Fidelity meets SEC for product discussions, submits “Bitcoin ETF Workflows” presentation

- Fidelity held a meeting with the US SEC amid ongoing engagements between the financial regulator and institutions.

- Reportedly, the firm discussed its pending application, as well as submitted a presentation about ETF workflows.

- Among what featured in the presentation were detailed “In-Kind” creation and redemption models.

Fidelity has updated its spot Bitcoin Exchange-traded product (ETF) filling, following a meeting with the US Securities and Exchange Commission (SEC). This is amid ongoing engagements between the financial regulator and he product applicants, which adds credence to the likelihood of approvals.

Also Read: Fidelity spot Bitcoin ETF lists on DTCC website even as key TradFi members attack crypto

Fidelity submits Bitcoin ETF Workflows presentation

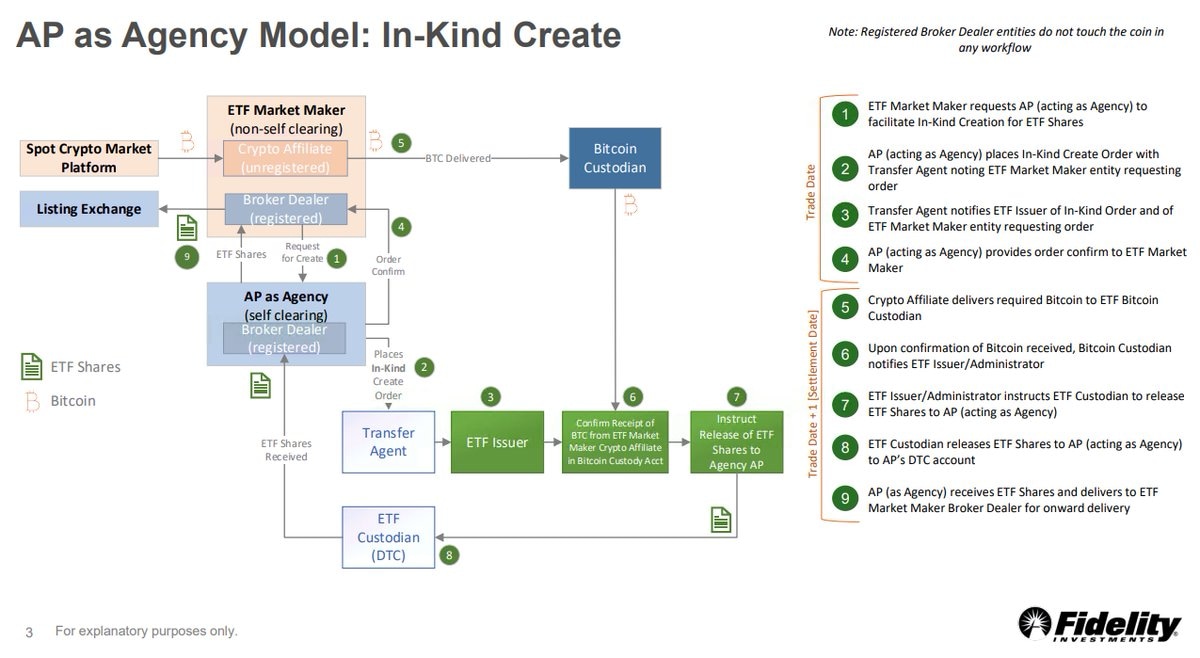

Fidelity is the latest institutional player to meet with the US SEC, with a memo on the financial regulator’s website revealing that the firm provided a presentation themed “Bitcoin ETF Workflows.”The firm made its case and showed its product design. Specifically, what was featured in the presentation included slides detailing in-kind creation and redemption models.

Fidelity Bitcoin ETF Workflows

The presentation indicates that Arbitrage and hedge provide more efficiency when it comes to physical creations while self-clearing ETF market maker firms could deliver efficient arbitrage in serving as Agency AP for non-self-clearing ETF market maker firms that have crypto affiliates. As such, according to Fidelity, “Allowing for physical creation and redemption is critical to enhance trading efficiency and secondary market pricing for all participants.”

The presentation comes barely a day after the firm included its spot Bitcoin ETF on the Depository Trust and Clearing Corporation (DTCC), a move that increased the odds for approval.

Besides, Fidelity, BlackRock also submitted a presentation about a “Revised In-Kind Model Design,” after meeting with the SEC back in November on matters regarding workflow and pending Bitcoin ETF application.

Crypto ETF FAQs

What is an ETF?

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Is Bitcoin futures ETF approved?

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Is Bitcoin spot ETF approved?

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.