Four reasons XRP has just been called the ‘hottest crypto trade’ of 2026

Ripple’s payment token, XRP, has just been labelled by CNBC as the “new cryptocurrency darling” after gaining 25% in the first week of the new year.

“The hottest crypto trade of the year is not Bitcoin, it is not Ether, it is XRP,” said CNBC’s Power Lunch host Brian Sullivan on Tuesday.

XRP price surges in the new year

XRP has gained 25% since Jan. 1, outperforming Bitcoin, which is up 6%, and Ether, which has risen 10% since New Year’s Day.

But there could be many more tailwinds driving the token’s price.

Exchange-traded fund momentum, social sentiment, on-chain fundamentals, and recent partnerships could explain why XRP is outperforming its peers at the moment.

XRP ETF momentum remains strong

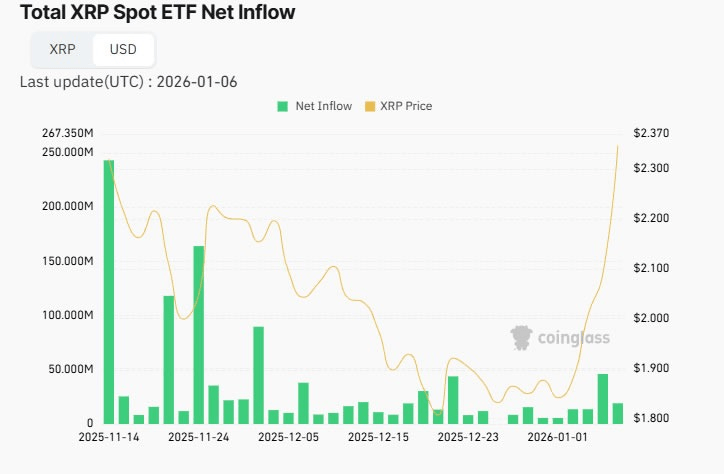

CNBC host Mackenzie Sigalos said, “during the doldrums of Q4, a lot of people were piling into XRP ETFs, which is the exact opposite of what happens with spot Bitcoin and Ether ETFs, where people move in tandem with the price of the coin.”

It is a way to have a “higher percentage jump” with investors buying the XRP dip in Q4, thinking “this is a less crowded trade” than BTC or ETH, “and that proved to be true in the first six trading days of January.”

The four spot XRP ETFs have seen almost $100 million in inflows since the beginning of the year, with the highest inflow for more than five weeks on Monday, according to Coinglass.

Aggregate inflows now total $1.15 billion, and there has yet to be an outflow day.

Bullish social sentiment and on-chain activity

Social sentiment for XRP is also bullish. Market Prophit, which uses AI to analyze crypto social media accounts, reports that both crowd sentiment and “smart money sentiment” are bullish.

XRP exchange reserves on Binance are also at their lowest levels for two years, according to CryptoQuant. High exchange balances usually mean investors are preparing to sell the asset.

There has also been an increase in network activity and transactions, which are up more than 50% over the past fortnight, according to XRPscan.

Ripple is making more moves in Japan

Ripple Labs also reportedly announced partnerships with major Japanese financial institutions, including Mizuho Bank, SMBC Nikko, and Securitize Japan, to boost XRP Ledger adoption in Japan.

In December, Ripple received conditional approval from the US Office of the Comptroller of the Currency to charter Ripple National Trust Bank.

Ripple President Monica Long told Bloomberg on Tuesday that the firm’s November fund raise and $40 billion valuation were “very positive and favorable for Ripple,” but there were no immediate plans for an IPO.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.