Every dog has its day: Dogecoin and Shiba Inu fetch 50% gains as altcoins rally

New use cases and a massive token burn signal that the dog days of summer could be over for DOGE and SHIB.

Momentum the wider cryptocurrency market appears to be on the upswing this week after bulls pushed Bitcoin price to the $46,700 and Ether price to $3,150 on Aug 9.

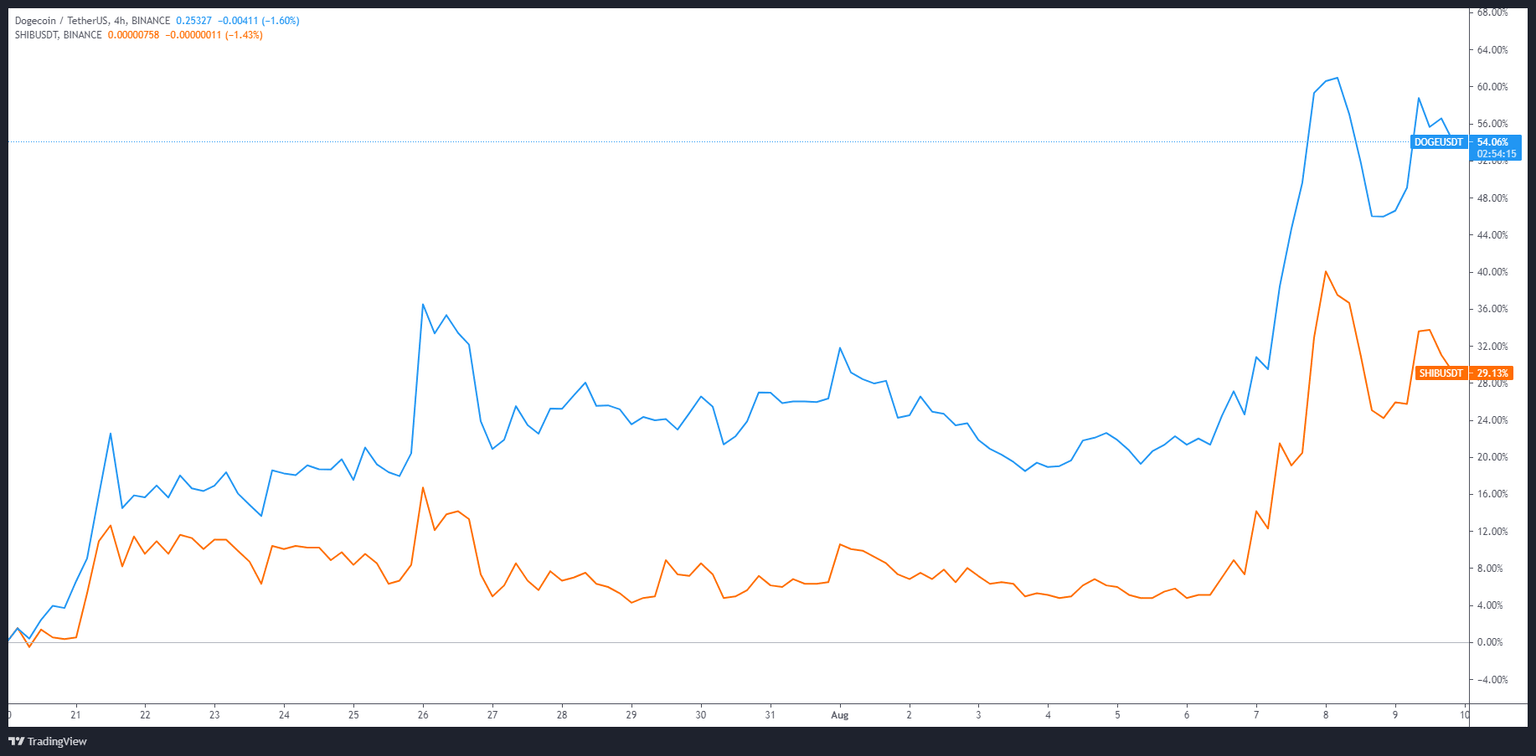

The growing optimism has also translated into a bounce in dog-themed meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB), which have both seen their prices rise by more than 55% over the past three weeks.

DOGE/USDT vs. SHIB/USDT 4-hour chart. Source: TradingView

Dog-themed meme coins caught fire earlier in the year after Dogecoin became the altcoin of choice for influencers like Elon Musk and Mark Cuban. Ethereum (ETH) co-founder Vitalik Buterin further rocked the boat on May 14 when he liquidated trillions of SHIB and donated the proceeds to charity.

At the time, investors viewed this as further bullish validation but have both projects had been in a rut since the Bitcoin-led market crash that took place on May 19.

Dogecoin leads the pack

Dogecoin’s trend reversal began on July 20, the same day that Bitcoin price hit a bottom at $29,500, as the price of DOGE reached a low of $0.16 before correcting its course and heading higher.

Data from Cointelegraph Markets Pro and TradingView shows that the price of Doge has rallied 78% from a low of $0.159 on July 20 to an swing high at $0.284 on Aug. 8 as its 24-hour trading volume surged to $9.3 billion.

Dogecoin’s recovery got off to a quick start on July 21 following an announcement from Coinbase Commerce that DOGE could now be used for payments.

Shiba Inu developers implement a token burn

Shiba Inu’s recovery also began on July 20 after SHIB dropped to a low of $0.0000057 amid the market-wide sell-off.

In the three weeks since its price bottomed, SHIB has seen a three-fold increase in its 24-hour trading volume which was followed by a 56% price rally to weekly high at $0.00000888 on Aug 8.

SHIB/USDT 4-hour chart. Source: TradingView

The spike in price came after developers announced that a new burning mechanism will be included with new listings on the ShibaSwap exchange. The token burns aim to reduce the circulating supply of SHIB and the protocol's 'Doge Killer' (LEASH) token.

In conjunction with the listing of Perlin (PERL) and Ryoshi Token (RYO) on ShibaSwap, $25,000 worth of SHIB and LEASH were burned.

According to the Shiba Inu website, the current circulating supply of LEASH is 107,646 tokens, while the estimated supply of SHIB is 394.8 billion.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.