'Fear' grips Bitcoin as crypto market sentiment drops to lowest levels since April 2020

Bitcoin (BTC) and altcoin traders are more nervous than any time in over a year as a classic sentiment gauge signals "fear" is driving the market.

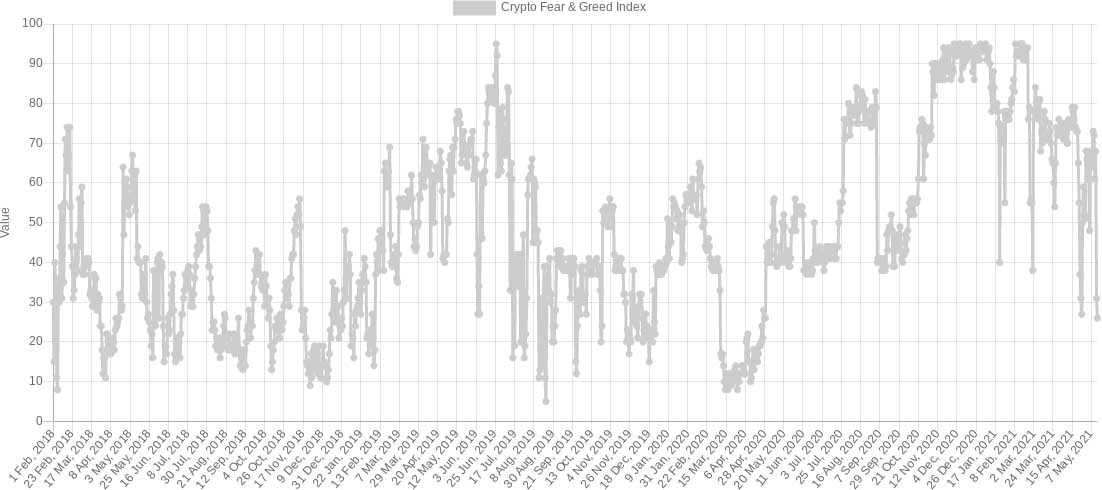

According to the Crypto Fear & Greed Index, cryptocurrency traders have not had such cold feet about the market climate since April 2020.

March 2020 on repeat

Fear & Greed uses a basket of factors to determine overriding sentiment among market participants — and therefore where the market itself is likely headed.

Price volatility can produce considerable shifts in its readings — just four days ago on May 10, the Index measured 72/100, corresponding to "greed" being at the heart of sentiment.

Crypto Fear & Greed Index. Source: Alternative.me

Fast forward to Friday and a completely different picture is apparent after Tesla rejected Bitcoin for alleged environmental damage and major exchange Binance sees attention from regulators. At the time of writing, Fear & Greed measured just 26/100 — firmly within the "fear" zone and bordering "extreme fear."

The last time that the Index was so low was just weeks after the cross-asset crash that sent BTC/USD to $3,600.

As Cointelegraph reported, however, this time around, Bitcoin appears to have weathered the storm, performing "very well" against an onslaught of sellers and trader liquidations.

"If the stock market can shrug off a global pandemic, I’m sure Bitcoin can survive a tweet," popular trader Scott Melker summarized.

Bitcoin strives to get back to "business as usual"

Analysts have already highlighted signs of a rebound setting in for Bitcoin, while certain large-cap altcoins managed to avoid the dip altogether.

"The Elon Dump now in recovery," statistician Willy Woo declared to Twitter followers on Thursday.

Woo highlighted inflows to exchanges turning to outflows as traders likely either bought the dip or bought back in after selling.

At the same time, stablecoin balances across exchanges continue on their own uptrend, providing huge potential liquidity should a bullish phase reenter crypto markets.

