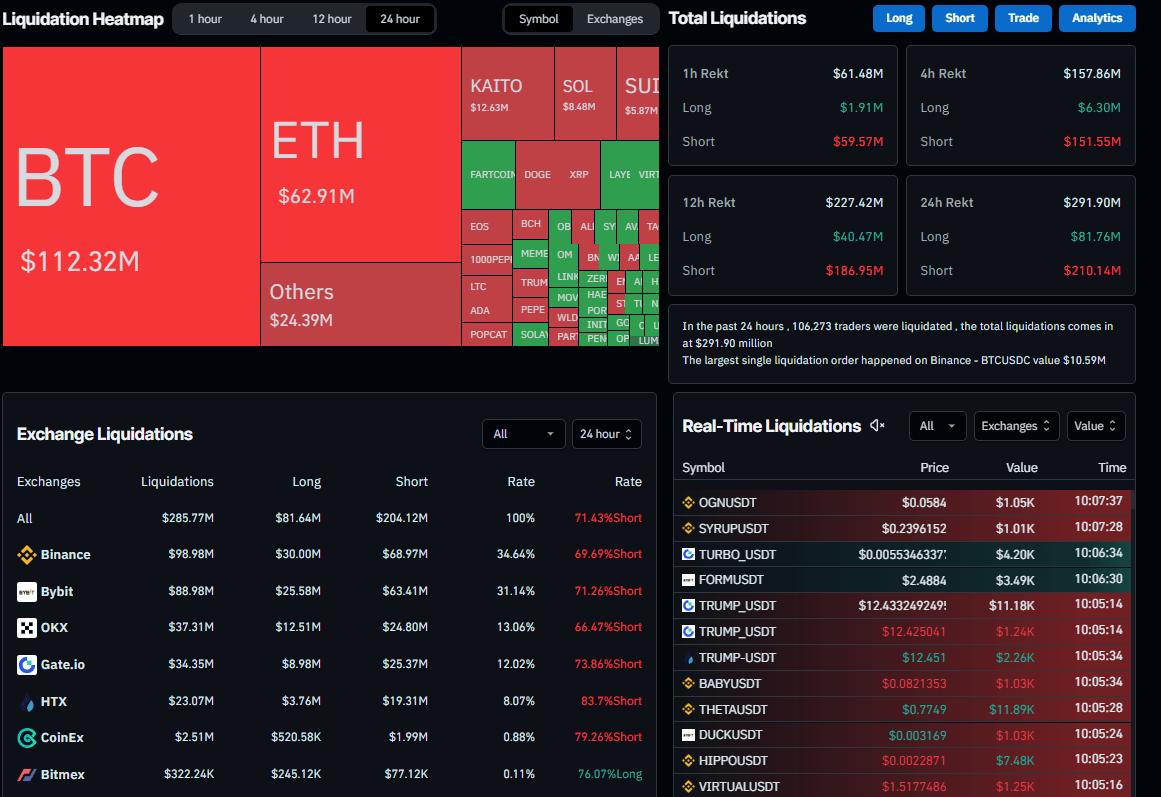

These gains in market value reflect a broader risk-on sentiment due to the ease of tariff uncertainty, which triggered a wave of liquidation. According to the CoinGlass Liquidation Map chart, in the last 24 hours,106,273 traders were liquidated, out of which 71.43% were leveraged short positions. The total liquidations came in at $291.90 million. The largest single liquidation order happened on Binance - BTCUSDC value $10.59 million.

Liquidation Heatmap chart. Source: Coinglass

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.