Flippening becomes more likely as ETH trade volume growth exceeds BTC in first half of 2021

- The growth in the trade volume of Ethereum exceeded that of Bitcoin so far in 2021, according to a report from Coinbase Global Inc.

- Increasing popularity of decentralized finance and the rise of scaling solutions are among key factors contributing to Ethereum's performance.

- Ethereum's market cap is more likely to exceed Bitcoin's based on its performance in 2021.

The first half of 2021 significantly improved Ethereum's price and its adoption among institutional players. The recent price action and increasing demand are fueling the flippening narrative.

Ethereum outperformed Bitcoin in past six months, flippening probability increased

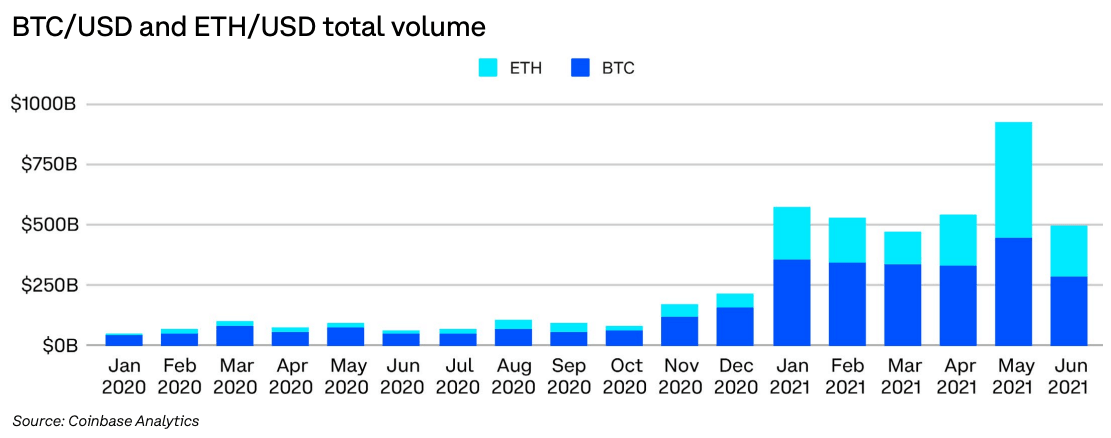

As the second most valuable cryptocurrency, Ethereum's trade volume grew faster than Bitcoin in the first six months of this year. Total ETH volume hit $1.4 trillion, up from $92 billion in the first half of 2020. In the case of BTC, it reached $2.1 trillion, up from $356 billion over the same period last year.

The volume of ETH traded grew by nearly 1461% against Bitcoin's 489% compared in the same time period. The statistics are based on a report published by Coinbase Global that considers data from the top 20 cryptocurrency exchanges.

BTC/USD and ETH/USD total volume

Ethereum's five-year performance got a boost in the past two quarters, which has brought ETH's total returns to 17,962%. A few factors driving the ETH rally were the increased usage of DeFi protocols and the rising optimism of traders and investors in anticipation of the upcoming London hardfork.

Both BTC and ETH have rallied since May 2021; however, ETH continues to outperform BTC in terms of growth in trade volume. The probability of flippening, otherwise known as the possibility of the market capitalization of Ethereum overtaking that of Bitcoin, is now higher based on the recent turn of events.

The long-awaited implementation of the EIP-1559 protocol in the London upgrade fuels the flippening narrative.

Evan Van Ness, a member of New York based blockchain technology company ConsenSys recently replied to a tweet, stating that the flippening is inevitable.

The Flippening is inevitable, sorry Sunny.

— Evan Van Ness (@evan_van_ness) July 27, 2021

The bullish outlook among crypto traders persists as ETH's price has appreciated over 240%, at its peak, since the beginning of 2021. ETH/BTC hit a high of 0.08193 in mid-May 2021 based on price data from Coinbase.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.