Shiba Inu price rally beat crypto bear market for this reason

- Binance recently announced a price tracking feature for Shiba Inu ecosystem’s BONE, ShibArmy argues that a listing is now imminent.

- Shiba Inu coin price posted nearly 30% gains over the past week, beating competitor Dogecoin and altcoins in the bear market.

- Analysts are bullish on Shiba Inu price and predict a continuation of the uptrend.

Shiba Inu coin price exploded over the past week, beating the crypto bear market and competitor Dogecoin. The ShibArmy believes Shiba Inu ecosystem’s BONE listing on Binance is imminent as the cryptocurrency exchange platform adds a price tracking feature for the token.

Also read: Billionaire supports meme coin, triggering Shiba Inu price rally

Binance adds price-tracking feature for BONE

The world’s largest cryptocurrency exchange platform recently added the price tracking feature for BONE. Binance’s page that lists BONE price clearly mentions that the coin is not listed on Binance for trade and service. Binance recommends that users buy BONE using Ethereum on a decentralized exchange platform.

BONE is the Shiba Inu ecosystem’s governance token and will soon be used to pay transaction costs on layer-2 solution Shibarium. The token has attracted the attention of investors since ShibArmy is awaiting the rollout of Shibarium in the Shiba Inu coin ecosystem.

The ShibArmy is convinced that a BONE listing on Binance is imminent. This speculation has triggered a bullish sentiment among Shiba Inu coin holders and fueled a double-digit price rally over the past week.

Binance has made no announcement on BONE’s listing and limited the coin’s exposure to users on the platform to the price-tracking feature.

Game developer invites users to burn Shiba Inu coins

Travis Johnson, an independent game developer, has invited users to sign up for an Audible trial and the commission raised through Amazon’s referral program will be used to burn Shiba Inu coins. So far Johnson has raised enough funds to burn 1 million Shiba Inu coins.

Johnson told followers on Twitter that the quantity of Shiba Inu will spike as sign-ups hit 100, 1,000 or higher.

Opportunity for anyone interested:

— SHIB Super Store (@shib_superstore) June 23, 2022

Amazon is offering a $5 Bounty for anyone who signs up for a free trial of Audible. This will be used to burn SHIB, every sign up would burn ~500k SHIB

Try it out for a month, and if you don't like it, cancel it! https://t.co/ULUVzjMEnu pic.twitter.com/lIfl0mKttG

Shiba Inu burn rate climbs 1,405%

With a higher number of Shiba Inu coins being burnt every day, there is a massive spike in the burn rate. Based on data from the Shibburn portal, 57.4 million Shiba Inu coins were burnt in the past 24 hours.

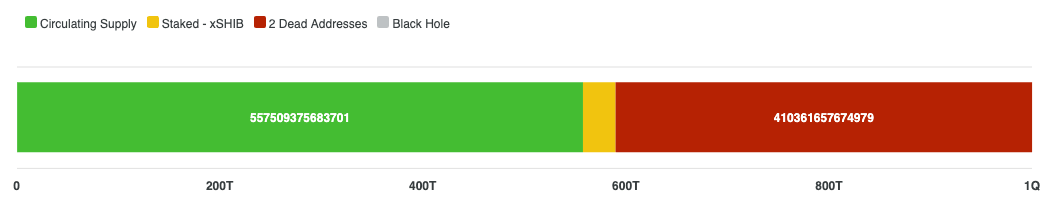

Burning pulls the coins out of Shiba Inu’s circulating supply and sends them to a dead wallet, permanently removing them from circulation. The spike in burn rate has fueled a bullish sentiment among Shiba Inu holders as it increases the value of the leftover tokens.

So far, 410.37 trillion Shiba Inu coins have been burned, according to Shibburn.

Shiba Inu coin burn data

Ethereum whale scoops up $1.57 million worth of Shiba Inu coins

In the recent bloodbath, an Ethereum whale identified as “BlueWhale0073” scooped up $1.57 million worth of Shiba Inu coins. BlueWhale0073’s purchase of 163.2 billion Shiba Inu tokens has increased the SHIB holdings in the investor’s portfolio.

Large wallet investors have consistently accumulated Shiba Inu coins through the dip in price and increased the number of SHIB in their portfolios. At the time of the whale’s purchase, Shiba Inu had witnessed a small dip in its price. However, the meme coin continued to trade 87.3% below its all-time high.

Analysts identify bullish signals on Shiba Inu price chart

Crypto analysts at InvestingCube identified a clear break out of the downtrend. With a sudden increase in trade volume, analysts have confirmed Shiba Inu’s breakout and believe that bulls could target $0.00001200 and $0.00001585.

SHIB-USDT 1-day price chart

FXStreet analysts believe Shiba Inu price could face a challenge during its recovery. For more information, watch this video:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.