Filecoin price aims for a short rebound as key indicator flashes buy signal

- Filecoin price had a severe 42% drop since the beginning of April.

- The digital asset aims for a short-term rebound after the TD Sequential indicator presented various buy signals.

- FIL could still drop further down if buyers can’t hold a crucial support level.

Filecoin has been trading inside a significant downtrend since the beginning of April after establishing a new all-time high at $238. The cryptocurrency market suffered a notable correction in the past 24 hours which hasn’t helped FIL.

Filecoin price aims for rebound towards $170

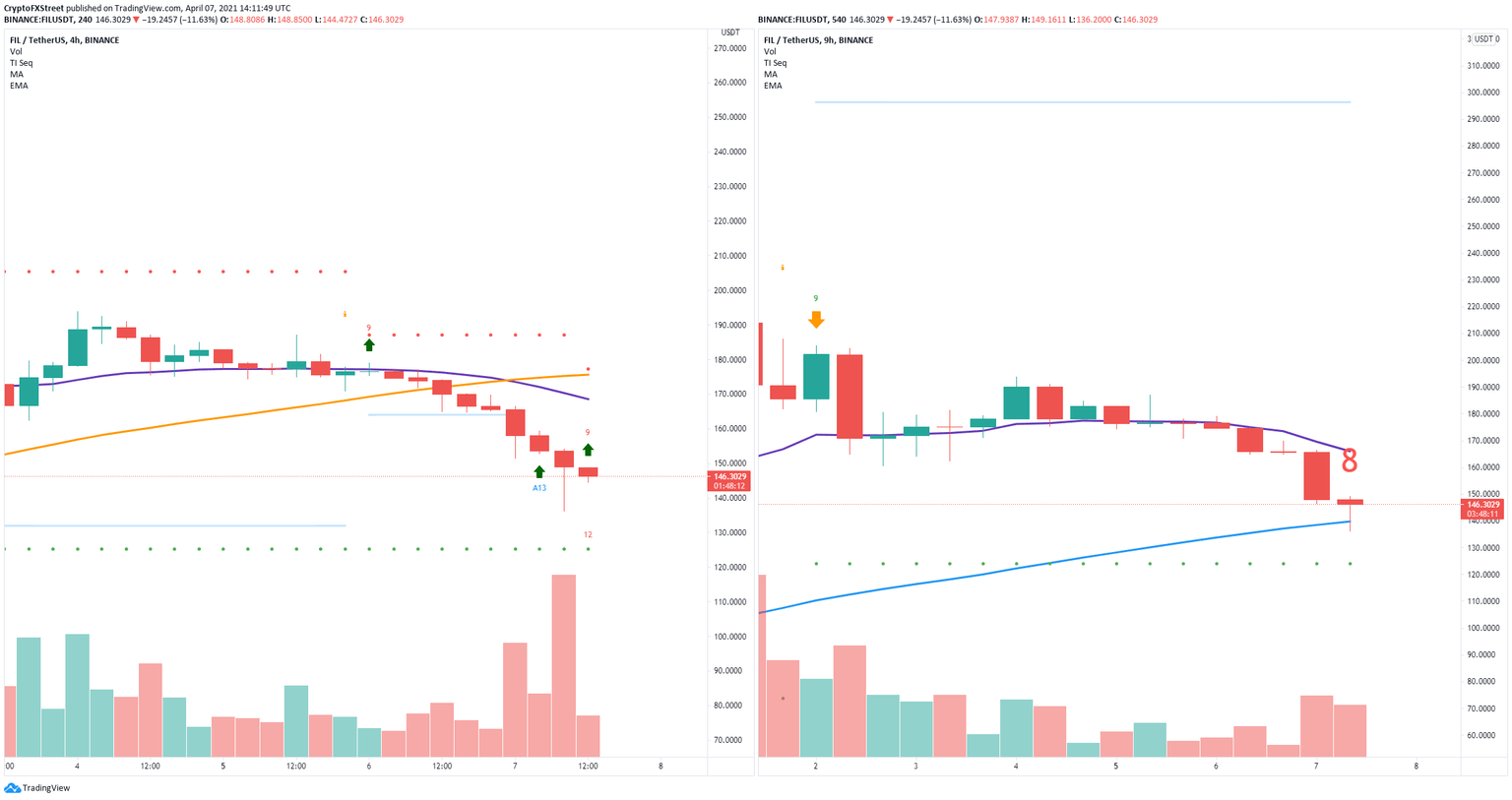

On the 4-hour chart, the TD Sequential indicator has just presented a buy signal and a red ‘8’ candlestick on the 9-hour chart which is often followed by a buy signal as well. On the 9-hour chart, Filecoin has defended the 100-SMA at $140.

