Ethereum whales scoop up 150 billion Shiba Inu coins as burn intensifies

- Ethereum whales continue scooping up Shiba Inu, buying 150 billion SHIB over the past 24 hours.

- 62.26 billion Shiba Inu coins were burned over the last 48 hours, reducing the number of tokens in circulation.

- Analysts predict a continuation of Shiba Inu price uptrend and set an upside target of $0.00001350.

Large wallet investors on the Ethereum network continued accumulation of Shiba Inu coins. Shiba Inu price is up 51% over the past week and analysts remain bullish on the meme coin.

Top 100 Ethereum whales acquired 150 billion Shiba Inu coins

Shiba Inu price has witnessed a massive rally over the past week, despite a bear market in crypto. While Bitcoin, Ethereum, Solana and other altcoins witnessed a steep decline in price, Shiba Inu price continued its climb. Shiba Inu price is up 51.6% over the last seven days. The Shiba-Inu-themed meme coin has become one of the most acquired cryptocurrencies among the 100 largest investors on the Ethereum network.

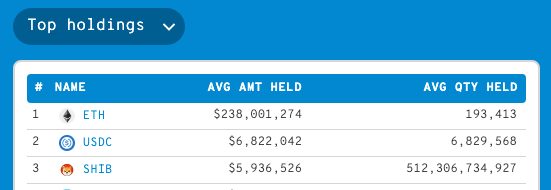

Throughout the crypto market bloodbath, large wallet investors have accumulated Shiba Inu coins. Based on data from Whalestats, a platform that shares insights on the top 100 wallets on the Ethereum network, whales now hold 512.3 billion Shiba Inu coins.

Shiba Inu holdings of 100 largest Ethereum whales

62.26 million Shiba Inu coins burned

Based on data from Shibburn, 62.26 million Shiba Inu coins were burned in less than 20 transactions. As the quantity of Shiba Inu burned increases, more coins are pulled out of the circulating supply and sent to dead wallets. Permanent removal of Shiba Inu coins reduces the quantity in circulation, and drives a bullish sentiment among holders.

Analysts set upside target at $0.00001350

Analysts at Cryptopolitan evaluated the Shiba Inu price chart and observed an ascending triangle pattern. Shiba Inu price crossed its 50-day exponential moving average at $0.00001041. Analysts believe Shiba Inu price could continue its upward trend, eyeing the $0.00001350 target.

SHIB-USDT price chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.