FTX Latest: Former CEO Sam Bankman-Fried explains reopening withdrawals of Bahamian arm

- FTX Digital Markets filed for bankruptcy on November 16; however, withdrawals for some will be resumed temporarily.

- Former FTX head Sam Bankman-Fried attempted to inform Bahamian regulators beforehand but to no avail.

- The crypto market regained over $21 billion in market capitalization over the last 24 hours, breaching the $800 billion mark.

FTX’s collapse sent shockwaves across the crypto space, with many, including its own 130 extensions falling. Among these companies was the Bahamian arm of the cryptocurrency exchange, which is set to make changes in its operations soon.

FTX Bahama to reopen withdrawals

FTX’s former CEO Sam Bankman-Fried (SBF), in an interview from November 16 with blogger Tiffany Fong, stated that he decided to reopen withdrawals for Bahamian citizens. SBF intended to do so as he did not want himself or the company to be in a place with a lot of angry users.

He said,

“The reason I did it was it was critical to the exchange being able to have a future because that’s where I am right now, and you do not want to be in a country with a lot of angry people in it and you do not want your company to be incorporated in a country with a lot of angry people in it.”

This decision from the ex-FTX head came after the exchange halted all withdrawals on November 8 due to a liquidity crunch. SBF stated that he went ahead and resumed withdrawals without receiving a response to FTX's apparent notice informing Bahamian regulators about the same.

However, before the withdrawals could be resumed, FTX’s Bahamian arm, Digital Markets, ended up filing for bankruptcy. The Chapter 15 bankruptcy on November 16 would allow FTX Digital Markets to proceed with the case in the United States courts.

Crypto market marks revival

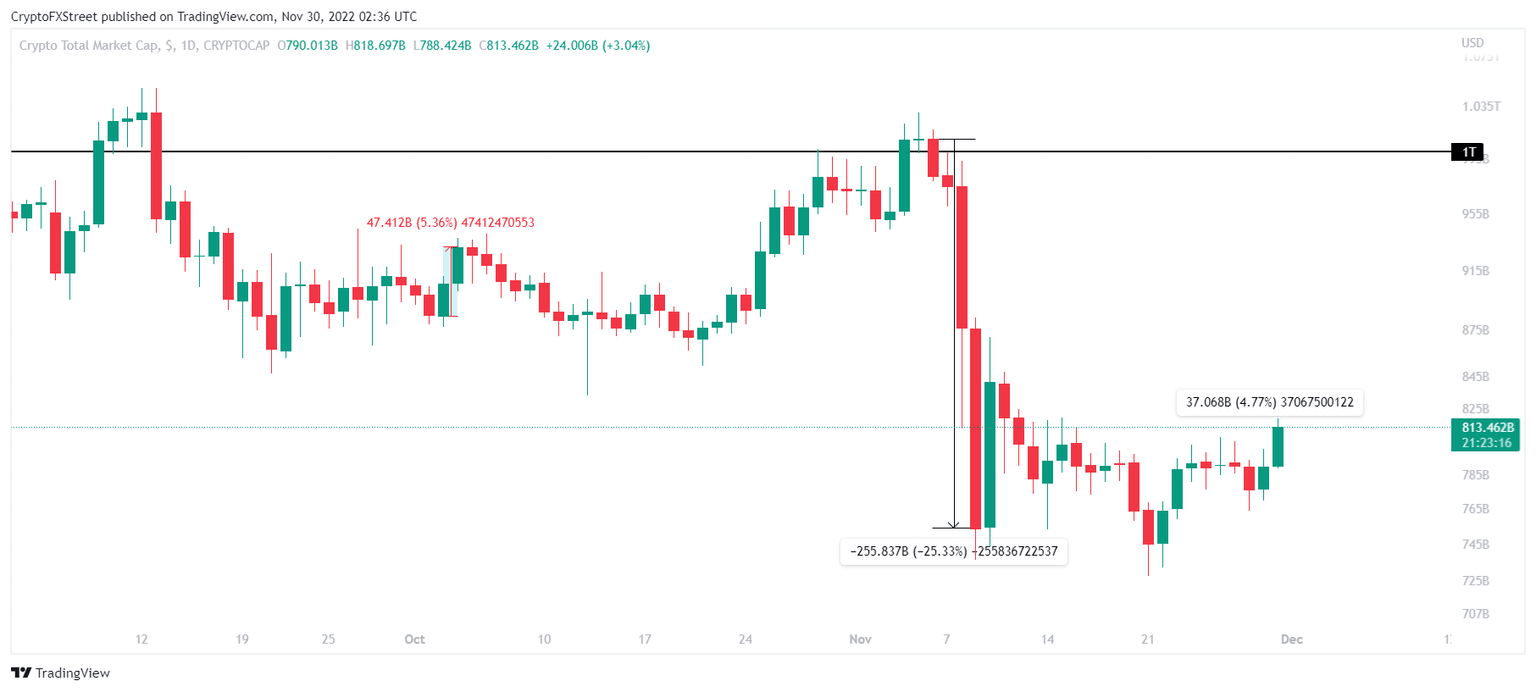

FTX’s downfall caused over $255 billion to be wiped out of the market between November 6 and 9. Since then, recovery has been difficult for the space as the total crypto market capitalization has been struggling to breach the $800 billion mark. Although following a 4.77% increase in the last 24 hours, the crypto market added over $37 billion. This brought the market cap back above $800 billion.

Total crypto market capitalization

At the same time, Bitcoin price also noted a 3.46% increase in price as the king coin could be seen trading at $17,007. The broader market impact will witness improvement in the price of altcoins as well, provided any irreversible damage doesn’t hit the crypto space.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.