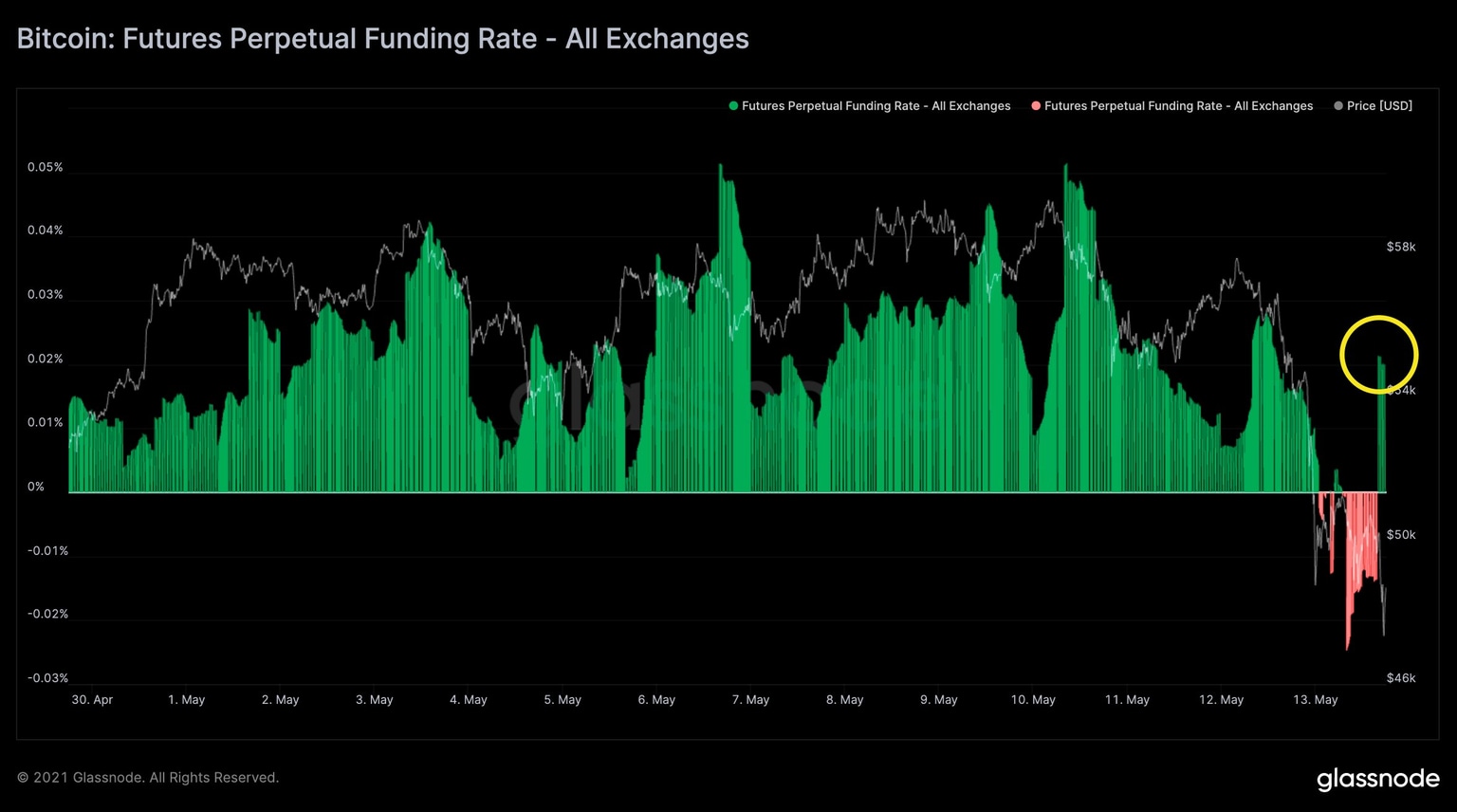

Rafael Schultze-Kraft, co-founder of on-chain analytics resource Glassnode, also noted that funding rates had reverted to their behavior from before the dip.

"That was quick: funding rates flipped positive again. Longs are back to paying shorts," he commented on an accompanying chart.

Bitcoin perpetual futures funding rates chart. Source: Rafael Schultze-Kraft/ Twitter

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.