Ethereum topped 11,00 today, what now?

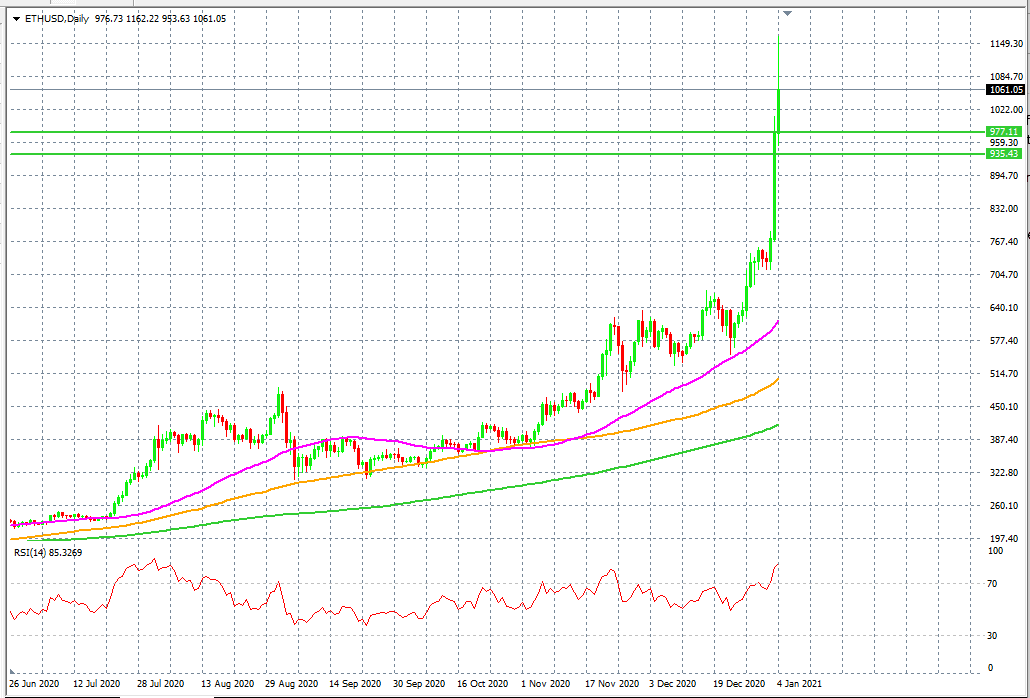

Ethereum prices have ripped all the resistance levels in its path, and the price has made some serious price moves over the weekend. Today, Ethereum price has crossed above the 11,00 price level for the first time since 2017. Traders have thought that this cryptocurrency may never be able to reach its all-time high, which was formed back in 2017. This is because while the crypto king, Bitcoin, was making some serious moves, we did not see anything meaningful for other crypto coins. And this made investors wary that we may never see any life coming back.

The SEC’s news about Ripple’s XRP made investors a lot more cautious, and they have thought that the game is over for all other coins except Bitcoin. Even today, despite the stellar rally in Bitcoin and Ethereum price, we are not seeing any major move in Ripple’s XRP.

In terms of technical analysis, there is no doubt that Etherum’s price is way overbought, and a serious correction is looming. The price has pierced the upper level of the Bollinger band, which shows higher volatility, and the RSI is trading in a well-overbought zone. There is a strong possibility that when a correction may take place, the price may revisit the support at 935, and a break of this price level will open the door towards the next support of 704. As for resistance, it is all all-time high and may break above this price level and continue to move towards the 1,500 price level.

Author

Naeem Aslam

Zaye Capital Markets

Based in London, Naeem Aslam is the co-founder of CompareBroker.io and is well-known on financial TV with regular contributions on Bloomberg, CNBC, BBC, Fox Business, France24, Sky News, Al Jazeera and many other tier-one media across the globe.