Fantom Technical Analysis: FTM/USD resumes its bullish momentum after a brief consolidation eying up $0.015

- After hitting a new 2020-high at $0.014, FTM/USD started a healthy consolidation towards $0.01.

- FTM bulls are back in town eying up the recent high at $0.014 and $0.015.

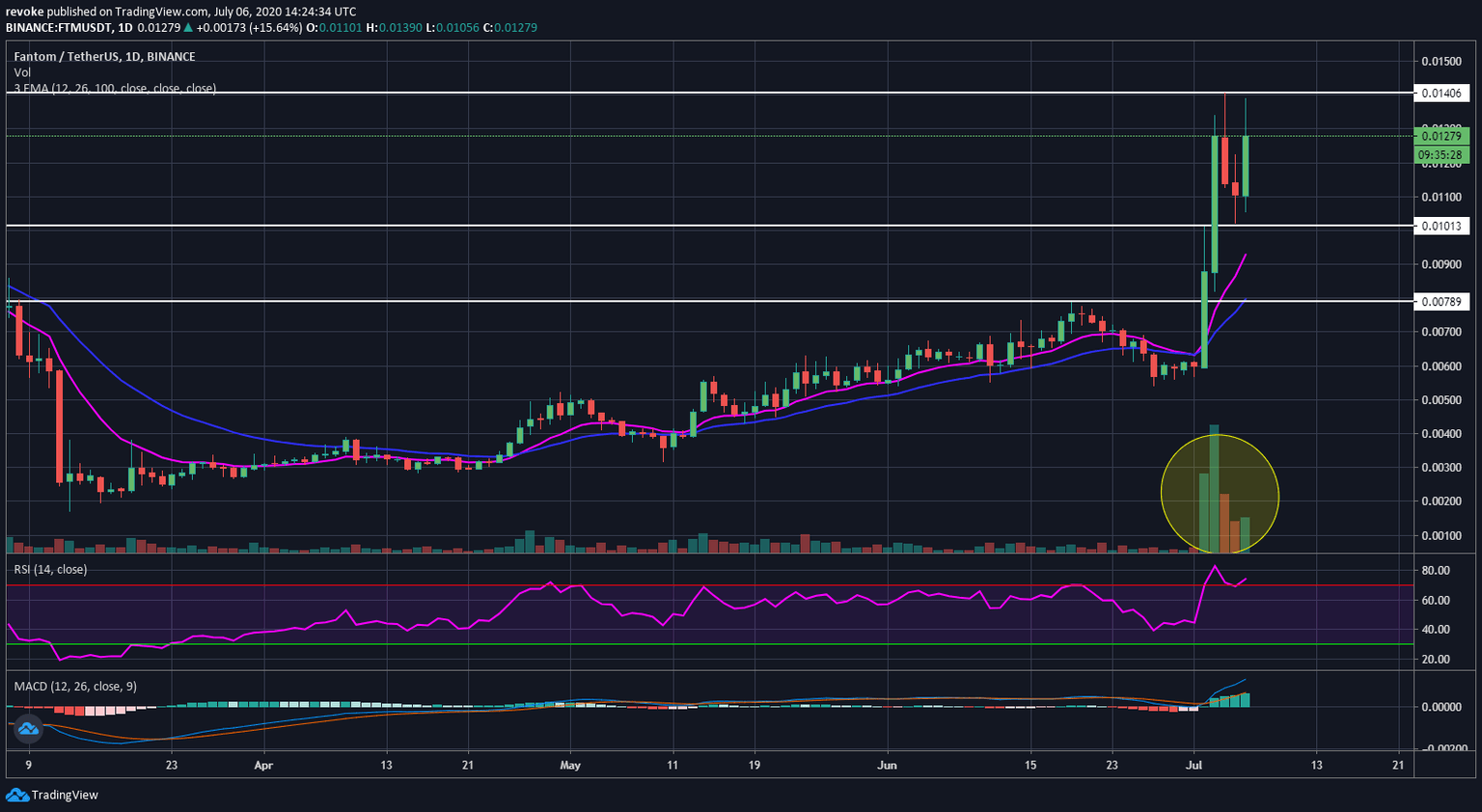

Fantom experienced a massive 135% surge in three days setting a new 2020-high. FTM/USD had a significant increase in trading volume and the daily RSI got heavily overextended. The digital asset had a healthy consolidation period of two days hitting a low of $0.0102 before resuming its bullish momentum.

FTM/USD daily chart

Fantom looks ready to crack $0.014 and continue towards $0.015 as there is very little resistance until that level. Buyers will need to break $0.0145, but after that, they have a free run until almost $0.016. The daily RSI has cooled off but remains overextended, however, this indicator will not necessarily stop bulls from climbing above the last high.

FTM/USD 4-hour chart

Fantom is back trading inside a 4-hour uptrend after defending the 26-EMA several times in a row. FTM/USD is currently above both EMAs which have remained bullish and will continue to act as support levels if needed. The MACD is still bearish but on the verge of a bull cross while the RSI is slightly under the overextended level.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.