Ethereum Weekly Analysis: Ethereum on steroids, hello $500

- Ethereum 2.0 release becomes apparent with the launch of the final Medalla testnet.

- Ethereum and Bitcoin see an overwhelming increase in on-chain activity as markets price roll upwards.

- Ethereum 2.0 launch could be Ethereum’s one-way ticket to $1,000.

Ethereum price action in the last week of July and the first week of August left everyone tremendously surprised. The journey of breaking barriers was not only a success but also helped bring back attention to other products within the Ethereum market such as the futures. As we will discuss later in this article, on-chain activity has also surged massively.

In the meantime, Ethereum is trading at $394 after a lower correction from levels closer to $400. Ether traded highs at $415 on Sunday last week. This move saw Ethereum make a comeback to levels it had not seen since August 2018. In 2019, Ethereum only managed to trade highs around $361.

Ethereum 2.0 testnet debuts with 20,000 validators

Ethereum developers finally released the final as well as official public testnet for the much-anticipated Ethereum 2.0 network. The test network dubbed Medalla is the final step of phase 0 of the long journey to the launch of Ethereum 2.0 hopefully by the end of 2020.

According to CoinDesk, more than 20,000 validators have joined Medalla. Impressively, about 650,000 ETH has already been staked in the testnet. Note that, every testnet has used its own token that is not in any way equivalent to the actual ETH. Medalla is a multi-client protocol that currently supports Prysmatic labs’ Prysm, ChainSafe’s Lodestar, PegaSys’ Teku, Status’ Nimbus and Prime’s Lighthouse.

Grayscale Ethereum Trust files to become US SEC reporting company

New York-based fund manager, Grayscale wants its Ethereum Trust fund to be accepted by the US Securities and Exchange Commission (SEC) as a reporting company. Grayscale Bitcoin Trust was given the mandate to be a reporting company to the SEC in January. According to a recent report by Grayscale the Ethereum Trust currently holds more about $745 million in Ether. Bitcoin Trust is the leading among its crypto holdings with a whopping $4.7 billion in BTC. As per the announcement made by Grayscale:

This is a voluntary filing that, if it becomes effective, would designate the Trust as an SEC reporting company and register its shares pursuant to Section 12(g) of the Securities Exchange Act of 1934, as amended.

Ethereum on-chain activity swells

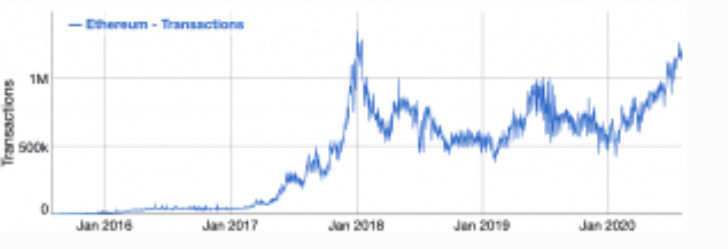

The surge in cryptocurrency prices in the last couple of weeks especially for Ethereum and Bitcoin has caused a positive ripple effect in on-chain activity for the world’s two largest cryptoassets. The increase has been attributed to decentralized applications (dApps) and blockchain casinos.

These dApps mainly execute on Ethereum blockchain by paying gas fees hence the higher activity within the network. Daily transactions on the network are closing in on all-time highs according to the data by BitInforCharts. Besides, on-chain transfers are said to have already clocked 1 million per day.

Ethereum technical analysis

Ethereum price appears to be settling for consolidation a few days after trading new yearly highs at $415. Support at $400 held for a short while but profit-taking investors are arming the bears who continue to force ETH towards the next support at $390.

The weekly chart shows the RSI holding comfortably above 70. This indicator has been overbought since July 21. This means that while buyers are in the driver seat, their rain could soon end with bears likely to take over.

On the other hand, the MACD shows that buyers have an upper hand. In addition to having a bullish divergence, the MACD is still grinding gradually upwards. This means that that Ether is in the hands of the bulls only that it lacks a catalyst and the volume to sustain gains to $500.

Ethereum has already proved that it has the ability to rise to new yearly highs. As the network draws closer to the launch of Ethereum 2.0 which will call for staking among the members of the community. ETH/USD could get the ultimate boost not just above $500 but towards $1,000. For now, support above $390 is key for the bullish case above $400 as we usher in the weekend session.

ETH/USD weekly chart

%20(78)-637323886704570228.png&w=1536&q=95)

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren