Ethereum transactions hit record as staking exit queue drops to zero

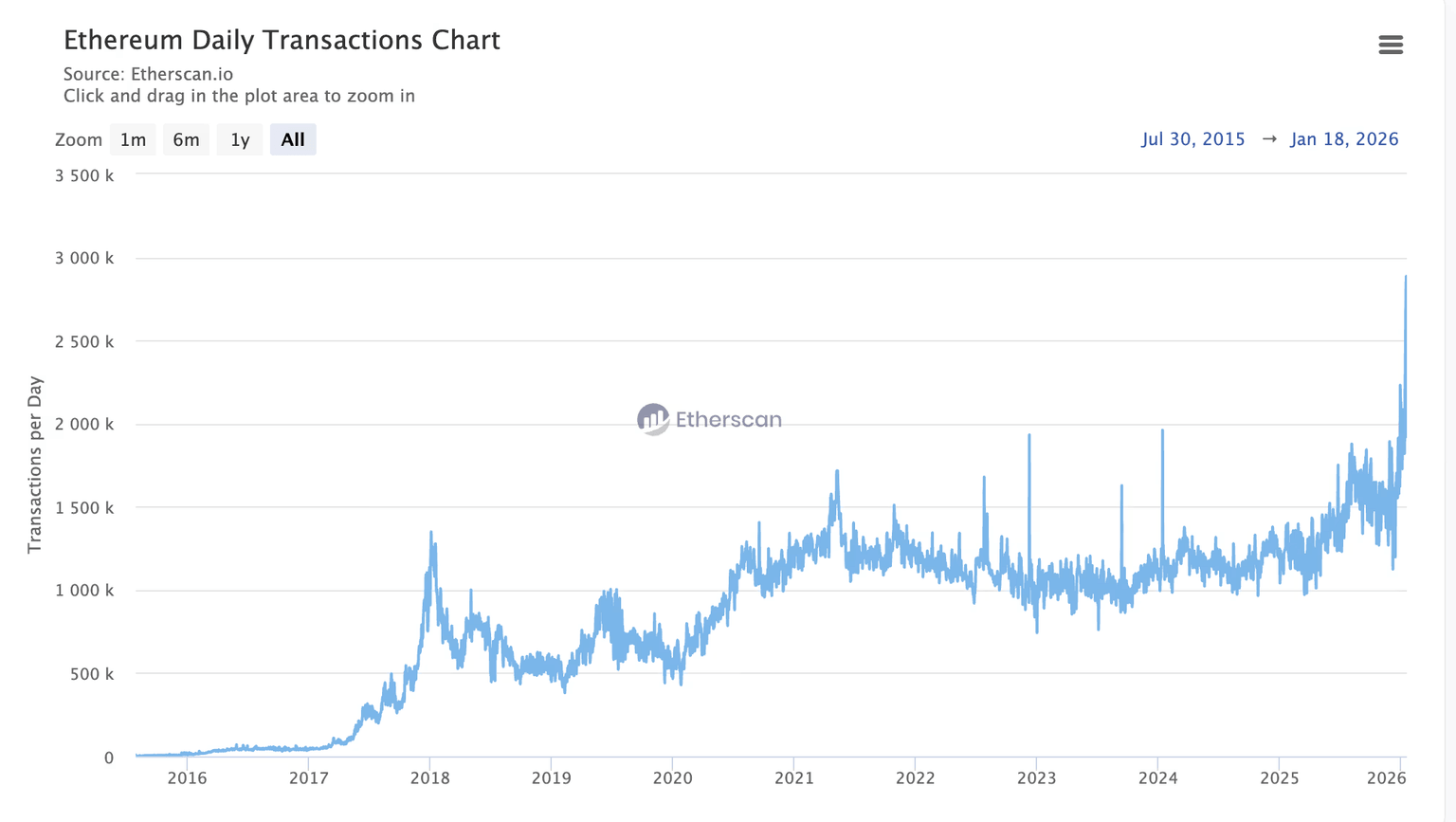

- Ethereum is processing a record number of daily transactions, with activity hitting an all-time high of nearly 2.9 million transactions and continuing to climb into early 2026.

- Despite the surge in usage, average transaction fees remain near recent lows, suggesting recent upgrades and layer-2 networks are helping the system handle demand more efficiently.

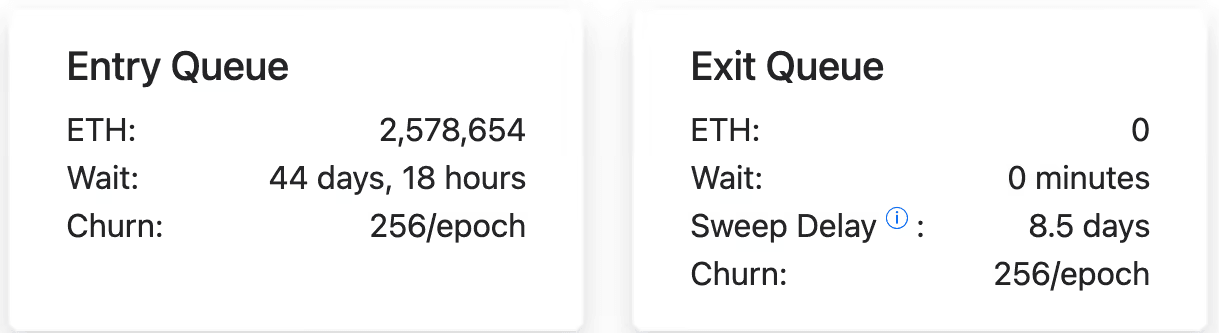

- Ethereum’s validator exit queue has dropped to zero while entry queues remain long, indicating steady but not booming staking activity as the network manages heavier use without major bottlenecks.

Ethereum is processing more transactions than at any point in its history, with daily activity pushing to new records last week.

The network processed a record 2,885,524 transactions on Friday, the highest daily count in its history. The surge caps a sharp pickup in on-chain activity this month, with transaction volumes pushing to new highs into early 2026.

Activity has accelerated since mid-December, reversing a gradual slowdown that persisted through much of 2025.

At the same time, average fees remain near recent lows, even with the pickup in usage. The combination points to a network that is absorbing higher demand more smoothly than past cycles, helped by recent upgrades and more activity moving to layer-2 networks.

Staking dynamics have also shifted. Ethereum’s validator exit queue has fallen to zero, meaning stakers can now withdraw ETH almost immediately, while entry queues still show long waits.

The empty exit queue mainly shows there isn’t a big rush to lock up ETH or pull it out right now, and staking looks steady rather than in a boom.

Paired with the jump in transactions, it suggests Ethereum is handling heavier use without the usual bottlenecks.

That’s good news for users, but it also means the old “fees will spike and make ETH scarcer” storyline is less central when the network is running smoothly.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.