FIL/USD Buy Signals

A rebound from this key support level has the potential to drive Filecoin towards the 26-EMA established at $167 on both charts. The next price target is located at $175, which is the 50-SMA on the 4-hour chart.

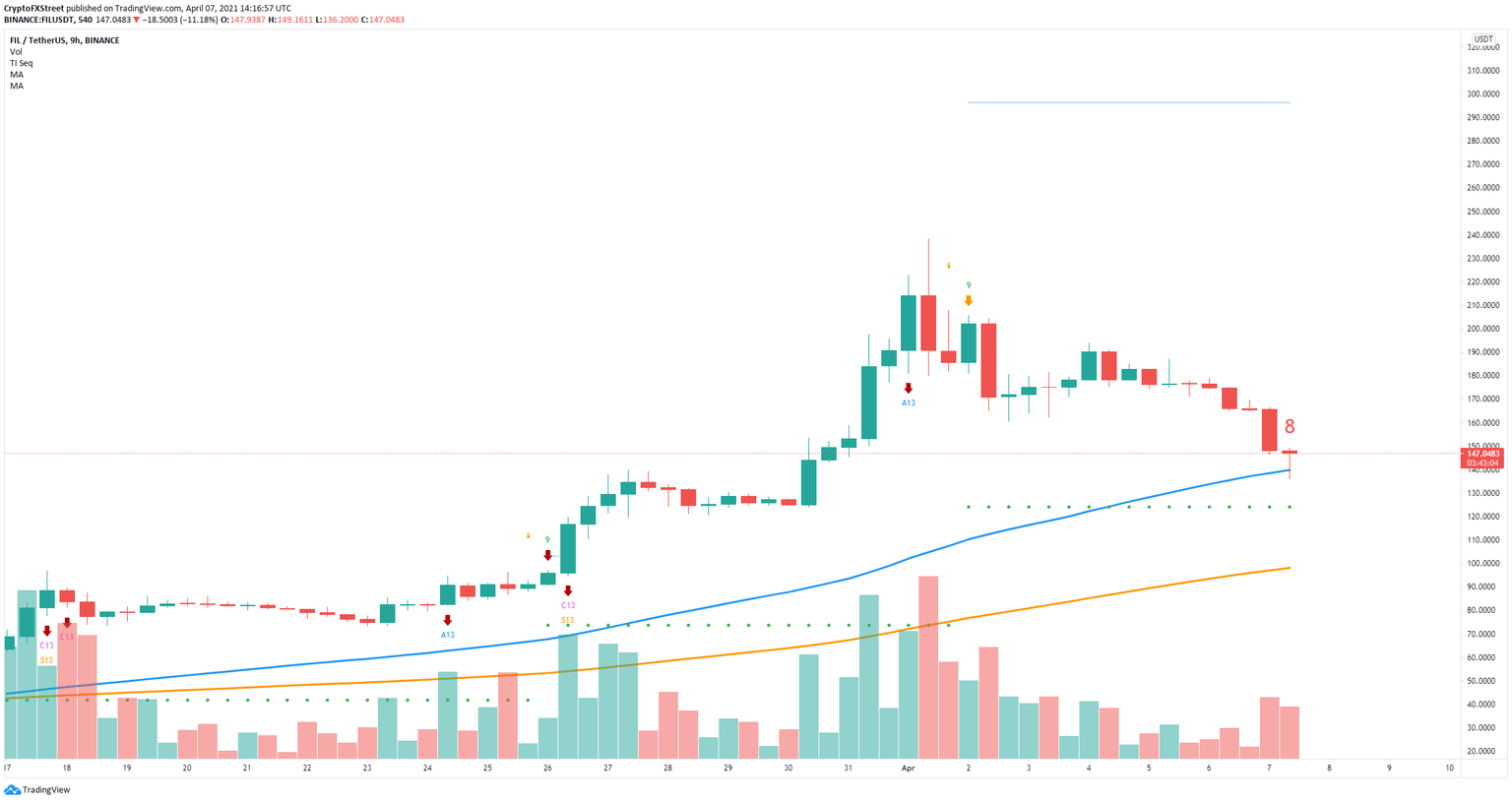

FIL/USD 9-hour chart

To invalidate the buy signals, bears must push Filecoin below the last low of $136.2. A breakdown from this point will ultimately drive Filecoin price down to $97.7 and at least towards $120.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.