ETH/USD Elliott Wave analysis – Looks for correction

-

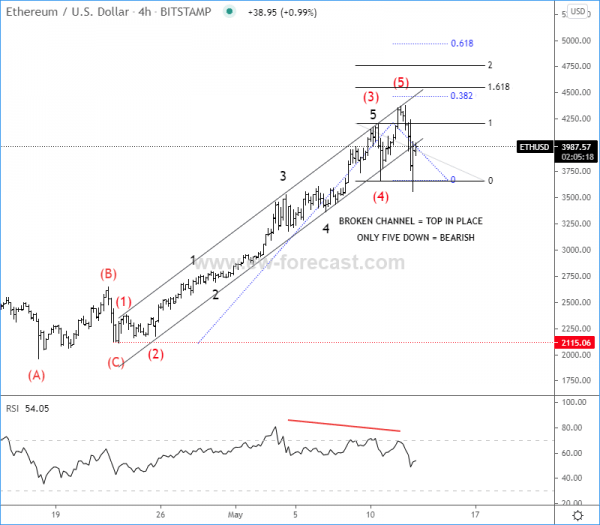

ETHUSD completes five wave cycle.

-

It has broken Elliott Wave Channel Support Line.

-

RSI shows bearish divergence.

Ethereum, the world’s second-largest cryptocurrency, breaks well above $4,000 but investors may not get too excited around here as ETHUSD can be trading in a fifth wave, final leg of a five-wave rise from 2115 level. We know that five waves may suggest a slow of a current cycle, maybe already this month at 4500-5000 area where we see some projections for a fifth wave.

At the same time it's worth to mention that we see subwave 5) near upper Elliott Wave channel resistance line while RSI also shows a divergence, so it can be very late for any new longs. Of course the trend is up, no doubt, but it’s good to be patient and be aware of a dips and maybe rather look for a new opportunities after three wave retracements.

Interesting first support can be here at 3500, at the former wave four, but ETHUSD has broken Elliott Wave channel support line, so in case if we see a five-wave decline, then ETH may face a deeper corrective decline.

ETH/USD 4h Elliott Wave analysis chart

Finally, another ELLIOTT WAVE OPEN DOOR Event is here. See all of our charts FREE for 10 days. Join us at www.ew-forecast.com/register

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.